The Bank of Canada’s quarterly Business Outlook Survey (BOS) and June’s inflation data will be the last major data releases before the BoC’s next interest rate announcement on July 24. We expect a slowdown in inflation after an upside surprise in May and for the BOS to look soft enough to justify a second consecutive 25 basis point interest rate cut from the BoC at that meeting.

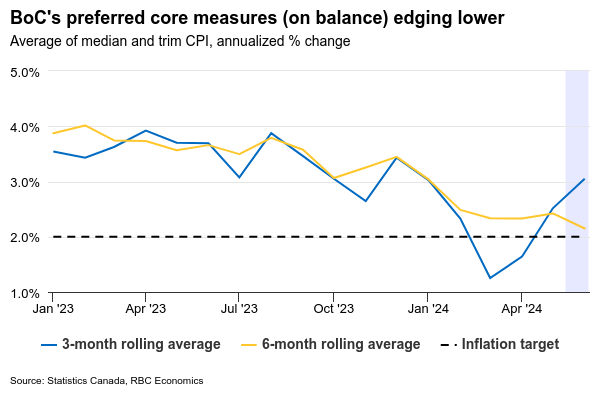

Headline consumer price index growth is expected to slow to 2.7% year-over-year after a surprisingly higher 2.9% reading in May. Energy price growth slowed on lower gasoline prices in June and food price increases have also been edging lower. Stripping out volatile food and energy components, inflation should come in at 3%, little changed from the prior month. But, the BoC will focus on growth in the preferred “core” measures, which provide more insights into broader underlying price growth trends. The closely watched three-month average of monthly increases will likely tick higher for both the median and trim CPI measures as a very small monthly increase in March falls out of that calculation, but the six-month average should hold around the 2% inflation target given earlier downside surprises.

The Q2 BOS will also be closely watched for further confirmation that the economic backdrop is continuing to soften in a way that would raise the central bank’s confidence about inflation pressures easing. The BoC’s governing council is particularly focused on indicators of the supply and demand balance in the economy, corporate pricing behaviour, inflation expectations, and wage growth. We expect all to show further improvement in the survey. Business responses’ will be reviewed for whether global shipping disruptions (and a jump higher in container shipping costs) are feeding through to increased costs. However, falling per capita gross domestic product and rising unemployment should mean that expected wage growth and inflation continue to slow. Corporate pricing behaviour has been normalizing with the frequency and size of price adjustments edging slowly back towards pre-pandemic levels.

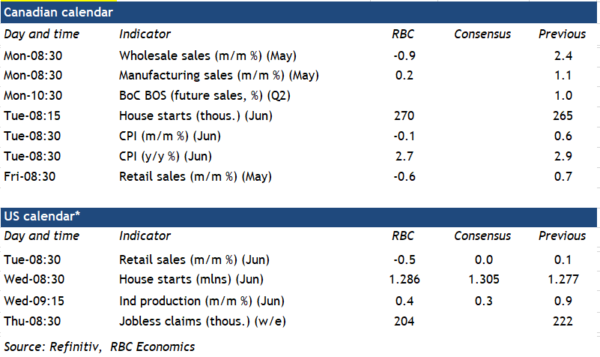

Week ahead data watch

Canadian manufacturing sales likely edged up 0.2% in May, according to Statistics Canada’s flash estimate, down from 1.1% sales growth in April and primarily driven by higher sales in aerospace products and parts industry group as well as the food product subsector.

We expect Canadian core wholesale sales (excluding petroleum, products, and other hydrocarbons and excluding oilseed and grain) to drop by 0.9%, with sales in motor vehicles, parts and accessories seeing the largest decline.

Canadian housing starts likely increased by 270,000 in June, up 2.1% from last month after a 9.7% jump in April.

We look for a 0.6% decline in May Canadian retail sales, in line with StatCan’s advance indicator. Much of the slowdown came from lower auto sales during that month (-3.7% seasonally adjusted), as well as a price-related sales decline at gas stations (-3.2%).

U.S. retail sales likely edged lower 0.5% in June, given auto sales and sales at gas stations were down. Control sales should hold flat during that month.

We expect U.S. industrial production to inch higher by 0.4% in June with higher output in the manufacturing and mining sectors offsetting lower output in the utility sector.