A weak Yen is aiding the Bank of Japan’s inflation objective for now by dislodging the deflationary mindset. But homegrown inflation needs further wage increases and investment.

The Bank of Japan (BoJ) raised rates at its March meeting. Since then, the Yen has held above USD/JPY150, a level traditionally regarded as a trigger for intervention. While there is evidence that the Ministry of Finance has intervened in recent months, its actions have come only as the spot rate threatened JPY160 and have also been limited in duration, leaving USD/JPY currently trading towards the top end of the recent range at JPY157.

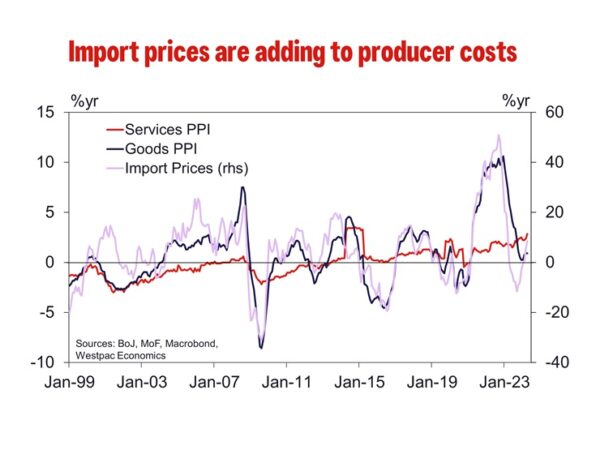

We take from this market activity that authorities are reticent to allow a further rapid depreciation in the Yen but are not overly concerned by sustained weakness in the currency. Arguably that is because a higher rate structure (and lower USD/JPY) can only be justified by the inflation target being sustainably achieved. The weak Yen fosters cost-push inflation, furthering the BoJ’s inflation objective in two important ways: 1) via the pass-through of input inflation to consumer prices; and 2) the reshaping of inflation expectations amongst businesses and households.

Historically, higher costs have prompted Japanese firms to cut costs by narrowing profit margins, bargaining with suppliers or reducing their wage bills. However, in this episode, the persistence of input price pressures, significant (largely co-incident) wage gains, and the global narrative around inflation have helped to dislodge the traditional mindset of Japanese firms. Normalising price increases is also proving to be the first step towards sustained real wage gains and businesses investing in future capacity, alleviating any lingering concerns amongst businesses that higher prices will sap demand.

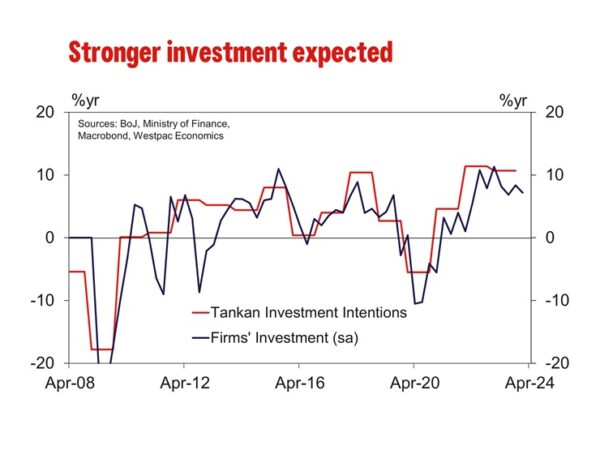

Innovation in particular has taken a considerable hit in recent decades amongst businesses focused on the domestic economy as firms perceived an unwillingness on the part of households to pay for new or improved goods and services. However, this may finally be taking a turn. Investment in plant and equipment grew rapidly through 2023, beating the peak set in 2007 and second only to the record set in Q4 1991. The Tankan’s surveyed investment intentions also peaked in Q3 2022 at the second highest level since 1989. Strong profits have certainly helped businesses invest, but so has the shifting inflation mindset. A survey conducted by the BoJ showed that participants in the corporate sector preferred moderate rises in prices and wages as it removed the ‘need for cost cuts to avoid raising prices enabling active fixed investment and wage hikes’.

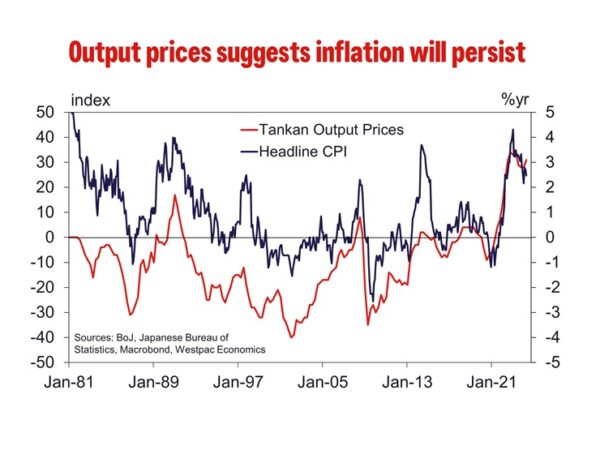

Inflation above target for a sustained period has also lifted inflation expectations. Japan’s inflation expectations are responsive to price shocks. This is supported by our analysis of historic shocks and financial market measures of inflation expectations. The BoJ also characterise price expectations as ‘adaptive rather than forward-looking’, evinced through history with inflation expectations settling close to 1% as headline inflation averaged 0.5% between 1990 and 2019.

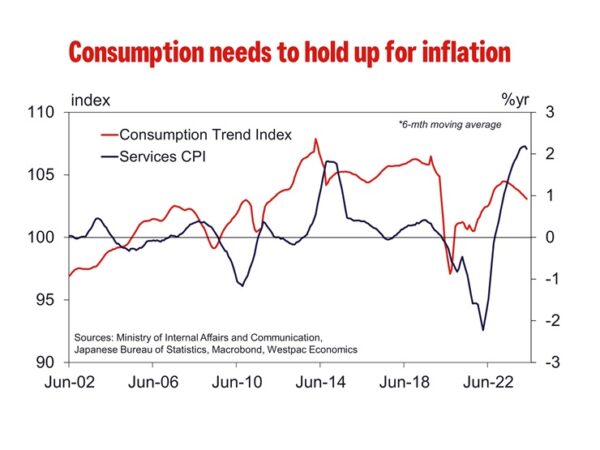

Recently, expectations have risen and settled around the 2% target according to both the outlook in general and output price expectations collected in the Tankan survey. High imported inflation from a weak Yen have clearly bought time for demand-pull inflation to build strength. For inflation to persist at target however, demand pressures must become dominant and sustainable, particularly with the Yen near the level authorities have recently intervened at, and with global rates now falling.

The demographic challenge in Japan means that savings will remain high, posing a risk to reestablishing a healthier demand-driven inflation. Whether there is a shift in consumption will be seen in the household spending data in the second half of 2024, when most wage increases will be received. While strong services inflation implies wages are already feeding through to inflation, assessment is difficult due to the surge in foreign tourist spending. A pick-up in household spending in late-2024 would signal that consumers are looking to make purchases sooner to avoid price increases – a deviation from the deflationary mindset of the past. Further robust increases in wages in the 2025 Shunto negotiations would provide additional support for consumer confidence and spending, and entrench a change in the consumer psychology around prices.

While this transition takes hold, it is also important that businesses focus on expansion and productivity over efficiency. In doing so, lasting weakness in the Yen can add to inflation as wages, consumption and investment continue to expand. Arguably, GDP growth sustainably at or above trend is a necessary prerequisite for households to feel as though the economy is fully employed and inflation at target is justified.

It is only after expectations are fully reset and inflation consistently at or above target that the BoJ will be justified in lifting the policy rate materially above the lower bound. This is not to say they will not edge policy rates higher in coming months, but to emphasise that policy will need to be restrained if its to avoid jeopardising the years (indeed decades) of progress that have been required to get to this point.