- Euro rebounds as French election fears ease

- June PMIs to come into the spotlight amid more cautious ECB

- Flash estimates are due on Friday at 08:00 GMT

Calmer week for the euro after French turmoil

European assets are having a better week following the market panic sparked by the rise of the far right across the continent in the European Parliament elections on June 9. But the biggest shockwave came from French President Emmanuelle Macron’s decision to call a snap legislative election the following day, raising fears that Marine Le Pen’s far-right National Rally party would repeat its success on a national level.

The threat of a far-right government in the Eurozone’s second largest economy raised fears of another debt crisis in the bloc, or at the very least, some kind of a market fallout on the scale seen in the UK from Liz Truss’s mini-budget. Investors’ biggest worries from a Le Pen government are the party’s protectionist policies and its calls for increased public spending.

French jitters ebb, for now

But after the panic-induced selloff in French stocks and bonds, as well as the euro, the National Rally appears to be backtracking on some of the party’s more controversial policies. Moreover, Le Pen has vowed to work with Macron rather than force his resignation.

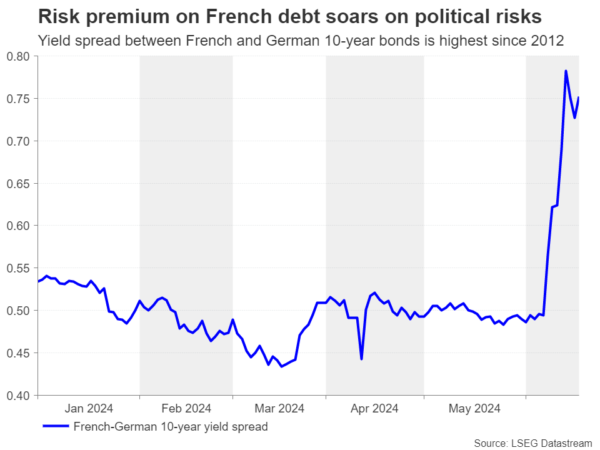

Subsequently, market jitters have calmed somewhat and the risk premium on French debt has also fallen slightly. The spread between French and German 10-year government bond yields spiked to the highest since 2012 as the French political drama unfolded, but for now, a major crisis appears to have been averted and the focus is once again on ECB rate cut expectations.

ECB rate cut expectations pared back

On its part, the European Central Bank steered clear of getting caught up in France’s domestic politics, but there were subtle warnings that neither would it stand idle should widening yield spreads become problematic.

Meanwhile, ECB policymakers have been out and about since the June 6 policy decision when rates were slashed, casting doubt on the prospect of back-to-back rate cuts. Most seem to be in favour of one cut per quarter, with the markets pricing in somewhere between one and two additional 25-bps cuts for the remainder of the year.

Eurozone economy on the mend

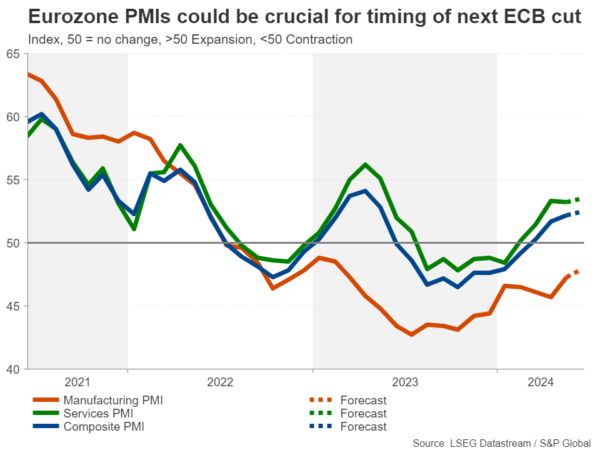

How the economy performs over the coming months will be crucial as to how rate-cut expectations shape out. The Eurozone economy picked up some momentum in the first quarter of 2024 and the composite PMI climbed to the highest in a year in May.

Forecasts point to a further improvement in June’s flash estimates. The services PMI is expected at 53.5 versus 53.2 in May, and the manufacturing PMI is projected to come in at 47.9 from the prior 47.3. The composite PMI is expected to tick up to 52.5 in June.

Investors will also likely be scrutinizing the details of the PMI surveys, particularly on employment, amid still elevated wage growth, and on price pressures. With a follow-up rate cut in September only 60% priced in, a soft set of PMI numbers, or signs of a cooling off in inflation, would boost those odds, weighing on the euro.

Can the euro restore its uptrend?

The single currency recently slipped below its short-term ascending trendline against the US dollar, falling below its 50- and 200-day moving averages (MA) too. Further losses could lead to a re-test of the April low of $1.0599.

However, if the PMIs show a strengthening recovery or an unfavourable trend in inflation, the euro could extend its latest rebound by climbing back above the 200-day MA, bringing into scope the June top of $1.0915.

In the event that the PMI data fails to shed some light on the ECB policy path, investors will turn their attention to the flash CPI readings due on July 2.