It was a rather dull week last week as US tax plan was the main market driver. Dollar ended broadly lower as investors were clearly dissatisfied with the Senate’s version of the plan, which delay corporate tax cut by a year. But judging from reactions in US stocks, comparing to European markets, sentiments were not that bad. For the moment, DOW’s up trend is still intact. Similar picture is seen in Dollar which is holding above key near term support level against all other major currencies. Indeed, US long term yields staged the strongest rally in more than a month on Friday, on worry off additional bond supply next year. And the surge in 10 year yield could provide the greenback with extra support. The economic calendar with come back this week with more important economic data, like CPI fro US and UK. And, with a tight working schedule, US tax plan will stay on top as a key focus in the markets.

DOW showed resilience comparing to DAX and FTSE

DOW made new record high at 23602.12 last week. But it failed to sustain above 100% projection of 20379.55 to 22179.11 from 21721.12 at 23530.68 and retreated. With daily MACD dived below signal line, a short term top is in place and more corrective trading would be seen in near term. But as long as 23251.11 support holds, such correction/consolidation should be brief. Another rise is expected through 23602.12 to 161.8% projection at 24642.80. However, firm break of 232.51.11 will bring deeper pull back to 55 day EMA (now at 22814.51) before up trend resumption.

DAX also hit record high at 13525.56 but retreated steeply since then. A short term top is in place and more corrective trading would be seen. But outlook will remain bullish as long as 12911.58 support holds. The larger up trend is expected to continue through 13525.56 high. However, firmed break of 12911.58 will be an early sign of medium term reversal and bring deeper fall to trend line support (now at 12347. )

FTSE’s sharp decline last week and firm break of 55 day EMA suggests that rise from 7196.58 has completed at 7582.85, ahead of 7598.99 high. Fall from 7582.82 is tentatively viewed as the third leg of the pattern from 7598.99 and could target 7196.58 support. At this point, we’d expect strong support from there to bring rebound. However, firm break there will complete a double top reversal pattern and will indicate medium term trend reversal.

TNX rebound strongly on Friday, maintains bullishness

10 year yield’s strong rebound of Friday argues that pull back from 2.475 has completed at 2.304, after drawing support from 55 day EMA. More importantly, as 2.273 structural support remains intact, so is near term bullish outlook. That is, we’re holding on to the view that correction from 2.621 has completed at 2.103. And rise from 2.034 is still in progress and would resume through 2.475 to retest 2.621 high later.

Dollar stayed in consolidation with bullishness intact

Dollar index’s consolidation from 95.15 extended last week after failing to take out this resistance. While there was a steep selloff in the latter part of the week, DXY is held well above 93.47 support so far. Thus, near term outlook remains cautiously bullish. We’re holding on to the view that whole medium term fall from this year’s high at 103.82 has completed at 91.01 after drawing support from long term cluster at 91.91/93 (38.2% retracement of 72.69, 2011 low, to 103.82, 2016 high). Break of 95.15 will target 38.2% retracement of 103.82 to 91.01 at 95.90 and then 61.8% retracement at 98.92 and above.

Trading strategy

Dollar’s pull back last week is seen as a correction for the moment. And we’re expecting more dollar buying ahead as the reconciled tax plan of House and Senate emerges. Hence, we’ll stay with out USD/JPY long position (bought at 114.50). Stop will be kept at 112.80. As noted before, the medium term correction from 118.65 should have completed at 107.31. We’d expect a strong break of 114.49 key resistance later to confirm this bullish view. 118.65 is the first target. We’ll look at the upside momentum on rally resumption to gauge the chance of hitting 2015 high at 125.85 at a later stage.

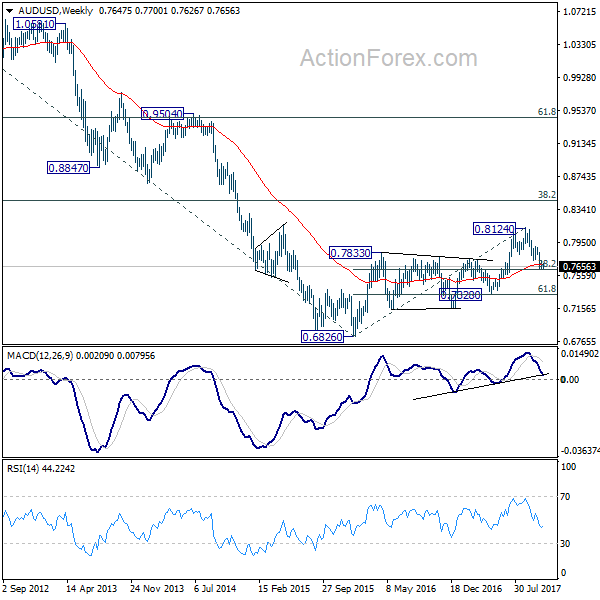

Meanwhile, RBA monetary policy statement released on Friday confirmed the view that the central bank will stay on hold. Monetary policy divergence will keep AUD/USD pressured. We’ll try to sell AUD/USD on break of 0.7624 this week. In our view, the medium term rise from 0.6826 should have completed with three waves up to 0.8124. Going forward, first target is 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8124). But we’ll also look at downside momentum to assess the chance of breaking through 0.6826 low to resume the long term down trend. Stop will be placed at 0.7710, slightly above last week’s high.

AUD/USD Weekly Outlook

AUD/USD’s consolidation from 0.7624 continued last week and outlook is unchanged. Initial bias remains neutral this week first. In case of another recovery, upside should be limited well below 0.7896 resistance to bring fall resumption. On the downside, decisive break of 0.7624 will resume whole fall from 0.8124 and target next key cluster level at 0.7322/8.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8067). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7896 near term resistance holds.

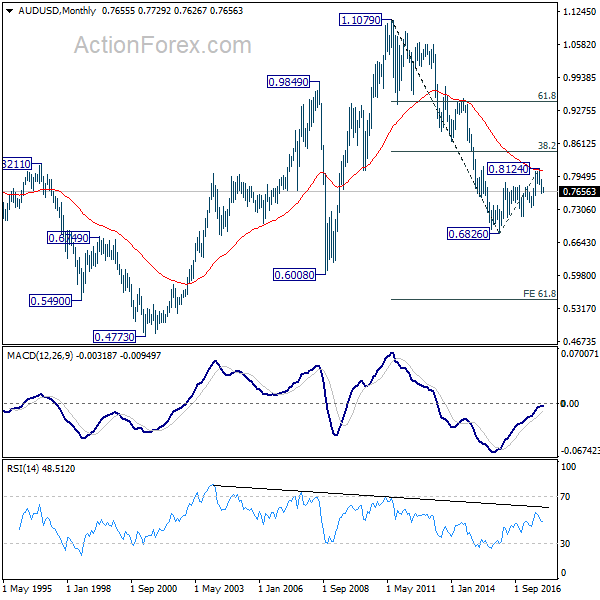

In the longer term picture, 0.6826 is seen as a long term bottom. Rise from there could either reverse the down trend from 1.1079, or just develop into a corrective pattern. At this point, we’re favoring the latter. And, as long as 38.2% retracement of 1.1079 to 0.6826 at 0.8451 holds, we’d anticipate another decline through 0.6826 at a later stage. But strong support should be seen between 0.4773 (2001 low) and 0.6008 (2008 low).