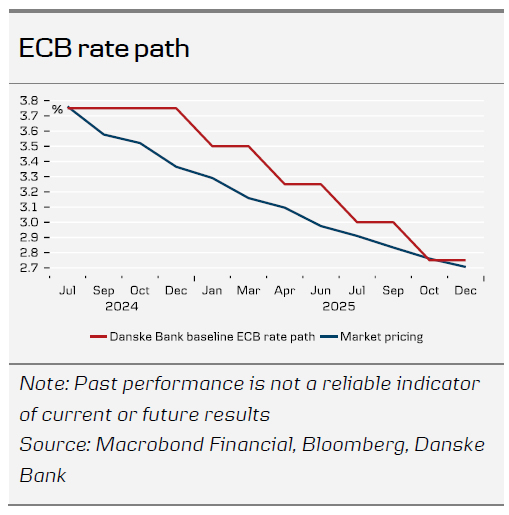

Today, the ECB held its policy rates unchanged, as unanimously expected by markets and analysts. The central bank did not send any signals for the September decision, where it repeated its call for a data-dependent and meeting-by-meeting approach. During the Q&A, Lagarde said that the “question of September and what we do in September is wide open”, although markets do not share that view, pricing a 25% rate cut probability at 80%. We find the 2025 pricing of 84bp on the slightly dovish slide of expectations. We expect four more rate cuts by the ECB until end-2025.

Nothing (really) new…

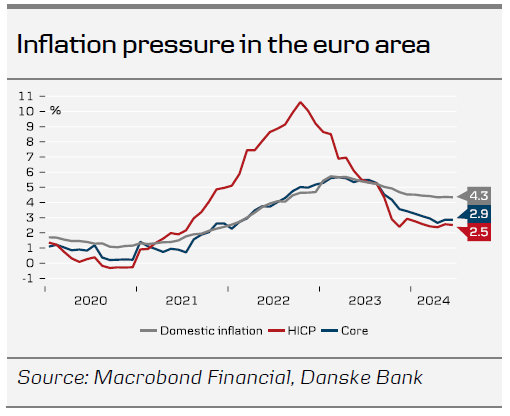

As widely expected, the ECB meeting did not carry new policy signals. We did not expect that either given the limited new information that the ECB has received since the June ECB meeting. The decision statement was balanced with a key paragraph to both the dovish and the hawkish camp of the ECB. The statement read; “While some measures of underlying inflation ticked up in May owing to one-off factors, most measures were either stable or edged down in June”, as well as, “domestic price pressures are still high, services inflation is elevated and headline inflation is likely to remain above the target well into next year”. The inflation assessment was largely unchanged, yet we took note of the slight adjustment in the risk picture for growth, which is now titled to the downside (in June it was balanced in the short-term and to the downside in the medium-term). During the press conference Lagarde said that arguments on the “one hand and on the other hand” were discussed, thus leading us to conclude that this will be remembered as a stock taking meeting. With no new policy signals, Lagarde ended the press conference with greetings for the “vacation and summer break”.

… as key data is only coming ahead of the September meeting

The ECB’s modus-operandi of taking a meeting-by-meeting and data-dependent approach on a three-tiered reaction function (inflation outlook, underlying inflation, and strength of transmission mechanism) means that incoming information ahead of September will be important. In particular the triangulation between wages, productivity, and profits will play a key role in whether the ECB will hold or cut in September, which Lagarde also highlighted today. The key dates to watch are 14 August for productivity, 22 August for negotiated wages, and 6 September for both compensation per employee and profits data. The meeting is scheduled for 12 September. In addition, we will have the flash inflation for July and August, and the final inflation for July. The latter in particular is key given that this allows to compute the domestic inflation pressure that features prominently in the ECB’s underlying inflation discussion. We see this still printing in excess of 4% at the timing of the September meeting. In September, we will also get new staff projections.

Our median baseline of no September rate cut still holds, which is built on a combination of the strength of the labour market, sticky underlying inflation, and the recovery of the euro area growth. We repeat that a key risk to our ECB September rate call is whether the Fed will cut in September, and whether this adds ‘political’ pressure to cut rates as well, despite the sticky underlying inflation. We find the September rate cut case more compelling in the US (and in light of Powell’s comments this week) than in the euro area.

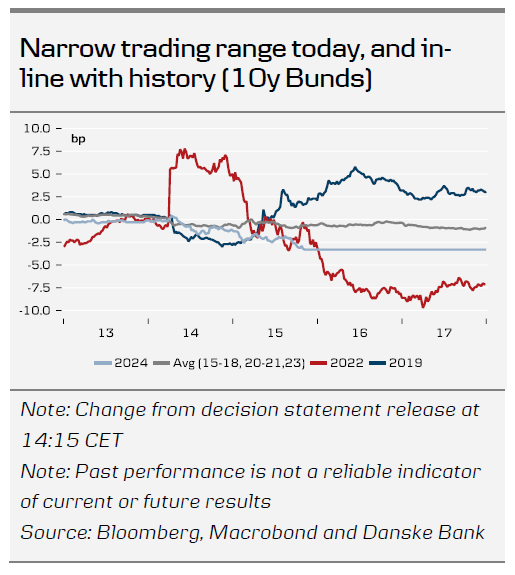

Subdued market response following no new policy signals

The ECB meeting did not notably affect the bond or the FX markets as expected. 10y Bunds traded in a narrow range of less than 1bp around 2.43%. The EUR/USD remained steady in the 1.0900-1.0950 range throughout the announcement and the press conference. With limited new information since the ECB’s first rate cut in this round six weeks ago, the ECB hardly had any reason to send new monetary policy signals ahead of the September meeting.

The next catalysts for the markets are the July flash PMIs for both the US and the euro area, the FOMC meeting on 31 July, and the US jobs report at the beginning of August, alongside developments in US politics. Concerns about euro area debt, spurred by the French election, have largely subsided following the “hung parliament.”

Overall, even though we disagree with the market and think the ECB will stay on hold at the September meeting and only deliver one more cut this year, we believe that fundamental factors indicate a lower EUR/USD in the second half of the year. Despite recent softer US data, persistent US inflation and/or US growth outperformance in the second half could support the USD for the remainder of the year. We forecast EUR/USD to reach 1.05/1.03 in 6/12M.