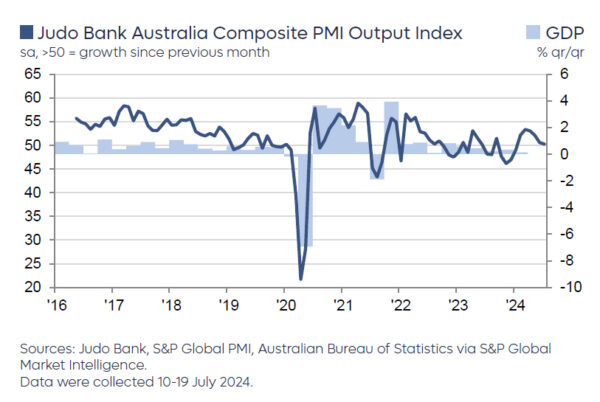

Australia’s PMI Manufacturing saw a marginal improvement in July, rising slightly from 47.2 to 47.4. Conversely, PMI Services dropped to a six-month low, moving from 51.2 to 50.8. PMI Composite also decreased from 50.7 to 50.2, the lowest in six months.

Warren Hogan, Chief Economic Advisor at Judo Bank, highlighted that despite a further moderation in the composite output index, “there are no signs of a significant slowdown in Australian business activity in 2024.” He noted that while manufacturing continues to struggle, services sector is still experiencing better activity compared to the end of 2023.

Hogan also mentioned that the impact of recent tax cuts and cost-of-living support measures has yet to fully manifest in the business conditions and should positively affect consumer spending in future months. Insights from the upcoming final PMIs for July and the reports for August are expected to provide a clearer picture of these effects.

Despite softer activity levels, inflation pressures have not eased significantly. The services sector saw a notable increase in input costs, which rose four points to 63.3—the highest since November 2023. In contrast, manufacturing input costs rose only slightly and are near their lowest in four years. The composite output price index nudged up to 54.1 in July, indicating a small increase but suggesting that inflation is likely stabilizing around an annualized rate of 4% as of mid-2024.