- The Fed maintained its monetary policy unchanged as widely anticipated.

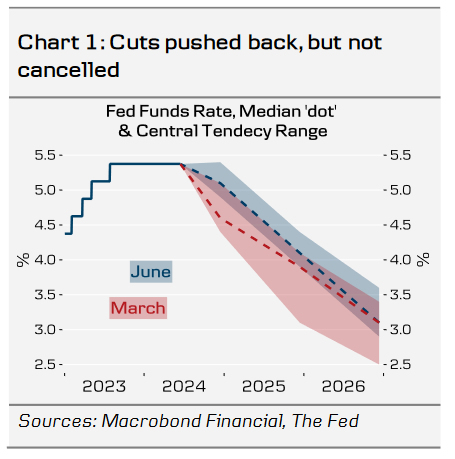

- The ‘dots’ signalled delayed cuts, with median pencilling in only 1 reduction for 2024 (prev. 3) but 4 for both 2025 and 2026 (prev. 3). 2024 Core PCE forecast was adjusted to 2.8% (prev. 2.6%) while other forecasts were largely unchanged.

- UST yields retracted part of the earlier CPI-driven decline and USD regained strength. We make no changes to our Fed call and still expect two 25bp rate cuts this year (starting September) followed by four more in 2025.

The FOMC’s June meeting provided markets with very few new forward-looking signals. Inflation and policy rate expectations were revised modestly higher for this year, but Powell noted that the change was largely a backward-looking reaction to the ‘pause in progress’ seen in Q1 inflation data. CPI prints received since the May meeting have been a clear ‘step to the right direction’, you can read our views on today’s release from Global Inflation Watch – The Fed welcomes easing supercore inflation, 12 June.

Powell mentioned that FOMC participants had a chance to revise their previously set forecasts after the CPI release but did not specify if this was widely the case (only saying that ‘most policymakers [generally] don’t’)

The median 2024 dot shifted higher slightly more than what we had anticipated, signalling only one rate for this year. That said, the FOMC remains divided with four participants calling for no cuts, seven seeing 1 cut and eight expecting 2 cuts. Furthermore, the cuts were not removed from the forecast profile, but rather pushed back to 2025 and 2026, where the Fed now sees four cuts per year instead of three. It is worthwhile noting that the ‘longer-term’ dot also took another step higher (2.8%; from 2.6%). But when asked, Powell re-emphasized that the Fed still sees the current policy stance firmly restrictive.

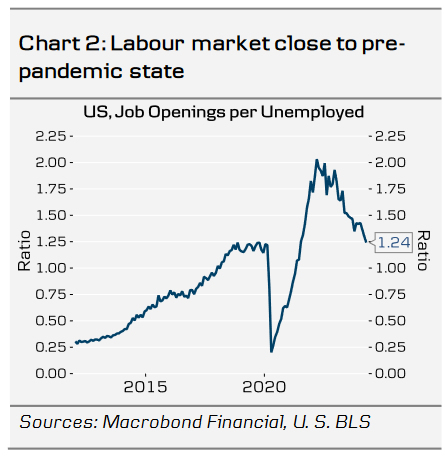

Powell noted that labour market balance has now largely returned back to pre-pandemic state, illustrated for example by the ratio of job openings to unemployment (Chart 2). He refrained from speculating about potential drivers or implications of the sharp divergence between nonfarm payrolls and household employment seen in last Friday’s Jobs Report. See the macro section of this week’s RtM USD, 11 June, for our take on the matter.

Overall, the Fed remains in a comfortable position with no imminent need to influence current financial conditions. As expected, Powell felt no urgency to even speculate with the timing of the first cut. The Fed is still biased towards easing and Powell underscored the need to remain conscious about downside economic risks as well.

We remain happy with our call for two 25bp rate cuts this year, followed by four more in 2025. As real interest rates are set to remain at clearly restrictive levels well towards next year, we see risks tilted towards somewhat weaker growth and higher unemployment than the Fed pencils in, although tail-risk of a deeper downturn has clearly eased. QT was not discussed today, but after the earlier announcement on slower pace starting from this month, we think that QT will complement the restrictive policy well into 2025 as well.

Markets: Lack of direction

Yields rose on the back of the slightly hawkish revisions to the SEP, though the move was not nearly sufficient to reverse the strong market reaction following the soft CPI figures out earlier today. The market pricing of cuts this year dropped from 50bp to 45bp in response to the statement/SEP release, and Powell managed to keep it there throughout the press conference. 10Y UST yields are trading about 5bp higher since the statement release.

In a similar fashion, EUR/USD edged marginally lower following the meeting, from around 1.0840 to around the 1.0800 mark. Overall, a very modest reaction, which seems fair given the lack of direction from Powell tonight. We think EUR/USD will range trade around the 1.08 level in the near term, but in the longer term, we believe the structural case for stronger US growth dynamics will take the cross lower towards 1.05/1.03 on a 6/12M horizon.