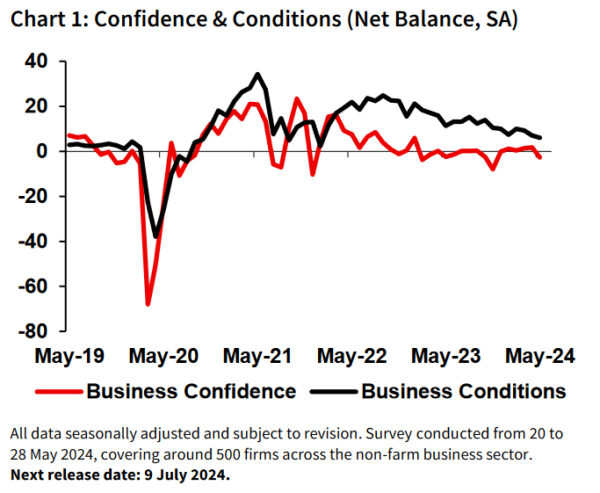

Australia’s NAB Business Confidence fell from 2 to -3 in May, returning to negative territory. Business conditions also saw a slight decline, dropping from 7 to 6. Specifically, trading conditions decreased from 13 to 10, and profitability conditions fell from 6 to 3. However, employment conditions improved, rising from 2 to 5.

NAB Chief Economist Alan Oster noted pointed out that forward orders are particularly weak in retail, wholesale, and construction sectors, indicating potential challenges ahead. Despite a slowdown in activity, capacity utilization remains above average, suggesting that the “process of bringing supply and demand back into balance remains incomplete”.

Inflationary pressures are re-emerging, with labor cost growth increasing to 2.3% on a quarterly basis, up from 1.5% in April. Purchase cost growth also rose to 1.9%, compared to 1.3% previously. Overall product price growth climbed to 1.1%, up from 0.8%, with retail price growth increasing to 1.6% from 1.0%, and recreation and personal services prices edging up to 1.0% from 0.9%.

Oster concluded that the data presents a “mixed” picture for RBA. There are clear signs of growth challenges, yet inflationary pressures remain a concern. “We expect the RBA to keep rates on hold for some time yet as they navigate through these contrasting risks.”