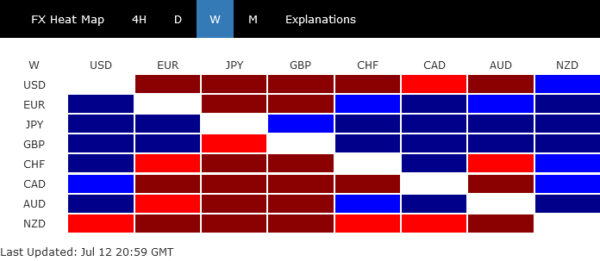

Dollar weakened broadly last weeks market expectations on Fed’s policy path shifted dramatically. The June US CPI report continued the narrative painted by the previous week’s Non-Farm Payroll data, both suggesting further cooling in economic activity and easing price pressures. These developments have firmly positioned a September Federal Reserve rate cut as a near certainty in the minds of traders, with additional expectations for another reduction in December. Some aggressive market participants are even betting on an additional reduction in November. This shift in sentiment also boosted US stocks to new record highs and hammered treasury yields.

However, despite its significant movement, Dollar was only the second worst performer, with the New Zealand Dollar taking the bottom spot. Kiwi plunged following the surprisingly dovish statement from RBNZ, which accompanied their decision to hold interest rates unchanged. The hint of future monetary easing has markets betting on a rate cut by RBNZ as early as November. Meanwhile, Canadian Dollar was the third worst performer.

Conversely, Japanese Yen emerged as the week’s star performer, buoyed by what appeared to be a strategically timed market intervention by Japan. The next move for Yen will depend on whether market participants join in to further boost its value, a development that might hinge on BoJ’s meeting later this month.

Meanwhile, British Pound secured its position as the second strongest performer, rallying after expectations for an August rate cut by BoE were dashed by comments from a top BoE official and stronger-than-expected UK economic data. Euro ranked third in performance, while Aussie and Swiss Franc ended mixed in the middle.

Odds of Three Fed Rate Cuts in 2024 Now a Toss-Up

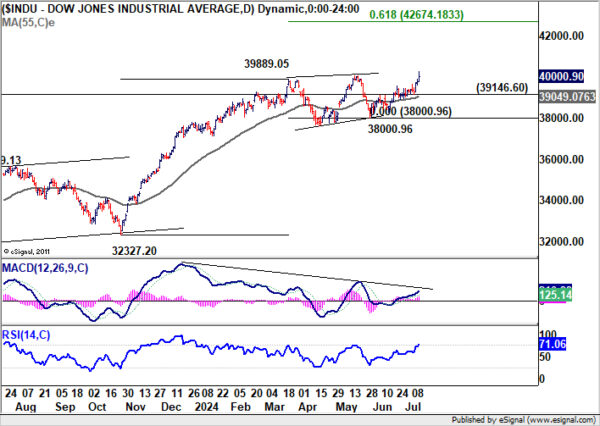

US stock markets were on a high, with even laggard DOW reaching a new intraday record, following earlier surges by S&P 500 and NASDAQ. The upbeat sentiment among investors was largely driven by optimism that Fed is on track for rate cut, and this expectation was further solidified by US June CPI data.

The CPI report showed further slowdown in both headline and core inflation rates, suggesting that the “last mile” of disinflationary process in the US might be less daunting than previously feared. This positive development should bolster Fed policymakers’ confidence to consider lowering interest rates sooner.

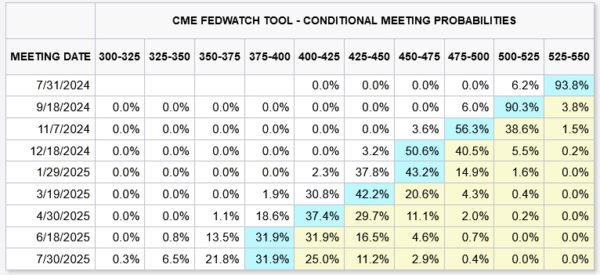

In light of these developments, fed fund futures now indicate 94% chance of a 25bps rate cut in September, bringing federal funds rate down to 5.00-5.25%. By year-end, there’s also 94% chance of two total rate cuts, lowering the rate to 4.75-5.00%.

More importantly, there’s around 60% chance of seeing two rate cuts by November meeting, reducing the rate to 4.75-5.00%. Furthermore, there’s 54% probability of three cuts by year-end, bringing the rate down to 4.50-4.75%.

This suggests that some market participants are aggressively betting on back-to-back rate cuts in September, November, and December. This speculation has dialed back the clock to March, with close probabilities between two and three rate cuts this year.

Technically, S&P 500 surged to new record high at 5655.56. But it appears to be struggling slightly facing 61.8% projection of 4103.78 to 5263.95 from 4953.56 at 5670.55.

For now, further rally is expected as long 5523.64 resistance turned support holds. Firm break of 5670.66 will pave the way to 100% projection at 6113.73. This is where the real test lies with 100% projection of 2191.86 to 4818.62 from 3491.58 nearby.

Meanwhile, firm break of 5523.64 will bring consolidations first, before the up trend resumes.

DOW’s last breakout suggests that long term up trend is resuming. Further rise is expected as long as 39146.60 support holds. Sustained trading above 40000 handle will pave the way to 61.8% projection of 3237.20 to 39889.05 from 38000.96 at 42674.18.

Also, it should be emphasized that 40k handle is critical as it’s also close to 61.8% projection of 18213.65 to 36952.65 from 28660.94 at 40241.64. Decisive break there could prompt medium term upside acceleration towards 100% projection at 47399.94.

Nevertheless, break of 39146.60 support will delay the bullish case.

Yields Fall and Dollar Weakens Amid Changing Fed Expectations

US 10-year yield fell notably last week along with the development in Fed expectations. Technically, outlook is unchanged that fall from 4.737 is the third leg of the pattern from 4.997 and it’s still in progress. Further decline is expected as long as 55 D EMA (now at 4.352) holds.

Sustained break of 55 W EMA 55 W EMA (now at 4.189) could prompt downside acceleration in TNX, and extend the fall from 4.737 to 3.785, or even further to 100% projection of 4.997 to 3.785 from 4.737 in the medium term.

However, there is a notable counterargument to this bearish outlook, linked to steepening yield curve. This steepening is reflective of market concerns that re-election of Donald Trump could lead to policies that might increase the risk premium on longer-maturity Treasuries. In this case, TNX’s decline could be floored to a certain extent.

The bearish case in Dollar index is starting to build up with a close below 55 W EMA (now at 103.40). Deeper decline is expected as long as 105.20 support holds, to 100% projection of 106.51 to 103.99 from 106.13 at 103.61. Break there will target 138.2% projection at 102.64 next.

More importantly, sustained trading below 55 W EMA will strengthen the case that whole rise from 100.61 has already finished at 106.51. That would open up deeper fall through 102.35 to retest 100.61 support next.

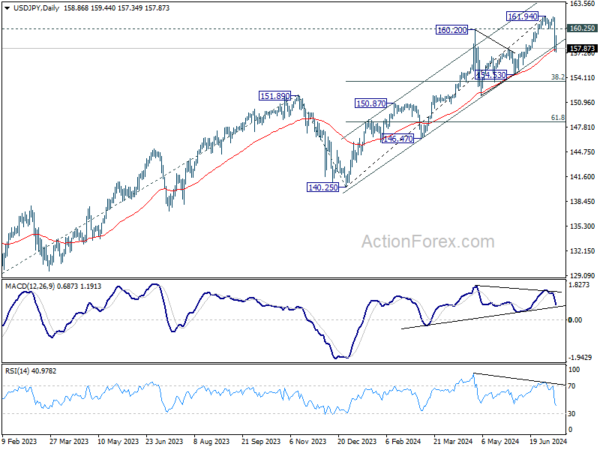

Yen Jumps on Suspected Intervention; Market Awaits BoJ’s Next Steps

Yen also dominated financial headlines, with its largest daily rally since late 2022, allegedly driven by unconfirmed market intervention from Japan. The timing of this intervention was notably strategic, occurring just after US CPI release, which had already exerted significant downward pressure on the greenback. Reports from BoJ accounts suggest that approximately JPY 3.5T may have been deployed in these efforts to buoy Yen.

Despite this surge, the yen’s rebound was limited as market participants seemed hesitant to join to drive the currency higher. The focus now shifts to BoJ’s meeting at the end of July. The financial community are divided over BoJ’s next move: Some economists argue that market interventions increase the likelihood of a rate hike, viewing it as a necessary follow-up to governmental actions. Others believe that the easing pressure on Yen makes a rate hike less probable.

Technically, further decline is expected in USD/JPY as long as 160.25 support turned resistance holds. Considering bearish divergence condition in D MACD, fall from 161.94 might be correcting the whole five-wave rally from 140.25 already.

Sustained trading below 55 D EMA (now at 157.34) will strengthen this bearish case and send USD/JPY further lower to 38.2% retracement of 140.25 to 161.94 at 163.65. But strong support should emerge there to bring rebound, as set the range for medium term consolidations.

Nikkei, on the other hand, suffered with Yen’s strong rebound. The Japanese index had it biggest daily drop of the year just after hitting new record above 42k. As long as 40746.89 support holds, there is still prospect of extending the record rally to 61.8% projection of 35038.28 to 41087.75 from 37950.19 at 44469.76. However, firm break of 40746.89 will bring deeper pull back to 55 D EMA (now at 39407.32). The depth of Nikkei’s correct in this bearish case, would depend on that of USD/JPY too.

Sterling Stands Strong on Diminished Hopes for Aug BoE Rate Cut

Sterling stood out as one of the best performers again last week. There was a prevailing sentiment among investors that BoE might cut rates in August, especially after the general election. However, these hopes were tempered following remarks from BoE’s Chief Economist, Huw Pill. Pill hinted a preference for maintaining interest rate at 5.25%, citing persistent wage growth and inflation within the services sector as key concerns. His cautious stance was further reinforced by stronger than expected UK GDP data for May. Consequently, the likelihood of an August BoE rate cut, previously priced into the market at around 60%, has tumbled to approximately 50%.

EUR/GBP’s breach of 0.8396 support suggests that medium term down trend is ready to resume. Further decline would be seen to 61.8% projection of 0.8619 to 0.8396 from 0.8498 at 0.8360. Firm break there could prompt downside acceleration to 100% projection at 0.8275.

GBP/CHF’s strong rebound from 1.1216 continued last week towards 1.1675 resistance. Firm break there would confirm resumption of whole rise from 1.0634. Next near term target is 61.8% projection of 1.0634 to 1.1675 from 1.1216 at 1.1859.

EUR/USD Weekly Outlook

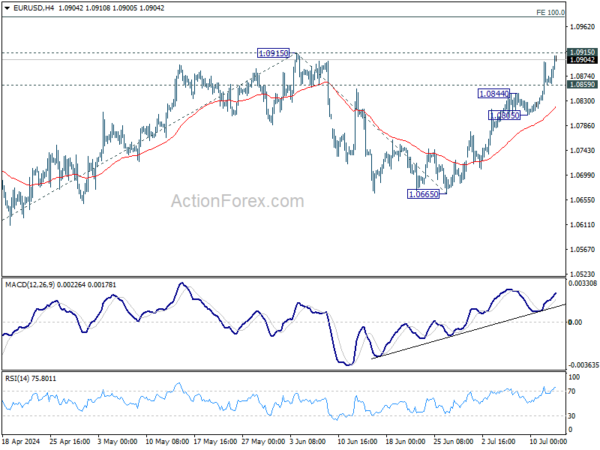

EUR/USD’s rally continued last week and hit as high as 1.0910. Initial bias stays on the upside this week. Firm break of 1.0915 will resume howl rise from 1.0601 to 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0979. On the downside, below 1.0859 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern, possibly a triangle, that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). This will now remain the favored case as long as 1.0601 support holds.

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). Sustained break of 55 M EMA (now at 1.1046) will raise the chance of long term reversal. But even in this case, firm break of 1.2348 structural resistance is needed to confirm. Rejection by 55 M EMA will maintain bearishness for extend the down trend from 1.6039 (2008 high) through 0.9534 at a later stage.