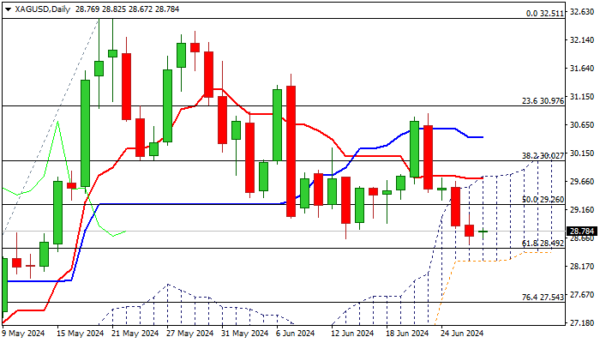

Near-term action remains in bearish mode and cracks first pivot at $28.65 (June 13 low), with pressure on nearby other key supports at $28.49 and $28.25 (Fibo 38.2% retracement of $26.00/$32.51/daily cloud base, respectively).

Sustained break below $28.65/49 triggers to generate bearish signal on completion of failure swing pattern on daily chart/breach of pivotal Fibo support), with extension below the base of thick daily Ichimoku cloud, to verify the signal.

This would open way for deeper drop and expose targets at $27.54 (Fibo 76.4%) and $26.98 (100DMA) in extension.

Technical picture is weakening on daily chart (10/20/55DMA’s in bearish setup / 14-d momentum in negative territory) however, deeply oversold stochastic warns that bears may face headwinds at key support zone.

Consolidation or limited correction likely to precede fresh push lower, with daily cloud top ($29.74), reinforced by daily Tenkan-sen, to cap upticks and keep bears in play.

Caution on lift above cloud top and psychological $30 barrier, which would sideline bears.

Res: 29.06; 29.26; 29.74; 30.00.

Sup: 28.49; 28.25; 28.00; 27.54.