- Hawkish FOMC adds further pressure on the BoJ as USD/JPY advances.

- Speculation builds that the BoJ will announce a more comprehensive cut to its bond buying programme.

Fundamental Overview: FOMC Recap and BoJ Outlook

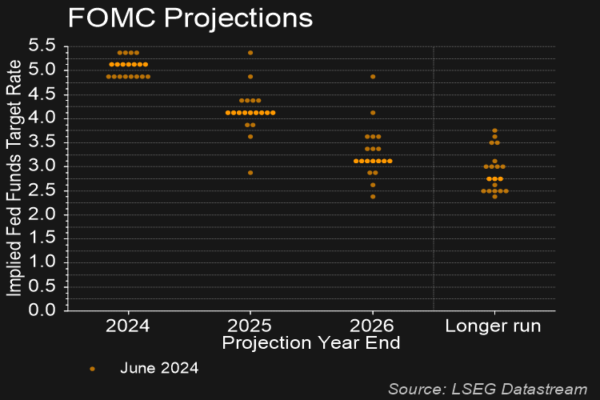

The Japanese continued its slide this morning as USD/JPY edged higher toward the 160.00 psychological level. A brief respite yesterday for USD/JPY which was somewhat of a surprise given the outcome of the Federal Reserve (FOMC) meeting. The Fed left its benchmark lending rate steady in the range of 5.25%-5.50% while delivering a somewhat hawkish update to the summary of economic projections (dot plot).

The Fed adjusted its rate cut expectation for 2024 down to one 25bps cut from the previous three, while at the same time increasing their expectations for rate cuts in 2025 from three to four. A comment that surprised many was Fed Chair Powell stating that the Fed does not have a high degree of confidence in their forecasts, something which may have cast a shadow on the updated dot plot and inflation projections moving forward. Given the higher-for-longer narrative, market participants may be eyeing further gains for the US Dollar against the Japanese Yen, which adds an extra layer of intrigue around the BoJ policy meeting

FOMC Dot Plot Updated, Showing 1 Rate Cut in 2024

Source: LSEG Datastream, June 12, 2024

The BoJ meeting tomorrow will now take center stage as market participants look for further cues from the Central Bank. Governor Ueda has been on the right path in terms of policy normalization but has constantly reiterated the need for caution as the BoJ continues to keep a close watch on wage growth.

In March, the BoJ ended 8 years of short-term negative interest rates and the yield curve control (YCC) policy on the 10-year Japanese Government Bond (JGB). Despite the removal of the YCC policy the Central Bank pledged to keep buying roughly $38 billion worth of government bonds each month to maintain its balance sheet. A surprise cut in bond buying on May 13 has led to increased speculation that the BoJ may be ready to move to a more comprehensive reduction in its bond purchases.

The Nikkei Newspaper reported as much earlier today as well, which begs the question, will such a move provide support to the ailing Japanese Yen? In theory, this would be correct as a reduction in bond buying leads to a decrease in the money supply which tends to strengthen a country’s domestic currency. It is also seen as a prelude to rate hikes and a sign that the Central Bank has confidence in the economy thereby increasing foreign investment and demand for the Japanese Yen.

The Japanese Yen could really use a ‘pick me up’ narrative, following months of struggles against its G7 counterparts. Given that FX intervention has only led to a short-term appreciation for the Yen, it may be time for Governor Ueda to get the ball rolling and offer bolder guidance in the context of policy normalisation.

Risk Events: US PPI Data and Initial Jobless Claims

Looking ahead to the rest of the day, two key US data releases are due later in the day which could stoke volatility in USD/JPY heading into the BoJ meeting. A positive beat of consensus for the US PPI data and initial jobless claims releases could provide further impetus to the US Dollar Index and push USD/JPY closer to the 160.00 handle. A miss to the downside may add some weakness to the US dollar which in my view may not be sustainable.

Technical Outlook for USD/JPY

Looking at USDJPY from a technical perspective, the pair has been stuck in a range for the past four weeks, trading between the 155.00 support level and the most recent high around 157.73. Price action has been choppy on USDJPY as the lack of clarity from the BoJ weighs on the mind of market participants.

As you can see on the chart below, USDJPY is supported by the 50-day MA which rests just above the psychological 155.00 handle with a long-term ascending trendline just below it. A break of the 50-day MA could see USDJPY retest the trendline in a break or bounce scenario.

Looking at the upside and immediate resistance is provided by the May 29 high around the 157.73 handle. A break of this level clears a path for a run up all the way to the 160.00 handle. Beyond the 160.00 handle it becomes increasingly challenging to look at the technical outlook given the lack of recent price action data at these levels.

USD/JPY Daily Chart – June 13, 2024