- At today’s monetary policy meeting, the Bank of England decided to cut the Bank Rate by 25bp to 5.00%.

- A tight vote split, the notion of it being a finely balanced decision to cut rates and a mention of upside risks to the inflation forecast, gave the cut a slight hawkish twist.

- Gilt yields tracked lower and EUR/GBP moved higher on the cut, but GBP more than fully retraced the move during the press conference.

The Bank of England (BoE) decided to cut the Bank Rate by 25bp to 5.00% at today’s meeting. The vote split was very tight with 5 members voting for a cut and 4 members voting for an unchanged decision. Pill joined the hawkish camp consisting of Greene, Haskel and Mann in voting for an unchanged decision, dissenting from Governor Bailey for the first time since he joined the MPC.

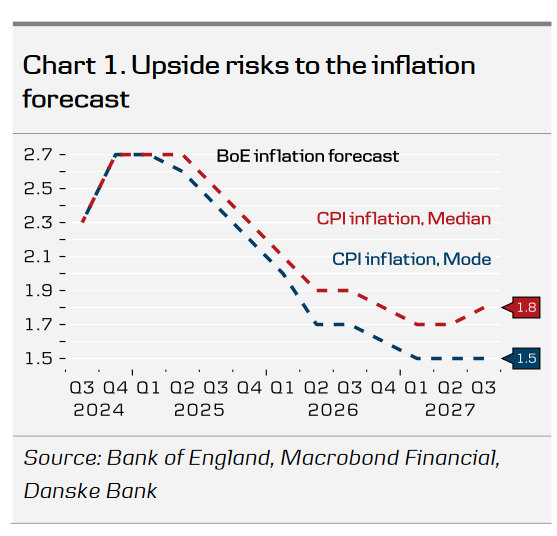

Delivering its first cut today following a hiking cycle, the BoE noted that “it is now appropriate to reduce slightly the degree of policy restrictiveness” but that “monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further“. The committee further signalled a cautious approach with Bailey wary on cutting “too quickly or by too much” and that for some of the members who decided to vote for a cut “the decision was finely balanced … and there remained some upside risks to the outlook.” On the forecasts, GDP forecast was revised up to 1.25% for 2024 (from 0.5%) as expected with upside risks around the output gap. The central (modal) projection on inflation was revised lower but with upside risks across the forecast horizon.

Given the notion of it being a finely balanced decision, upside risks to the inflation forecast and the tight vote split, we think that this suggests that the BoE will take a more gradual approach to a cutting cycle. We expect the next 25bp cut in November with the Bank Rate ending the year at 4.75%.

Rates. 2Y Gilt yields moved lower on the statement but overall, the reaction in rates markets was muted. While markets price a probability for a move in September (7bp), it sees it as more likely that the next cut will be later in the year (November).

FX. EUR/GBP moved higher on the announcement of a cut but given the tight vote split and the more cautious approach on monetary easing, EUR/GBP more than fully retraced the move. We see relative rates as rather neutral for EUR/GBP, given our hawkish call on the ECB. We expect EUR/GBP to continue its move lower driven by indicators pointing to a continued (modest) rebound in the global manufacturing cycle, tight credit spreads and low FX volatility. The key risk is policy action from the BoE.

Our call. We expect the BoE to deliver one additional cut this year at the November meeting with risks skewed towards an additional cut. Markets are pricing 40bp for the remainder of the year with the next cut 25bp cut fully priced by November.