The direction in the Forex markets is no too clearly today. Yen was initially sold off earlier but there was no follow through selling so far. Instead, Euro is back under some selling pressure despite solid economic data. On the other hand, Dollar is mixed as US President Donald Trump’s trip to Asia is no providing any inspiration to the markets. Instead, eyes will stay on the progress of the tax plan in Congress. But for now, in a rather light week, attention will be on RBA rate decision in the upcoming Asian session.

Trump gives no inspiration as a salesman in Asia

The way US President Donald Trump fed fish in the koi pond in Japan could have caught some headlines. But underneath, Trump is doing his salesman job there in his trip. He claimed that Japan Prime Minister Shinzo Abe will "shoot" North Korean missiles "out of the sky" when Abe completes the "purchase of lots of additional military equipment from the United States". But earlier he accused Japan for the trade surplus with US. He said that "the United States has suffered massive trade deficits at the hands of Japan for many, many years." He went further and said that "right now our trade with Japan is not free and it’s not reciprocal" and pledged that "it will be done in a quick and very friendly manner."

Meanwhile the markets are keeping an eye on those who are doing real business at home in the US. House Speaker Paul Ryan said his chamber could pass a Republicans backed tax reform plan by Thanksgiving. And Ryan expects Senate to follow about a week later. Ryan also defended against criticisms that the tax plan would add US 1.5T to deficit. He emphasized that "Paul Ryan Deficit Hawk is also a growth advocate. Paul Ryan Deficit Hawk also knows that you have to have a faster growing economy, more jobs, bigger take home pay, that means higher tax revenues."

ECB Peter explains ECB’s decision on APP

ECB chief economist Peter Praet explained ECB’s decisions to half monthly asset purchase to EUR 30b and extend the program by nine months. He noted that "when considering the appropriate calibration of the asset-purchase program there were three important dimensions to consider: pace, horizon and optionally." He reiterated the view that "the brighter economic prospects have increased our confidence in the gradual convergence of inflation toward our aim. This called for a lower pace of purchases."

Also, "we have always emphasized that monetary policy needs to be persistent and patient for underlying inflation pressures to gradually build up." Therefore, "the longer horizon also anchors short-term interest-rate expectations for a longer period, thereby reinforcing the Governing Council’s forward guidance on policy rates."

Eurozone Sentix confidence hit highest since 2007

Eurozone Sentix Investor Confidence rose to 34.0 in November, up from 29.7 and beat expectation of 31.0. That’s also the highest reading since July 2007. Meanwhile, current situation gauge rose to 45.8, up from 41.8. Expectation gauge rose to 22.8, up from 18.3. Sentix noted that "both situation and expectations contribute to this positive development. Things are even better in Germany, where we can report all-time highs."

Also from Eurozone, PPI rose 0.6% mom in September. Services PMI was revised up to 55.0 in October. Italy services PMI dropped to 52.1 in October. German factory orders rose 1.0% mom in September.

Swiss CPI was unchanged at 0.70% mom yoy in October.

RBA widely expected to stand pat

RBA rate decision will be a main focus in the upcoming Asian session. The central bank is widely expected to keep the Cash Rate unchanged at 1.50%. That will be the 15 straight months RBA stands pat. The last time there was a move, RBA cut interest rate by -25bps back in August 2016. Governor Philip Lowe has repeatedly stated his stance that RBA won’t follow some other global central banks in stimulus exit. And there are speculations that RBA could lower near term GDP forecasts as recent data disappointed. More importantly, if there would be a downgrade in inflation forecast, we could see another round of selloff in Aussie.

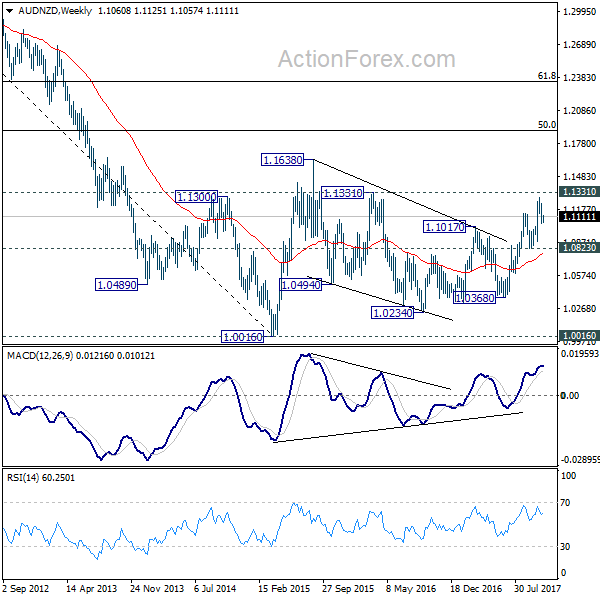

AUD/NZD was shot higher briefly after New Zealand Election, but there was no follow through buying since then. Even though the markets are unhappy with the new labor-led coalition in New Zealand, Aussie has indeed under-performed in the past two weeks. It’s early to call for a trend reversal in the cross with 1.0832 support intact. But for now, 1.1331 resistance looks solid and AUD/NZD will feel heavy as it approaches this level.

EUR/USD Mid-Day Outlook

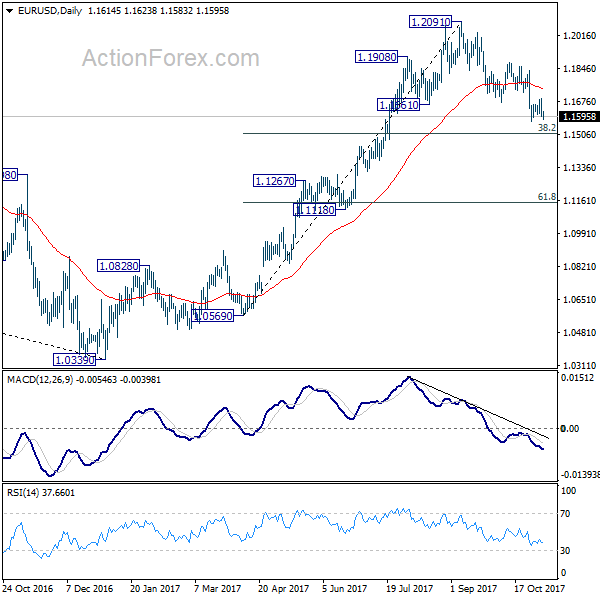

Daily Pivots: (S1) 1.1574; (P) 1.1632 (R1) 1.1666; More…

EUR/USD dips mildly today but it’s staying above 1.1574 support. Intraday bias remains neutral and more consolidation could be seen. But after all, break of 1.1879 resistance is needed to confirm completion of the decline from 1.2091. Otherwise, near term outlook will stay bearish. Below 1.1574 will target 38.2% retracement of 1.0569 to 1.2091 at 1.1510.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes Sep Meeting | ||||

| 0:00 | AUD | TD Securities Inflation M/M Oct | 0.30% | 0.30% | ||

| 2:00 | NZD | RBNZ 2-Year Inflation Expectation Q4 | 2.00% | 2.10% | ||

| 7:00 | EUR | German Factory Orders M/M Sep | 1.00% | -1.10% | 3.60% | 4.10% |

| 8:15 | CHF | CPI M/M Oct | 0.10% | 0.10% | 0.20% | |

| 8:15 | CHF | CPI Y/Y Oct | 0.70% | 0.70% | 0.70% | |

| 8:45 | EUR | Italy Services PMI Oct | 52.1 | 53 | 53.2 | |

| 8:50 | EUR | France Services PMI Oct F | 57.3 | 57.4 | 57.4 | |

| 8:55 | EUR | Germany Services PMI Oct F | 54.7 | 55.2 | 55.2 | |

| 9:00 | EUR | Eurozone Services PMI Oct F | 55 | 54.9 | 54.9 | |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Nov | 34 | 31 | 29.7 | |

| 10:00 | EUR | Eurozone PPI M/M Sep | 0.60% | 0.40% | 0.30% | |

| 15:00 | CAD | Ivey PMI Oct | 59.6 |