The financial markets continued to trade with risk appetite this week. DOW managed to make another record high despite a mere 9.23 pts rise. S&P 500 and NASDAQ performed slightly better and gained 0.13% and 0.33% respectively, both at new records. FTSE was also firm yesterday and gained 0.03% to new record close at 7562.28. While that was below intraday record at 7598.99, that was enough to help lift Sterling for a rebound. GBP/USD is temporary safe after failing to break through 1.3026 key support following post BoE selloff. Meanwhile, Aussie trades steadily after RBA left cash rate unchanged at 1.50% as widely expected, with a carbon copy statement.

NAO warned of Brexit risks to public finances

In a report by National Audit Office, Head Amyas Morse warned that "public and private borrowing are high, kept affordable by record low interest rates, and quantitative easing continues 10 years after the crisis it responded to". The report pointed out that since 2009, UK government borrowing had increased by 61%. Interest payments have already cost the government GBP 222b. And with the use of index-linked gilts, a rise of 1% in inflation could add GBP 26b in interest between 2016-18 and 2020-21.

Morse added that "there are significant risks to the public finances and any unexpected developments, potentially including consequences of leaving the EU could exacerbate them. In these circumstances, the Treasury needs to constantly monitor these risks and be ready to react quickly and flexibly. It has taken steps to increase its capacity to respond."

More reports on Brexit assessments will be published this week. John Bercow, the Speaker of the House of Commons, has set the government a deadline of Tuesday evening to publish the Brexit assessments demanded by parliament. That came after the parliament voted unanimously last week to call on Brexit Secretary David Davis to release all the details.

Eurogroup agree to ECB approach on bad loans

Eurogroup head Jeroen Dijsselbloem said in a press conference after the meeting of Eurozone finance ministers yesterday. He noted that there was "a general agreement" on ECB’s approach to tackle bad loans of banks in the region. And, it’s believed that it’s the right time to proceed with tougher measures to avoid the build up of so called non-performing loans by Eurozone financial institutions. EUR 1T of bad loans were accumulated after the financial crisis. And that has only be reduced to EUR 0.8T decently.

German Merkel to complete exploratory coalition talks in 10 days

In Germany, Chancellor Angela Merkel named out the clearly differences between her potential coalition partners. But she wants to end the exploratory talks to complete by November 16 and launch serious negotiations then.. Merkel noted that immigration and climate policy are the most contentious issues between the pro-business Free Democrats and the Greens.

NY Fed Dudley confirmed early retirement

The influential New York Fed President William Dudley confirmed his plan of early retirement, just four days after Jerome Powell was named as nomination to take our Janet Yellen as Fed chair by President Donald Trump. Dudley gave special thank to former Treasury Tim Geithner, former Fed chair Bernanke and Yellen for "giving me the opportunity to work closely with them during the crisis and the subsequent economic recovery."

Together with Yellen and former Vice Chair Stanley Fischer who stepped down in October, the Fed will be missing the three most important figures starting next year. The overhaul in Fed could bring fresh ideas into the most important central bank of the world. But at the same time, drastically reduce the experience level in crisis management.

On the data front

Japan labor cash earnings rose 0.9% yoy in September. UK BRC retail sales monitor dropped -1.0% yoy i9n October. German industrial production, Swiss, foreign currency reserves, Eurozone retail sales and retail PMI will be featured today.

AUD/USD Daily Outlook

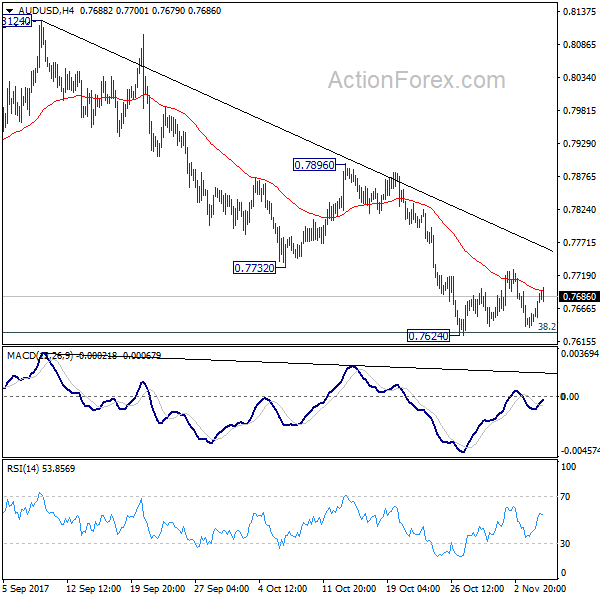

Daily Pivots: (S1) 0.7655; (P) 0.7673; (R1) 0.7708; More…

AUD/USD recovers ahead of 0.7624 support as consolidation continues. Intraday bias remains neutral first. Near term outlook remains bearish with 0.7896 resistance intact and deeper fall is expected. Decisive break of 0.7624 will resume whole decline from 0.8124. And, AUD/USD should target next key cluster level at 0.7322/8 next.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8067). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7896 near term resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | JPY | Labor Cash Earnings Y/Y Sep | 0.90% | 0.50% | 0.90% | 0.70% |

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Oct | -1.00% | 0.90% | 1.90% | |

| 3:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 7:00 | EUR | German Industrial Production M/M Sep | -0.80% | 2.60% | ||

| 8:00 | CHF | Foreign Currency Reserves (CHF) Oct | 724B | |||

| 9:10 | EUR | Eurozone Retail PMI Oct | 52.3 | |||

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | 0.60% | -0.50% |