Hello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index, published in members area of the website. As our members know, USDX has ended the cycle from the December’s 2023 low. The index has recently given us bounce in a 3-wave pattern, when sellers appeared right at the equal legs zone. Let’s break down our Elliott Wave forecast further in this article.

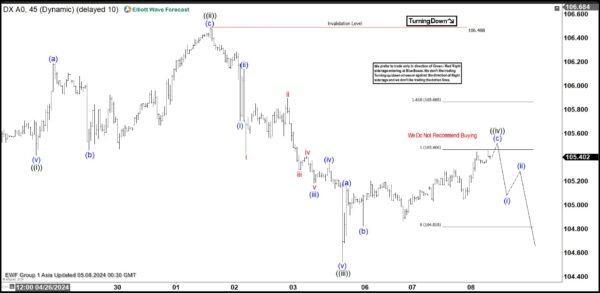

USDX H1 Asia Update 05.08.2024

The current view suggests that Dollar Index is doing a ((iv)) recovery, which is correcting the cycle from the 106.48 peak. Proposed recovery can be unfolding as a Elliott Wave Zig Zag Pattern .The price is reaching important technical area at 105.46-105.86. We expect potential sellers to appear in this area, which could lead to a further decline towards new lows or a three-wave pull back at least.

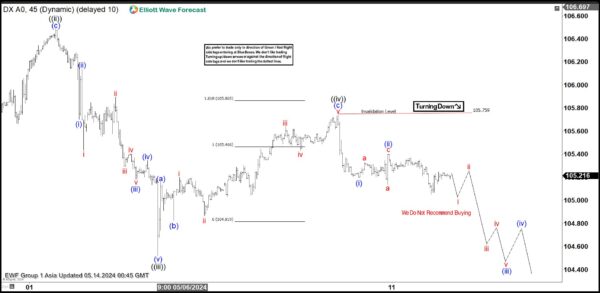

USDX H1 Asia Update 05.14.2024

USDX has found sellers as expected and made a nice bounce from the Equal Legs zone. We consider the wave ((iv)) correction completed at the 105.759 high. CWe would like to see break of previous ((iii)) black low as confirmation wave ((v)) is in progress. We advise against buying Dollar in during any suggested bounce and favor the short side.