- Gold pulls back after hitting record high near $2430

- Retreat remains short-lived as geopolitical risks escalate

- But demand from China seems to be slowing

- Yet, the chances for fresh advances remain elevated

Geopolitics among the main drivers

After hitting a record high at around $2,430 on April 12, gold entered a corrective phase due to the easing of geopolitical tensions at the time allowing investors to continue offloading safe-haven positions.

However, the retreat remained short-lived, with the precious metal rebounding again on new safe-have inflows as Israel ordered Palestinians to evacuate areas of Gaza’s Rafah, adding to fears of a ground attack in the region.

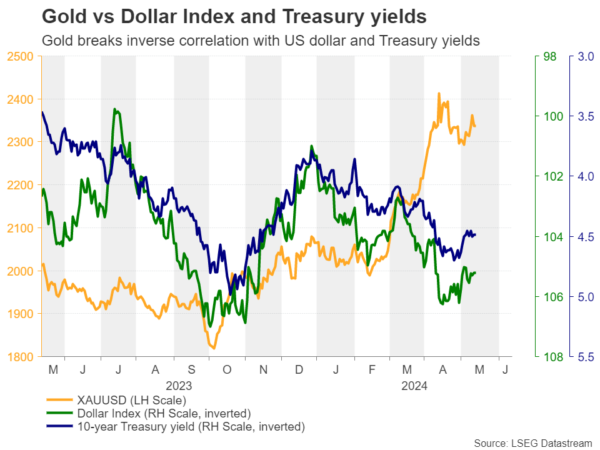

Even the latest hawkish remarks by several Fed policymakers that prompted market participants to price in only 41bps worth of rate reductions by the end of the year were not enough to deter the precious metal’s recovery. After all, it has been defying the market’s massive repricing since the beginning of the year, when investors were expecting around 160bps cuts.

Chinese demand for gold slows down

What has been driving gold was thoroughly discussed in a previous special report, where it was concluded that apart from geopolitics, one other main force behind the metal’s surge to record highs was China.

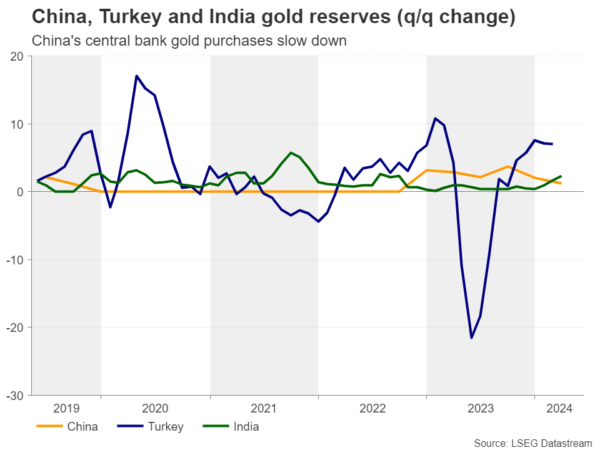

The People’s Bank of China has been compiling huge amounts of gold in an attempt to weaken its dollar dependency. However, although net demand from central banks during the first quarter of 2024 was the strongest first quarter of any year, the PBoC’s purchases have further slowed, with Turkey ramping up its pace notably, and buying the most in absolute terms as well.

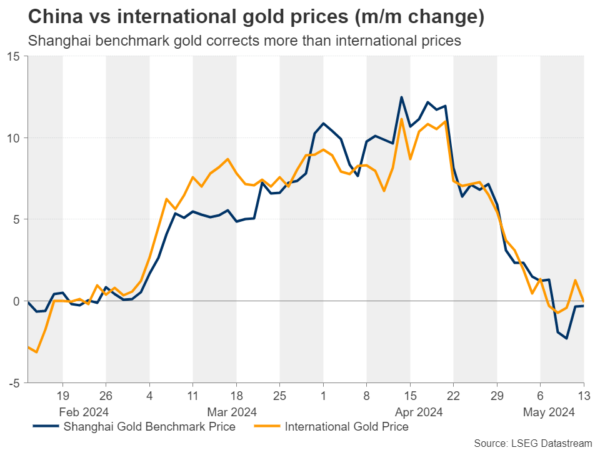

On top of that, retail demand in China may have also slowed lately, and this is evident by comparing the month-on-month change of the Shanghai gold benchmark price to international gold prices. This comparison suggests that the latest pullback was deeper in China’s benchmark than in international prices, and that the following rebound was healthier in international prices.

But slowdown may be temporary

So, has Chinese demand for the precious metal started fading out or is this just a temporary easing before another boost?

From the central bank perspective, the PBoC may reaccelerate its purchases getting closer to the US elections in November, as a Trump victory carries the risk of worsening US-China relations. Thus, Chinese policymakers may continue eliminating their dollar dependency in order to minimize the economic damage in case the US decides to weaponize its own currency.

As far as retail demand is concerned, with the Chinese stock market being subdued and cryptos banned there, the precious metal may have been one of the few vehicles that local investors could profit from.

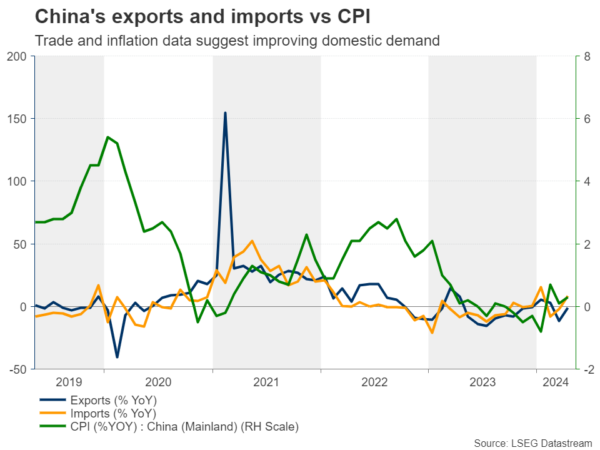

Nonetheless, the latest CPI data showed that China’s consumer prices rose for a third straight month in April, which combined with rising imports, suggests improving domestic demand. However, the official PMIs for the month revealed softening activity, while the wounds of the property sector are not showing signs of healing, which means that the recovery momentum may easily fade again.

With all that in mind, should incoming Chinese data increase confidence that the recovery is likely to continue, retail investors may decide to divert some flows from gold to the stock market. The opposite may be true in case the economic recovery proves to be short lived.

Anyhow, even if Chinese retailers decide to reduce their exposure to the yellow metal, the result could be just another corrective retreat rather than a full-scale bearish reversal as the other variables in the equation could remain supportive. As already mentioned, geopolitical tensions seem to be flaring up again, while China’s central bank may decide to reaccelerate its gold purchases in the months to come.

What about US interest rates?

As for the future direction of US interest rates, the fact that most Fed policymakers are seeing the case of a rate-hike resumption as very unlikely may be keeping gold traders at ease. Delayed rate cuts may not be much of a concern for gold investors as their horizons are likely longer than those of forex traders. Thus, the fact that the Fed is still seen reducing borrowing costs at some point later this year may be more than enough as it keeps the upside potential in Treasury yields limited.

Technical picture remains positive

The technical outlook is also suggesting that the latest uptrend in gold is not over yet. The price entered a recovery mode lately after hitting support near the $2,280 zone, remaining above the 50-day exponential moving average (EMA), and well above the uptrend line drawn from the low of October 6, which currently coincides with the 200-day EMA.

If investors remain willing to buy the precious metal at current levels, they may put the record high of $2,430 on their radars again. A break higher would confirm a higher high and perhaps pave the way towards the psychological zone of $2,500.

On the downside, a dip below the $2,280 area and the 50-day EMA could signal the beginning of a larger bearish correction. But given that the price would still be trading above the aforementioned uptrend line, any speculation about a long-lasting trend reversal may be premature.