- The GBP/USD pair is currently experiencing a standoff between bulls and bears, with the pair clinging to support at the 1.2850 level.

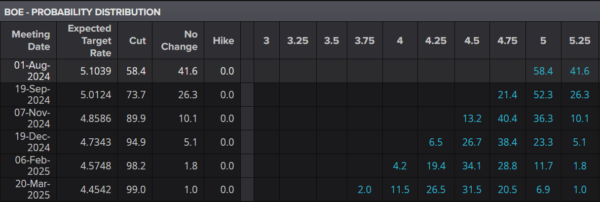

- The upcoming Federal Reserve and Bank of England policy meetings are adding to market uncertainty, with the odds of a BoE rate cut hovering around 58%.

- UK Finance Minister Rachel Reeves has announced immediate spending cuts, citing the unsustainability of public finances.

Cable has held onto support at the 1.2850 level as the battle between bulls and bears heats up. With the Federal Reserve and the Bank of England (BoE) holding their policy meetings this week, markets are on edge.

Yesterday, an attempted move lower driven by renewed US dollar safe haven appeal pulled the pair below 1.2850, but buying pressure quickly emerged. The increasing geopolitical risk premium continues to weigh on Cable, although expectations of the Federal Reserve’s rate cut cycle are providing some offset.

The BoE faces an even more intriguing situation at its upcoming monetary policy meeting. The odds for a rate cut on Thursday remain around 50%, making it a difficult decision to predict.

Bank of England Interest Rate Probabilities, July 30, 2024

Source: LSEG

An excellent way of looking at it, two members of the nine-person committee have already begun voting for rate cuts. Two or possibly three others hold the opposite view and are clearly resistant to cuts. This leaves four or five members in the middle, who seem undecided.

June’s meeting indicated that some, perhaps most, of these officials believed the decision was finely balanced. However, since the general election was called in late May, we’ve heard very little from these policymakers.

UK Government Cuts Spending

Britain’s new Finance Minister, Rachel Reeves, informed Parliament that her conservative predecessor had set public spending to reach £21.9 billion this year, necessitating immediate cuts of £5.5 billion.

Reeves emphasized the unsustainability of current public finances. Conservative opponents criticized her remarks, accusing her of setting the stage for tax hikes—a possibility Reeves has not dismissed.

The Office for Budget Responsibility announced it would review the preparation of Jeremy Hunt’s March budget, calling it a serious issue.

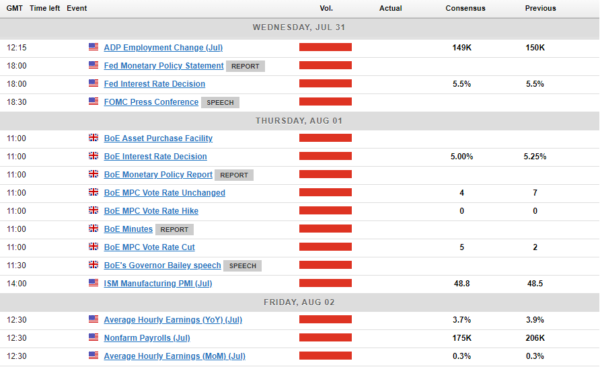

Economic Data Ahead

A big week for Central Banks with the Bank of England (BoE), Federal Reserve and the Bank of Japan (BoJ). On top of that we also have the NFP and jobs report on Friday which could have a bigger impact on the US Dollar than the FOMC meeting.

Of course the impact of the Fed meeting will largely depend on the rhetoric adopted by Fed Chair Jerome Powell as markets are expecting the Fed to hold rates steady.

Technical Analysis

From a technical perspective, GBP/USD has been consolidating over the past three days since hitting support at 1.2850.

Both bulls and bears have attempted to move the price away from this level, but each effort has been countered by buying or selling pressure. This underscores the current uncertainty surrounding the upcoming Central Bank meetings.

Immediate support below the 1.2850 area lies at the 1.2800 and 1.2750 levels. A break below these support zones could shift focus back to the psychological 1.2500 mark.

Conversely, an upward movement will face resistance at 1.2950 before the psychological 1.3000 level becomes crucial again.

GBP/USD Chart, July 30, 2024

Source: TradingView (click to enlarge)

Support

- 1.2800

- 1.2750

- 1.2680

Resistance

- 1.2950

- 1.3000

- 1.3040