Key Highlights

- USD/JPY rallied and tested the 160.80 zone.

- A major bullish trend line is forming with support at 159.80 on the 4-hour chart.

- EUR/USD is consolidating above the 1.0670 support zone.

- GBP/USD spiked lower toward 1.2600 before it recovered some losses.

USD/JPY Technical Analysis

The US Dollar remained in a strong uptrend above the 157.50 level against the Japanese Yen. USD/JPY cleared the 160.00 resistance to move further into a positive zone.

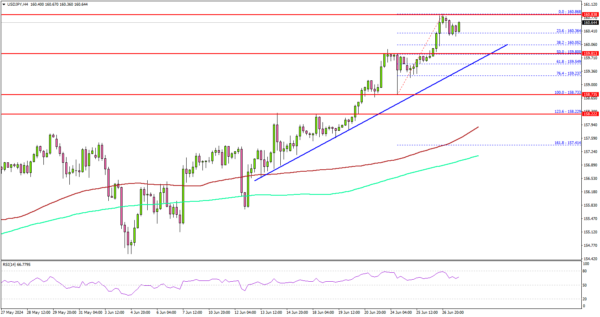

Looking at the 4-hour chart, the pair settled above the 160.00 level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The bulls remained in control and even pumped the pair toward the 160.80 zone.

On the upside, the pair is facing resistance near the 160.85 level. The next resistance sits at 161.20. The first major resistance is near the 162.00 level.

A clear move above the 162.00 resistance might send it toward the 162.50 level. Any more gains might open the doors for a test of the 165.00 zone and a new all-time high in the coming days.

Immediate support is near the 160.00 level or the 38.2% Fib retracement level of the upward move from the 158.73 swing low to the 160.86 high. The next major support is near the 159.80 level. There is also a crucial bullish trend line forming with support at 159.80 on the same chart.

The trend line coincides with the 50% Fib retracement level of the upward move from the 158.73 swing low to the 160.86 high. A downside break and close below the 159.80 support zone could open the doors for a larger decline. In the stated case, the pair could decline toward the 159.20 level.

Looking at EUR/USD, the pair remained stable above the 1.0670 support zone and is now attempting a short-term recovery wave.

Economic Releases

- US Personal Income for May 2024 (MoM) – Forecast +0.4%, versus +0.3% previous.

- US Core Personal Consumption Expenditure for May 2024 (MoM) – Forecast +0.1%, versus +0.2% previous.