Risk aversion has firmly gripped the markets, leading to the steepest selloff in US stocks since 2022 overnight. This sharp decline continued into the Asian trading session, with Nikkei plunging nearly 3%. The market rout is further exacerbated by a broad decline in base metals, oil, and even cryptocurrencies, signaling a widespread flight to safety.

Amidst this backdrop, Japanese Yen’s rally appears unstoppable. Yen, along with Swiss Franc and Dollar, are benefiting from their status as safe-haven currencies. Conversely, commodity currencies such as the Australian Dollar are bearing the brunt of the selloff, sinking to the bottom of the performance charts. Euro and British Pound are faring relatively better, positioning themselves in the middle of the pack.

Today’s key economic focus is US Q2 GDP advance report, where growth is expected to pick up to 2.0% annualized from Q1’s 1.4%. This anticipated increase is attributed to resilient consumer spending, which has persisted despite inflationary pressures and high borrowing costs. However, there are concerns about how long this resilience can last, especially as pandemic-era savings dwindle.

A lower-than-expected GDP reading could strengthen the case for Fed to implement two interest rate cuts this year. Yet, it’s uncertain if the markets will maintain the trend of interpreting “bad news as good news.”

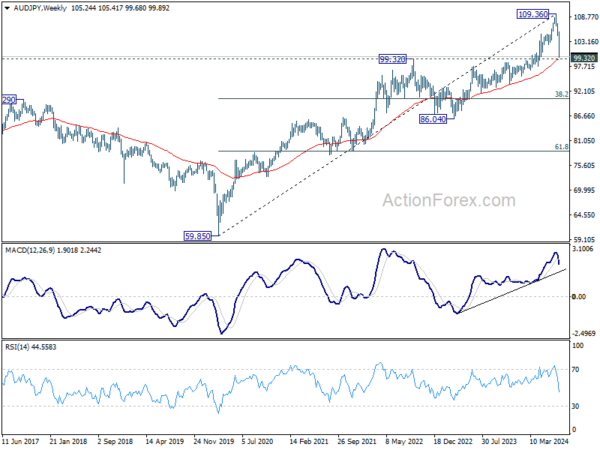

Technically, AUD/JPY is now in proximity to a key medium term support zone with this week’s free fall. There is prospect of stabilization around 99.32 resistance turned support as well as 55 W EMA (now at 99.24). However, decisive break there will argue that it’s already correcting the whole up trend from 59.85, could pave the way back to 38.2% retracement of 59.85 to 109.36 at 90.44.

In Asia, at the time of writing, Nikkei is down -3.21%. Hong Kong HSI is down -1.72%. China Shanghai SSe is down -0.72%. Singapore Strait Times is down -0.90%. Japan 10-year JGB yield is down -0.0101 at 1.067. Overnight, DOW fell -1.25%. S&P 500 fell -2.31%. NASDAQ fell -3.64%. 10-year yield rose 0.047 to 4.286.

Tech Woes and Election Jitters Trigger Steep US Stock Sell-Off

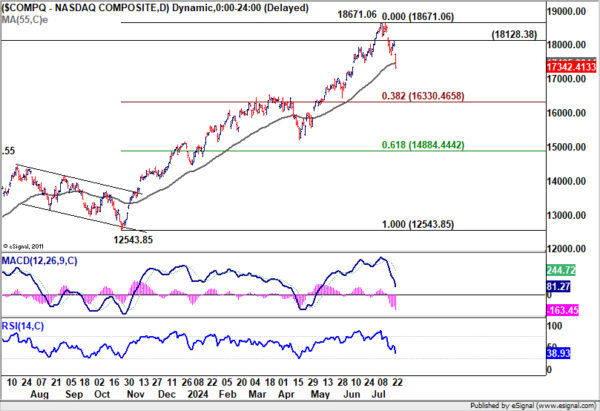

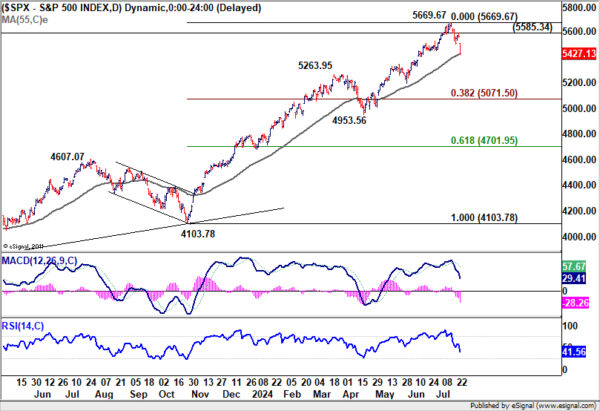

US stocks took a steep dive overnight, with S&P 500 and NASDAQ Composite suffering their worst sessions since 2022, down -2.31% and -3.64% respectively. The sell-off was triggered by disappointing earnings reports from tech giants Alphabet and Tesla. Alphabet’s shares fell -5%, marking their biggest one-day drop since January 31, while Tesla plummeted -2.3%, its worst performance since 2020.

Beyond earnings, the market’s unease is likely compounded by the approaching US presidential election in November. With Joe Biden stepping out of the race and Kamala Harris stepping in, Donald Trump’s lead appeared to have narrowed significantly, and political uncertainty is looming large. Investors seem to be moving to lock in profits after the strong record run since last November, bracing for volatility in the lead-up to the election. This could signal a correction period, with the market possibly experiencing downward pressure for the next few months.

Technically, NASDAQ’s break of 55 D EMA (now at 17465.33) argues that it might at least be correcting the up trend from 12543.85. Risk is now on the downside as long as 18128.38 resistance holds. NASDAQ could falls to 38.2% retracement of 12543.85 to 18671.06 at 16330.46 before finding strong support to set the range for consolidations.

As for S&P 500, risk will stay on the downside as long as 5585.34 resistance holds. Decisive break of 55 D EMA (now at 5418.40) will align the outlook with NASDAQ. Deeper fall would be then be seen in S&P 500 to 38.2% retracement of 4103.78 to 5669.67 at 5071.50, before forming a base to set the range for medium term consolidations.

Japanese government notes export stagnation as global risks mount

Japan’s government maintained its economic assessment but noted a more pessimistic outlook for exports due to weakening demand from China.

According to the Cabinet Office’s Monthly Economic Report, the Japanese economy is recovering at a “moderate pace,” though it has recently “appeared to be pausing.” The assessment of exports was downgraded from “appearing to be pausing for picking up” to “almost flat,” reflecting the impact of slowing Chinese demand.

In the short term, the economy is expected to continue its moderate recovery, supported by an “improving employment and income situation.” However, several risks threaten this outlook. These include the slowdown in global economies, high-interest rates in the US and Europe, and the “lingering stagnation of the real estate market in China.”

The report also highlighted the need to monitor price increases, geopolitical tensions in the Middle East, and fluctuations in financial and capital markets.

Looking ahead

Germany Ifo business climate is the main feature in European session while Eurozone will release M3 money supply. Later in the day, US Q2 GDP advance will take center stag, while jobless claims and durable goods orders will also be published.

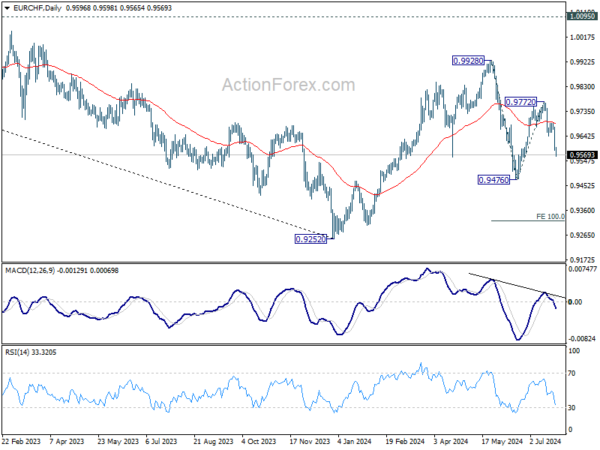

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9563; (P) 0.9620; (R1) 0.9652; More….

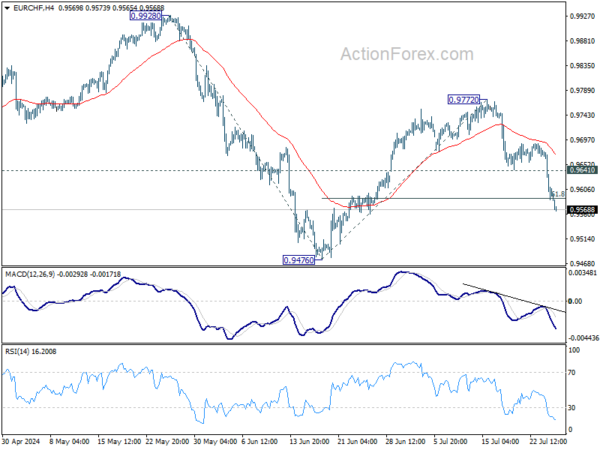

EUR/CHF’s fall from 0.9772 continues today and intraday bias stays on the downside. With 61.8% retracement of 0.9476 to 0.9772 at 0.9589 broken, next target is 0.9476 low. Firm break there will resume whole fall from 0.9928 to 100% projection of 0.9928 to 0.94767 from 0.9772 at .9320. On the upside, above 0.9641 support turned resistance will turn intraday bias neutral first.

In the bigger picture, with 1.0095 key medium term resistance intact, price actions from 0.9252 (2023 low) are seen as a corrective pattern. Fall from 0.9928 might be the second leg and break of 0.9476 would bring deeper fall to retest 0.9252 low. But strong support should be seen there to extend the corrective pattern with another rising leg. In case, medium term outlook will be neutral at best as long as 1.0095 structural resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 3.00% | 2.60% | 2.50% | 2.70% |

| 08:00 | EUR | Germany IFO Business Climate Jul | 89 | 88.6 | ||

| 08:00 | EUR | Germany IFO Current Assessment Jul | 88.5 | 88.3 | ||

| 08:00 | EUR | Germany IFO Expectations Jul | 89 | 89 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 1.90% | 1.60% | ||

| 12:30 | USD | Initial Jobless Claims (Jul 19) | 238K | 243K | ||

| 12:30 | USD | GDP Annualized Q2 P | 2.00% | 1.40% | ||

| 12:30 | USD | GDP Price Index Q2 P | 2.60% | 3.10% | ||

| 12:30 | USD | Durable Goods Orders Jun | 0.40% | 0.10% | ||

| 12:30 | USD | Durable Goods Orders ex Transport Jun | 0.20% | -0.10% | ||

| 14:30 | USD | Natural Gas Storage | 13B | 10B |