Euro is staging a solid rebound today, with investors feeling somewhat reassured by the preliminary results of French parliamentary elections. While the far-right National Rally made significant gains with approximately 34% of votes in the first round, this is insufficient for an outright majority in the second round scheduled for July 7. The National Rally’s aggressive fiscal policy stance has heightened concerns over France’s already strained fiscal situation. However, the prospect of a more centrist or balanced government composition is perceived as a positive development for Euro.

The days ahead are critical for French politics, as much depends on how President Emmanuel Macron’s Together alliance, which garnered 20-23% of the vote, and the left-wing coalition New Popular Front, with 29% of the vote, will navigate their strategies to prevent the far-right from gaining control. It’s important to remember that the initial vote percentages may not accurately predict the final seat distribution in the national assembly, adding another layer of uncertainty.

In the broader currency markets, Kiwi is trailing Euro as the second strongest currency today. Sterling is also showing strength, positioned as the third strongest, as it braces for its general elections on July 4. Conversely, Swiss Franc is the weakest performer due to Euro’s rebound, with Yen and Australian Dollar following as the next weakest. Dollar and Canadian Dollar are showing moderate performance, positioned in the middle of the pack. Beyond the political developments, this week promises a slew of significant events, including the release of minutes from RBA, FOMC, and ECB meetings, alongside crucial data such as US non-farm payrolls and Eurozone inflation figures.

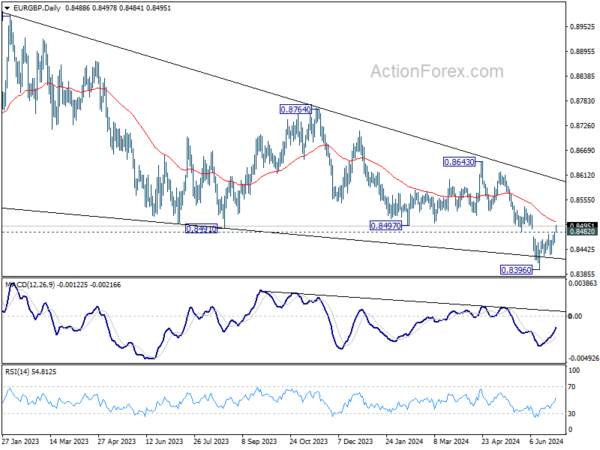

Technically, EUR/GBP’s break of 0.8482 support turned resistance suggests that fall from 0.8643 has completed at 0.8396. While it’s still early to call for bullish trend reversal, stronger rebound is anticipated in the near term through 55 D EMA (now at 0.8505). Focuses will also be on whether EUR/USD would break through 1.0760 resistance to start a stronger rally, and whether EUR/CHF would follow by breaking through 0.9683 resistance too.

In Asia, at the time of writing, Nikkei is down -0.04%. Hong Kong is on holiday. China Shanghai SSE is up 0.53%. Singapore Strait Times is up 0.08%. Japan 10-year JGB yield is up 0.0203 at 1.069.

Japan’s Tankan manufacturing improves but non-manufacturing may have peaked

BoJ’s closely watched Tankan survey revealed that while manufacturing sector showed continued improvement, sentiment among non-manufacturers appeared to have peaked, which may complicate BoJ’s considerations for another rate hike later this month.

The Tankan survey reported that large manufacturing index rose from 11 to 13, reaching its highest level since March 2022. Large manufacturing outlook also increased from 10 to 14. However, non-manufacturing index dipped slightly from 34 to 33, marking its first decline in 16 quarters, and non-manufacturing outlook remained unchanged at 27.

Long-term corporate inflation expectations edged up, with companies forecasting inflation to hit 2.3% in three years and 2.2% in five years. Despite these rising expectations, the mixed sentiment data do not strongly support another imminent rate hike by BoJ.

In a separate development, an unscheduled revision to historical data indicated that Japan’s real GDP contracted at an annualized rate of -2.9% in January-March, a much steeper decline than the previously estimated -1.8% contraction. This significant revision is likely to impact BoJ’s upcoming quarterly growth and price forecasts, which are due at the July 30-31 policy meeting.

Japan’s PMI manufacturing finalized at 50, stagnation amid cost pressures and weak demand

Japan’s PMI Manufacturing index for June was finalized at 50.0, slightly down from May’s 50.4, indicating a stagnation in the sector. S&P Global highlighted a marginal increase in manufacturing production, but new orders continued to decline, albeit slightly. Employment in the sector expanded, with business confidence reaching a six-month high.

Pollyanna De Lima at S&P Global Market Intelligence stated, “Notably, the latest PMI data revealed the first rise in Japanese factory production for over a year, and a rebound in business confidence.”

However, she also pointed out significant challenges, including heightened cost pressures due to Yen depreciation, which increased the price of imported materials. Labor costs also strained budgets.

“There was clear evidence that the sharp rise in overall purchasing prices was not caused by supply-chain issues, as delivery times improved to the greatest extent in over 15 years,” she added.

Consequently, manufacturers raised their selling prices at the highest rate in over a year, a move seen as unfavorable given the weak domestic and external demand.

China’s Caixin PMI manufacturing rises to 51.8, growth continues but optimism dips

China’s Caixin PMI Manufacturing index edged up from 51.7 to 51.8 in June, surpassing expectations of 51.2 and marking its highest level since May 2021. This rise keeps the index in expansionary territory for the eighth consecutive month. Notably, output price inflation reached an eight-month high, reflecting increased activity in the sector.

Wang Zhe, Senior Economist at Caixin Insight Group, noted, “Overall, the manufacturing sector kept improving in June, with supply, domestic demand, and exports continuing to grow.” He highlighted that manufacturers increased their purchases, resulting in higher inventory and price levels. Despite this positive trend, optimism among surveyed companies fell significantly, suggesting that market expectations need further strengthening.

Fed, ECB, RBA minutes, Eurozone CPI, and US NFP on the radar

The upcoming week will feature significant minutes from three major central banks and a slew of key economic data. Investors and analysts will be closely monitoring these developments for any signals that might indicate future monetary policy directions.

The minutes from FOMC’s June meeting are expected to attract substantial attention. The latest economic projections indicated a notable shift, showing only one expected rate cut this year, compared to three projected in March. This hawkish shift, underscored by 11 members favoring one or no cuts versus 8 members favoring two cuts, will be a primary focus. Additionally, any discussions about the long-term neutral rate, which has been raised, will be closely analyzed for further insights.

Also from the US, ISM indexes and Non-Farm Payroll report will be crucial data points. The manufacturing sector’s brief revival seems to have faltered, with ISM manufacturing index staying below 50 since November 2022, except for March this year. Conversely, the services sector has shown resilience, rebounding strongly in May after dipping below 50 in April. While many market participants view September as the tentative month for the first rate cut, Fed might remain cautious about premature easing if the services sector continues to show strength and the job market sustains solid growth with high wage increases.

ECB’s meeting accounts will be scrutinized for insights into the rationale behind June’s rate cut, the first in the current easing cycle. The Governing Council’s perspectives, especially those of Chief Economist Philip Lane, on the future path of policy easing will be critical. Additionally, Eurozone CPI flash report will provide crucial information for markets to adjust their expectations. Currently, it is likely that ECB will cut rates once or twice more this year, with the next one in September, but this outlook is not set in stone.

Minutes from RBA’s June meeting will also be significant. Governor Michele Bullock has indicated that a rate cut was not even discussed at the meeting. The minutes might reveal how concerned the board is about upside inflation risks, which somewhat materialized in May’s CPI data already. Any hints on what level of upside surprises in Q2 CPI data, due on July 31, might prompt an August rate hike will be closely watched by investors.

Other key economic data to watch include Japan’s Tankan survey, China’s Caixin PMIs, and Canada’s employment figures.

Here are some highlights for the week:

- Monday: Japan Tankan survey, PMI manufacturing final, consumer confidence; China Caixin PMI manufacturing; Germany PMI flash; Swiss retail sales, PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final, M4 money supply, mortgage approvals; US PMI manufacturing final, ISM manufacturing, construction spending.

- Tuesday: New Zealand building permits; Japan monetary base; Australia RBA minutes; Eurozone CPI flash, unemployment rate; Canada PMI manufacturing.

- Wednesday: Australia retail sales, building approvals, China Caixin PMI services; Eurozone PMI services final, PPI; UK PMI services final; Canada trade balance; US ADP employment, trade balance, ISM services, factory orders, FOMC minutes.

- Thursday: Australia trade balance; Swiss unemployment rate, CPI; Germany factory orders; UK PMI construction; ECB meeting accounts.

- Friday: Japan household spending, leading indicators; Germany industrial production; France industrial production; trade balance; Swiss foreign currency reserves; Eurozone retail sales; Canada employment, Ivey PMI; US non-farm payrolls.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0692; (P) 1.0708; (R1) 1.0731; More….

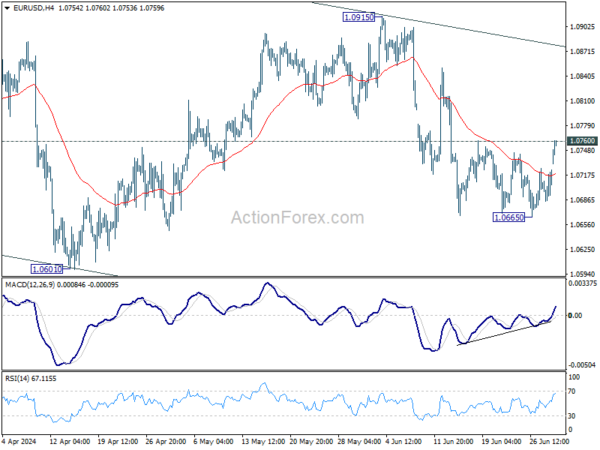

Immediate focus in now on 1.0760 resistance as EUR/USD extends the rebound from 1.0665. Decisive break there will argue that pull back from 1.0915 has completed. Intraday bias will be back on the upside for 55 D EMA (now at 1.0773) and above. Meanwhile, rejection by 1.0760 will maintain near term bearishness for another fall through 1.0665 later.

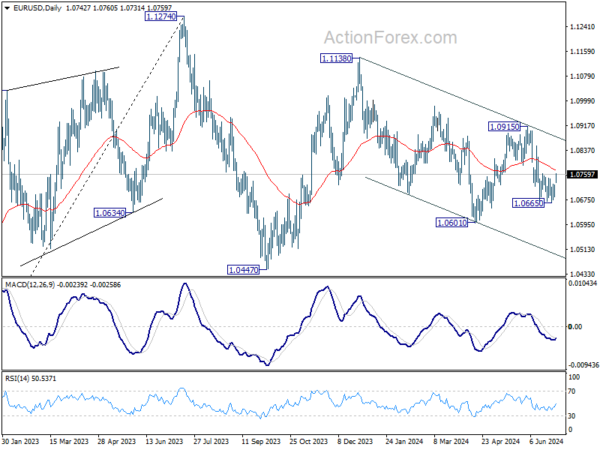

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still in progress. Break of 1.0601 will target 1.0447 support and possibly below . For now, this will remain the favored case as long as 1.0915 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q2 | 13 | 11 | 11 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q2 | 14 | 10 | ||

| 23:50 | JPY | Tankan Non – Manufacturing Index Q2 | 33 | 33 | 34 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q2 | 27 | 27 | ||

| 23:50 | JPY | Tankan Large All Industry Capex Q2 | 11.10% | 4% | ||

| 00:30 | JPY | Manufacturing PMI Jun F | 50 | 50.1 | 50.1 | |

| 01:45 | CNY | Caixin Manufacturing PMI Jun | 51.8 | 51.2 | 51.7 | |

| 05:00 | JPY | Consumer Confidence Jun | 36.4 | 36.5 | 36.2 | |

| 06:30 | CHF | Real Retail Sales Y/Y May | 2.50% | 2.70% | ||

| 07:30 | CHF | Manufacturing PMI Jun | 44.9 | 46.4 | ||

| 07:45 | EUR | Italy Manufacturing PMI Jun | 44.5 | 45.6 | ||

| 07:50 | EUR | France Manufacturing PMI Jun F | 45.3 | 45.3 | ||

| 07:55 | EUR | Germany Manufacturing PMI Jun F | 43.4 | 43.4 | ||

| 08:30 | GBP | Manufacturing PMI Jun F | 51.4 | 51.4 | ||

| 08:30 | GBP | M4 Money Supply M/M May | 0.20% | 0.10% | ||

| 08:30 | GBP | Mortgage Approvals May | 61K | 61K | ||

| 12:00 | EUR | Germany CPI M/M Jun P | 0.20% | 0.10% | ||

| 12:00 | EUR | Germany CPI Y/Y Jun P | 2.40% | |||

| 13:45 | USD | Manufacturing PMI Jun F | 51.7 | 51.7 | ||

| 14:00 | USD | ISM Manufacturing PMI Jun | 49.3 | 48.7 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Jun | 55.9 | 57 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Jun | 51.1 | |||

| 14:00 | USD | Construction Spending M/M May | 0.30% | -0.10% |