- Increased investor confidence fueled by a $1.04 billion inflow into Bitcoin Spot ETFs.

- Bitcoin miners, particularly in the US, are accumulating Bitcoin in anticipation of another potential rally, with Marathon Digital Holdings aiming to significantly increase its hashrate.

- Technically, Bitcoin’s breakout above a long-term descending trendline suggests further upside potential.

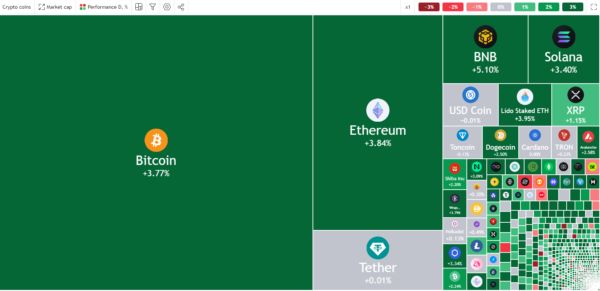

Bitcoin prices enjoyed somewhat of a renaissance over the weekend bursting back above the 60k mark and taking out some key technical hurdles in the process.

Bitcoin Spot ETF Net Inflow (USD) data reveals an inflow of $1.04 billion last week, indicating rising investor confidence and potentially suggesting a short-term increase in Bitcoin’s price. Market participants are also hoping that an approval of the ETH ETF may lead to further inflows in the days and weeks ahead as market participants diversify their crypto holdings.

Source: TradingView.com (click to enlarge)

The conclusion of the German Government’s Bitcoin sales provided some relief, but ongoing uncertainty regarding Mt.Gox repayments might still pose challenges for bullish investors.

The attack on US Presidential Candidate Donald Trump further fueled the Bitcoin recovery. Trump has vowed to allow miners to remain active while also confirming that he will ensure every American has the right to self-custody of their digital assets and transact free from Government control. Given the probability of a Trump election rising it is no surprise that sentiment in the crypto space received a significant boost. Marathon holds 18,536 Bitcoin worth over $1 billion, up 48% from 2023’s total of 12,538.

Bitcoin miners are also in a race against time and their own competition when it comes to upping Bitcoin mining capacity. Companies such as Marathon and CleanSpark are looking to up their hashrate to improve their mining output.

Miners Opt to Accumulate Bitcoin

Bitcoin miners in the US are accumulating Bitcoin as market participants eye another rally. There are big names on the list like Marathon Digital Holdings whose CFO mentioned that Bitcoin is different from other asset classes when it comes down to what to consider. Marathon is targeting a hashrate of 50 (EH/s) by the end of 2024, up from a 31.5 (EH/s).

Bitcoin advocate and influencer Michael Saylor returned to the spotlight as Bitcoin began its latest move. The co-founder and the Executive Chairman of business intelligence giant MicroStrategy has taken to his account on the X platform to comment on the Bitcoin price increase that began on Sunday.

A simple message but clearly Saylor sees more upside ahead for BTC/USD.

Technical Analysis BTC/USD

From a technical standpoint, Bitcoin has surged above the long-term descending trendline, suggesting further upward potential. However, the rally faces strong resistance just below the crucial 65k level, where both the 50-day and 100-day moving averages (MAs) are positioned.

If the MAs reject the price, Bitcoin could retrace to the support levels at 61,750 or 59,300, aligning with the 200-day MA. This would also involve a retest of the trendline, which did not occur after the breakout.

Should Bitcoin surpass the 65,000 mark, the next key levels on the upside would be the 70,000 and 71,900 handles.

Support

- 61750

- 59311 (200-day MA)

- 56561

Resistance

- 64030

- 65000

- 70000 (psychological level)

- 71935

Bitcoin (BTC/USD) Daily Chart, July 15, 2024

Source: TradingView.com (click to enlarge)