Gold came close to closing lower for the second week in a row, falling to $2372 per troy ounce on Friday morning, $111 below its high on July 17th.

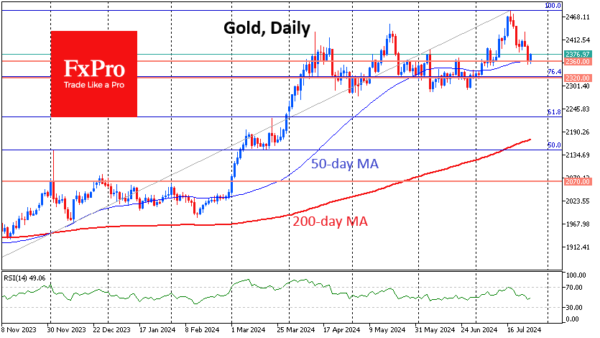

This decline occurred in two impulses, with an intermediate correction in between, and fits within a 61.8% Fibonacci retracement pattern from the initial decline. The extension of the pattern within the classic expansion suggests a downside target near $2320.

On the other hand, gold found buying support on Thursday and early on Friday at the crossover of the 50-day moving average near $2360. This also coincides with the consolidation centre of the repeated pullbacks from April to June. This means that the decline in this area is well within the framework of a correction, and it is not yet possible to claim that the gold rally has broken and that a top has been established for many months and years to come.

Therefore, there are two possible lines of defence for gold in the short term: $2360 and $2320. It is worth keeping a close eye on the price action around these levels. If gold breaks through them with a strong move, we should be prepared for a prolonged decline. If the buyers manage to break the trend near one of these lines, the price may well continue to rise on buyers’ encouragement.

Gold’s ability to avoid a sell-off in June after breaking the 50-day probably helped it make new highs in July. This story could be repeated if the financial markets avoid another deep sell-off and return to growth even without an official correction (a fall of more than 10% from the peak).