- RBA interest rate expected to remain unchanged

- Sticky inflation and economy’s uncertainty still a concern

- Aussie holds in downward channel ahead of Tuesday’s decision at 04:30 GMT

Australia’s uncertain economy and sustained inflation

The Reserve Bank of Australia (RBA) is scheduled to announce its June policy decision early on Tuesday, likely maintaining the central bank’s agenda. The policymakers had anticipated that their responsibilities would become significantly less challenging in the current year. However, persistent inflation and ongoing economic uncertainty have made policy decision-making quite challenging for RBA officials.

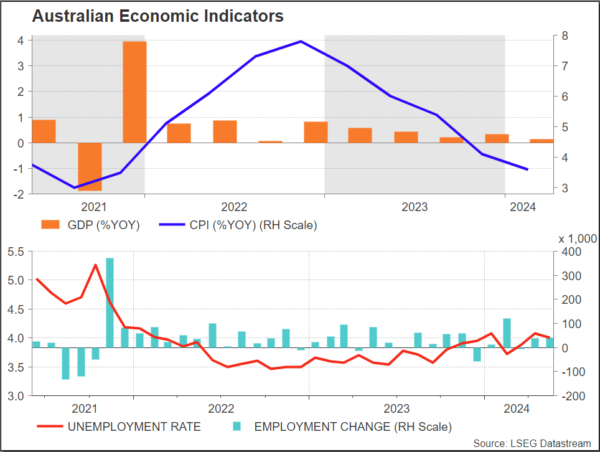

Australia experienced a year-on-year inflation rate of 3.6% in the first quarter of 2024, which was lower than the 4.1% recorded in the previous period but higher than the market’s anticipated rate of 3.4%. The latest data shows that the figure reached its lowest point since the fourth quarter of 2021. This was due to a decrease in goods inflation for the sixth consecutive quarter and a slowdown in services inflation for the third consecutive quarter.

In the first quarter of 2024, the Australian economy grew by 0.1% compared to the previous quarter, which was lower than the revised 0.3% increase in the previous quarter and fell short of market expectations of 0.2%. Following a three-month high of 4.1% in April, the unemployment rate fell 4.0%, in line with market expectations.

June’s meeting expected to remain unchanged

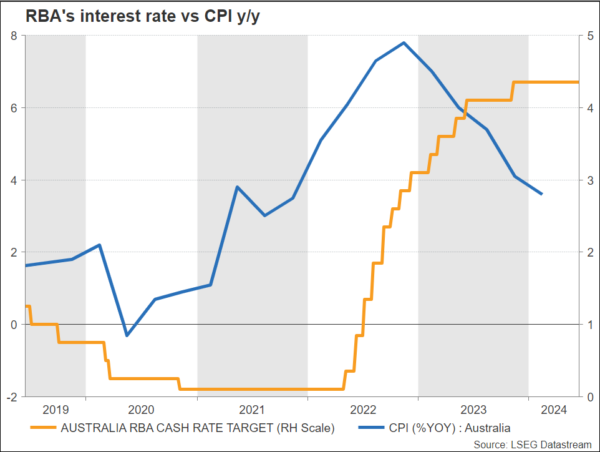

During the May meeting, policymakers considered increasing interest rates. However, they finally determined that risks to the inflation predictions were evenly balanced. This month’s statement is anticipated to adopt a comparable stance, with the cash rate projected to remain unchanged at 4.35%.

Even though investors have priced out any possibility of a rate increase in recent weeks, the inflation path in Australia continues to be more concerning, as it is holding well above the 2-3% target, higher than that of other developed countries, and it may be too soon to rule out a rate increase. Despite this, it is highly improbable that there will be any changes to the policy until the meeting in August, when new economic estimates will be published.

Technical look: AUDUSD

The aussie may not be affected much by RBA’s decision because of the lack of clarity on interest rates in the US as well. Currently, AUDUSD has been developing within a tight downward sloping channel since May 16 with strong support provided by the 50-day simple moving average (SMA) around 0.6580. A dive beneath this area could endorse the short-term bearish outlook, hitting the 0.6555 area, ahead of the 200-day simple moving average (SMA) at 0.6543. Alternatively, a successful climb above the 20-day SMA at 0.6630 could open the door for a retest of the upper boundary of the range at 0.6675. Above this line, the 0.6710-0.6730 restrictive regions would change the picture to a more positive one.