Yen trades broadly higher today following a so called flattening yield curve phenomenon globally. 10 year German bund yields extends recent decline and hits a two month low at 0.32 today. 2 year yield was flat at -0.76% and that makings the 108 basis points spread the lowest in two months. Similar situation is seen in US with spread between 2- and 10-year yield at 67 basis points, lowest in nearly a decade. Economists see that as a sign of worry over inflation path. That is, inflation might not be heading up while global central banks begin tightening policies. Meanwhile, sentiments were also weighed down by uncertainty over the US tax plan as there were reports that Senate Republican could delay corporate tax cuts by a year to comply with Senate rules.

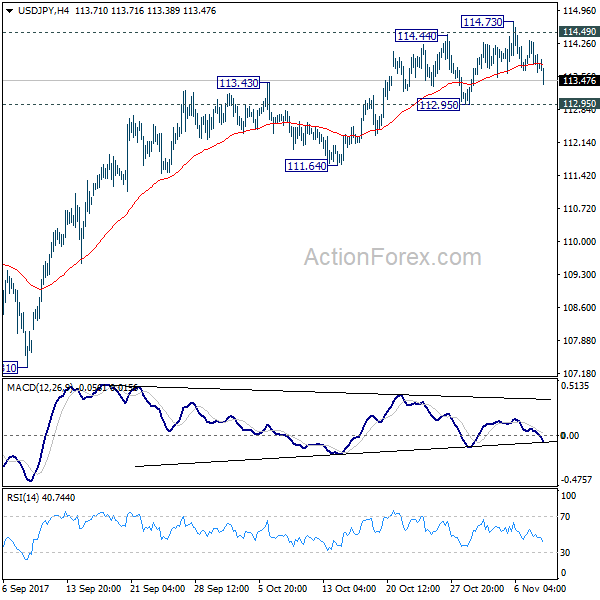

Technically, USD/JPY is so far holding well above 12.95 near term support despite today’s dip. Hence, outlook in USD/JPY stays bullish. However, EUR/JPY as taken out 131.65 key near term support again. GBP/JPY also breaches 148.65 minor support. Both developments suggests more downside should be seen in EUR/JPY and GBP/JPY in near term.

Sterling lower as PM May could fire another minister

Sterling tumbles broadly today on news that Prime Minister May could lose a second member of her cabinet within a week. International Development Secretary Priti Patel could follow Defense Secretary Michael Fallon to be shown the door by May. The political turmoil and scandals add to undermining May’s authority, with no tangible progress shown on Brexit negotiation so far.

Accord to a BoE report, regional agents found that hiring difficulties were "above normal" a some sectors. And, pay growth had already begun to head up. More upside pressure in wages would be seen in 2018. Meanwhile, overall growth in activity was "broadly stable" comparing to a year ago. Strongest growth was found in manufacturing. Services growth was moderate. Economic uncertainties were weighing on constructions. In particular, the uncertainty around Brexit negotiations was "dragging on spending".

German Merkel making progress in coalition talks

German Chancellor Angela Merkel seems to be making progress in her coalition talks. The Green party has agreed to compromise on key environmental issues with the pro-business Free Democratic Party. Greens admitted that the target to ban on internal combustion engines by 2030 wouldn’t be enforceable. The request for shutting down 20 most polluting coal-fired power plants by 2020 will also be modified. Now it’s the time for AfD to respond. Merkel targets to end the exploratory talks and start serious negotiation on coalition by November 16. .

Staying in Germany, a five-member Council of Economic Experts urged ECB to "quickly reduce the purchases and end them earlier". The group said that interest rate developments "suggest the ECB should significantly tighten its monetary policy to adapt to macro economic developments". The German economy is believed by the group to be heading for a "boom phase" with growth hitting 2.2% next year, an upward revision of prior expectation of 2.0%. Meanwhile, the group also warned that "hard Brexit" could create upheaval in EU. And, the "one-off extension that largely preserves the status quo would be sensible".

IMF Lagarde hails BoJ Kuroda

IMF Managing Director Christine Lagarde hailed that BoJ was doing the correct thing to maintain the pledge on the massive stimulus. She noted that "one of the strengths of central bankers is to be very clear in their communication and determined in their resolve, which clearly Governor Kuroda has demonstrated."

BoJ board member Yukitoshi Funo also defended the central bank’s massive asset purchase program. And even with the JPY 6T ETF purchases, "stock prices aren’t overheating". But he also sounded open to tweaking of the program and said "we’re not assuming we won’t make any changes to all of our various policy tools until 2 percent inflation is achieved."

RBNZ to stand pat as overhaul starts

RBNZ rate decision will be the main focus in upcoming Asian session. The central bank is widely expected to keep OCR unchanged at 1.75%. Acting Governor Grant Spencer will stay in change until next March. New Zealand Finance Minister Grant Robertson has launched a review on RBNZ mandate earlier this week. Additional mandate could include employment as monetary policy goals, but exchange rate won’t be. But after all, it’s perceived that the revision will raise the bar for a rate hike by RBNZ, and make monetary policies friendly to the labor-led government’s expansionary fiscal policy.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 113.67; (P) 114.00; (R1) 114.31; More…

USD/JPY dips notably today as pull back from 114.73 extends lower. But still, with 112.95 support intact near term outlook stays bullish and further rally is in favor. Sustained trading above 114.49 key resistance will pave the way to retest 118.65 high. However, break of 112.95 support will now indicate rejection from 114.49 and turn bias to the downside for 111.64 support and below.

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 03:45 | CNY | Trade Balance (CNY) Oct | 254B | 275B | 193B | |

| 03:50 | CNY | Trade Balance (USD) Oct | 38.2B | 39.5B | 28.5B | |

| 05:00 | JPY | Leading Index Sep P | 106.6 | 106.6 | 107.2 | |

| 13:15 | CAD | Housing Starts Oct | 223K | 220K | 217K | 219K |

| 13:30 | CAD | Building Permits M/M Sep | 3.80% | 0.70% | -5.50% | -5.10% |

| 15:30 | USD | Crude Oil Inventories | -2.5M | -2.4M | ||

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |