- EURUSD rally slows down near 4-month high

- Gets bearish vibes, but positive trend is still alive above 1.0900

- ECB to hold interest rates steady at 12:15 GMT; Will it signal a second rate cut?

EURUSD took a breather after heightened expectations of a Fed rate cut lifted the pair as high as 1.0947 on Wednesday.

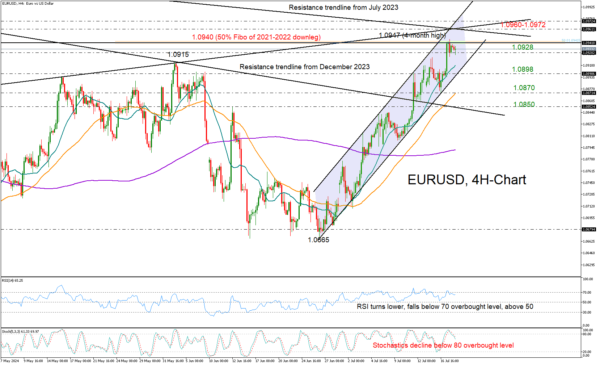

The price has been displaying a pattern of higher highs and higher lows in the past three weeks, but its failure to reach the upper band of the bullish channel on the four-hour chart could indicate a bearish wave approaching. Besides, considering the negative turn in the RSI and the stochastic oscillator, some weakness in the near term cannot be excluded.

If the nearby support zone of 1.0928 cracks, the bears could directly head towards the channel’s lower boundary at 1.0898. The credibility of the uptrend could be undermined if there is a decisive close below the latter, but only a significant drop below the 50-period SMA at 1.0870 would disrupt the positive pattern. If that scenario plays out, the spotlight will fall on the 1.0850 region, where the former resistance trendline drawn from December’s peak is located.

On the upside, the 1.0945 level, which halted bullish movements on Wednesday, might be symbolic for traders as it represents the 50% Fibonacci retracement of the major downtrend from 2021-2022. Slightly higher the 1.0960-1.0972 trendline zone could be another tough obstacle, which the pair needs to pierce in order to touch the 1.1000 number. The 1.1045 mark could be the next target.

In brief, EURUSD is expected to trade with weaker momentum in the coming sessions, though optimism for a bullish continuation may not evaporate unless the price tumbles below 1.0900.