New Zealand Dollar dips mildly as the new week began on a quiet note. This comes in wake of New Zealand weaker services data and the decline in short-term inflation expectations, which may provide some relief to RBNZ about the persistence of high inflation. However, the key question remains on the pace at which inflation will decline. Slower-than-expected disinflation ahead would still limited scope for RBNZ to initiate rate cuts within this year.

Elsewhere in the currency markets, Australian and Canadian Dollars also softened, trailing Kiwi as the next weakest. In contrast, Euro and Sterling appeared stronger, followed by relatively steady Dollar, while Swiss Franc is mixed. But as side from the Aussie and Kiwi, most major currencies remained within Friday’s range against each other.

Today’s economic calendar appears light, suggesting that trading might remain quiet. However, upcoming reports such as tomorrow’s UK employment data and Wednesday’s US retail sales and CPI could significantly increase market volatility.

Technically, NZD/USD’s rebound from 0.5851 is still in favor to continue as long as 55 4H EMA (now at 0.5984) holds. Break of 0.6044 will target near term channel resistance. Sustained break there will argue that whole fall from 0.6368 has completed with three waves down to 0.5851, and turn near term outlook bullish. However, firm break of 55 4H EMA will argue that rebound from 0.5851 has completed, and retain near term bearishness instead.

In Asia, at the time of writing, Nikkei is down -0.43%. Hong Kong HSI is up 0.47%. China Shanghai SSE is down -0.08%. Singapore Strait Times is up 0.23%. Japan 10-year JGB yield is up 0.038 at 0.947.

RBNZ survey shows moderating short-term inflation expectations

According to RBNZ Business Expectations Survey for Q2, respondents have lowered their expectations for CPI inflation in both the short-term and medium-term, while their long-term CPI inflation expectations have remained stable.

Specifically, one-year-ahead annual inflation expectations have notably decreased by 49 bps, moving from 3.22% to 2.73%. Two-year-ahead inflation expectations also saw a decline from 2.50% to 2.33%. Five-year-ahead inflation expectations are holding steady at 2.25%. Ten-year-ahead expectations edged up slightly by 3bps, from 2.16% to 2.19%.

Regarding the Official Cash Rate, survey respondents anticipate that it to 5.46% by the end Q2, similar to current rate at 5.50%. Looking further ahead, they forecast a reduction in OCR to 4.79% by the end of Q1 2025, marking a slight increase from last quarter’s prediction of 4.74%. These expectations align with anticipation of approximately three rate cuts by the end of Q1 next year.

NZ BNZ services dips to 47.1, lowest since early 2022

New Zealand’s BusinessNZ Performance of Services Index ticked down from 47.2 to 47.1 in April, marking the lowest level since January 2022.

Breaking down the components of the index reveals mixed signals: Activity and sales saw a modest improvement, rising from 44.8 to 46.5. However, employment took a downturn, dropping from 49.9 to 47.1, recording its lowest level since February 2022. New orders and business also declined slightly to 47.1, from 47.9. Stocks and inventories remained unchanged at 46.6, while supplier deliveries worsened, falling from 48.6 to 47.6—the lowest since November 2022.

The feedback from businesses has increasingly skewed negative, with 66.3% of comments in April being pessimistic, up from 63.0% in March and 57.3% in February. Many respondents highlighted the difficult economic environment and persistent inflationary pressures as significant concerns.

Doug Steel, a senior economist at BNZ, commented on the broader implications of these figures, stating, “combining today’s weak PSI with last week’s PMI yields a composite reading that would be consistent with GDP tracking below year earlier levels into the middle of this year.” He further noted that the combined index suggests there could be “some downside risk” to their current economic forecasts.

Australia’s NAB business confidence steady at 1, conditions normalize with slowing cost growth

Australia’s NAB Business Confidence held steady at 1 in April. Business Conditions index fell from from 9 to 7. Notably, trading conditions declined from 15 to 12, while profitability was unchanged at 6. A significant reduction was observed in employment conditions, which dropped from 6 to 2.

NAB Chief Economist Alan Oster reflected on these figures: “All three components of business conditions were back at their long-run averages in April.” He described this as a milestone, marking a normalization after the unusually high levels of 2022, “reflecting slowing economic growth.”

Labour cost growth decreased to 1.5% from 1.7%, and purchase cost growth slowed to 1.2% from 1.5%. Meanwhile, product price growth rose slightly to 0.9% from 0.7%. Retail price growth moderated significantly to 0.9% from 1.4%.

Oster noted, “There was some further improvement in the pace of cost growth in April, and a step down in the pace of retail price growth.” He suggested these changes could indicate easing in inflation in the second quarter, though further observation is needed to confirm this trend.

US CPI and retail sales, UK jobs, and more

US CPI is a major highlight of the week while retail sales will also be released on the same day. Expectations are set for the headline CPI to fall back 3.5% to 3.4% in April. Core CPI is expected to resume its down trend and decrease from 3.8% to 3.6%.

If realized, these anticipated declines do represent modest progress. However, the broader concern remains that momentum in disinflation that was evident last year has largely diminished. This is attributed to a robust labor market that continues to fuel strong consumer spending despite elevated prices and borrowing costs.

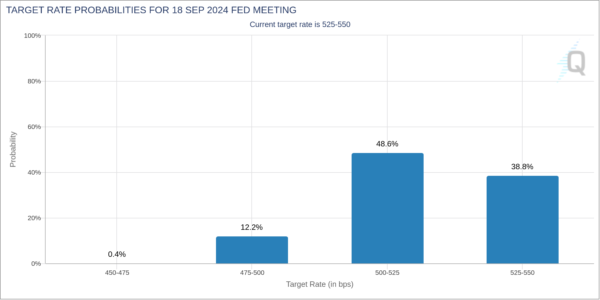

Any upside surprises in inflation figures could revive speculations around the necessity for further rate hikes by Fed, with the current rate level of 5.25-5.50% deemed insufficiently restrictive. Currently, Fed funds futures indicate 61.2% probability of a rate cut in September, with 52.6% chance of two rate cuts within the year. These expectations could shift dramatically following the CPI release.

In the UK, job data will also be closely watched. BoE Governor Andrew Bailey has stated clearly that a June rate cut is “neither ruled out nor a fait accompli.” For BoE to consider starting monetary easing, there will need to be additional loosening in the job market, and more substantial slowing in wage growth.

Additionally, other significant economic indicators due this week include Germany’s ZEW economic sentiment, Japan’s GDP, Australia’s wage price index and employment figures, and a series of reports from China, including industrial production, retail sales, and fixed asset investment.

Here are some highlights for the week:

- Monday: New Zealand BNZ services, inflation expectations; Australia NAB business confidence; Swiss SECO consumer climate; Canada building permits.

- Tuesday: Japan PPI; UK employment; Swiss PPI; Germany CPI final, ZEW economic sentiment; Canada wholesale sales; US PPI.

- Wednesday: Australia wage price index; Eurozone GDP revision, industrial production; Canada housing starts, Manufacturing sales; US CPI, retail sales, Empire state manufacturing, business inventories, NAHB housing index.

- Thursday: Japan GDP; Australia employment; US jobless claims, building permits and housing starts, industrial production.

- Friday: New Zealand PPI; China industrial production, retail sales, fixed asset investment; Eurozone CPI final; US leading index.

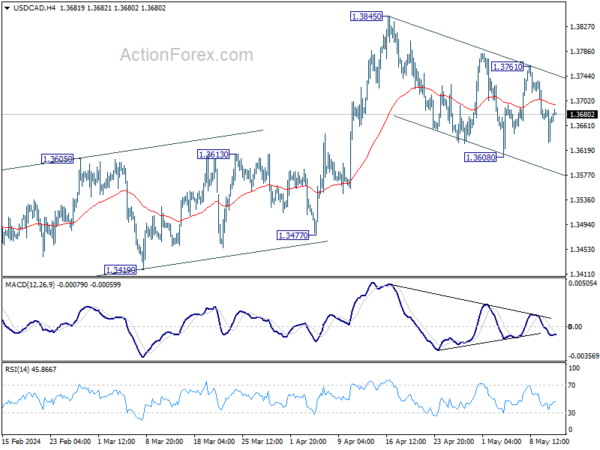

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3641; (P) 1.3667; (R1) 1.3698; More…

Intraday bias in USD/CAD remains neutral for the moment. On the upside, break of 1.3761 resistance will argue that correction from 1.3845 has already completed. Intraday bias will be back to the upside to resume larger rally from 1.3176 through 1.3845. However, sustained trading below 55 D EMA (now at 1.3630) will argue that whole rise from 1.3176 has completed already, and bring deeper fall to 1.3477 support next.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Firm break of 1.3976 will confirm up resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Apr | 47.1 | 47.5 | 47.2 | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Apr | 2.20% | 2.50% | ||

| 01:30 | AUD | NAB Business Confidence Apr | 1 | 1 | ||

| 01:30 | AUD | NAB Business Conditions Apr | 7 | 9 | ||

| 03:00 | NZD | RBNZ Inflation Expectations Q/Q Q2 | 2.33% | 2.50% | ||

| 07:00 | CHF | SECO Consumer Climate Q2 | -40 | -38 | ||

| 12:30 | CAD | Building Permits M/M Mar | -4.60% | 9.30% |