Sterling and Euro rebound broadly today, bolstered by encouraging PMI data that suggests continued recovery momentum in both UK and Eurozone. For the Pound, the latest PMI readings indicate that UK’s recovery from last year’s recession is gathering pace. Meanwhile, rising cost pressures, particularly in the services sector, are heightening concerns about the sustainability of disinflation progress. These concerns are echoed by some BoE officials, who appear hesitant to consider interest rate cuts in the near future due to the persistent inflationary pressures.

Similarly, the Euro found support from the Eurozone PMI data, which highlighted strengthening recovery led by the services sector and an improved economic outlook for Germany and France. While a rate cut in June is still considered “failt accompli”, ECB may proceed more cautiously with policy easing thereafter.

Meanwhile, Australian Dollar is ranking as the third strongest performer, with its rise similarly supported by encouraging PMI data. On the other end of the spectrum, New Zealand Dollar is the day’s weakest at this point, with Canadian Dollar and Dollar also underperforming. Japanese Yen and Swiss Franc are holding middle positions.

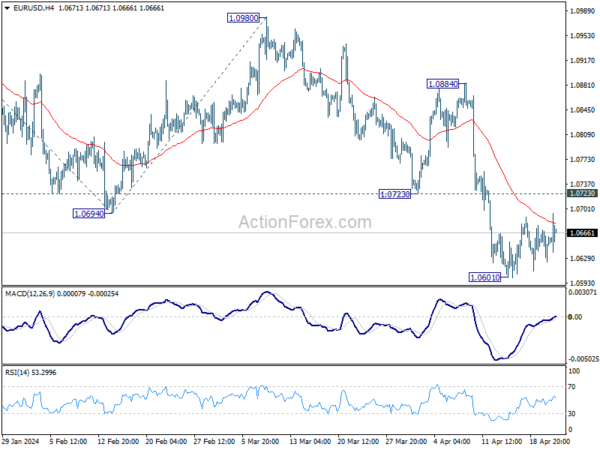

Technically, EUR/USD’s price actions from 1.0601 is still seen as a corrective pattern for now, despite today’s recovery. Upside is expected to be limited by 1.0723 support turned resistance to bring resumption of fall larger decline at a later stage. However, firm break of 1.0723 will confirm short term bottoming and bring stronger rebound instead.

In Europe, at the time of writing, FTSE is up 0.18%. DAX is up 1.13%. CAC is up 0.55%. UK 10-year yield is up 0.0746 at 4.278. Germany 10-year yield is up 0.031 at 2.519. Earlier in Asia, Nikkei rose 0.30%. Hong Kong HSI rose 1.92%. China Shanghai SSE fell -0.74%. Singapore Strait Times rose 1.47%. Japan 10-year JGB yield closed flat at 0.886.

BoE’s Pill: Rate cut somewhat closer but still some way off

BoE Chief Economist Huw Pill indicated in a speech today that while a rate cut is “somewhat closer” now, it remains “some way off” in his baseline scenario.

Pill emphasized that the MPC’s evaluation of the inflation outlook is concentrated on the “persistent component” of consumer price inflation. This focus includes three critical indicators: services price inflation, pay growth, and the tightness of the UK labor market.

Pill noted current signs of “downward” shift in the persistent components of inflation dynamics. However, he also highlighted that there is still a “reasonable way” to go before he can be convinced that the underlying inflation has stabilized at rates consistent with achieving the 2% inflation target sustainably.

Given these conditions, Pill underscored the need for the MPC to “maintain a degree of restrictiveness” in monetary policy to effectively “squeeze the persistent component out of the system.”

BoE’s Haskel: Inflation outlook hinges on quick reduction of job vacancies to unemployment ratio

During a seminar today, BoE MPC member Jonathan Haskel emphasized the critical role of the labor market in shaping the UK’s inflation outlook.

Haskel pointed out that the labor market tightness, specifically the ratio of job vacancies to unemployment, is a key factor in assessing inflationary pressures. Although this ratio is gradually decreasing, Haskel expressed concern over the pace, stating it is “rather slowly” and it remains uncertain if it is sufficient to align inflation with the target levels.

“The persistence of inflation depends a lot on how quickly that ratio comes down,” Haskel remarked, underscoring the direct impact of labor market conditions on inflation trends.

UK PMI composite rises to 54, sustainable path to target inflation not achieved yet

UK PMI Manufacturing fell from 50.3 to 48.7 in April, below expectation of 50.2. PMI Services rose from 53.1 to 54.9, above expectation of 50.2, and an 11-month high. PMI Composite rose from 52.8 to 54.0, also an 11-month high.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, stated that UK economy’s rebound from last year’s recession “continued to gain momentum”. He noted that GDP is now growing at an increased quarterly rate of 0.4%, up from 0.3% in the first quarter.

This economic upturn has led to increased hiring, driven further by the rise in the National Living Wage in April. However, these factors have also escalated cost pressures significantly. Although the inflation of selling prices has moderated slightly, the combination of rising costs and solid demand could lead businesses to hike prices in the near future.

“While the improving economic recovery picture is welcome news, the upward pressure on inflation will add to concerns that a sustainable path to below target inflation has not yet been achieved,” he added.

ECB’s de Guindos: June cut a failt accompli, uncertain afterwards

In an interview with Le Monde, ECB Vice President Luis de Guindos indicated barring any surprises, a June rate cut is a “fait accompli.”

“If things move in the same direction as they have in recent weeks, we will loosen our restrictive monetary policy stance in June,” he said.

However, looking beyond June, the Vice President expressed considerable caution due to heightened levels of uncertainty. “I’m inclined to be very cautious,” said de Guindos.

Eurozone PMI composite rises to 51.4, recovery to sustain

Eurozone’s PMI Manufacturing fell from 46.1 to 45.6 in April, below expectation of 46.5. PMI Services rose from 51.5 to 52.9, above expectation of 51.8, an 11-month high. PMI Composite rose from 50.3 to 51.4, also an 11-month high.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that Eurozone had a “good start” to Q2, with GDP projected to expand by 0.3%, mirroring the growth rate of the first quarter.

De la Rubia outlined three factors contributing to the sustainability of the recovery. Positive momentum in new business over the past two months has spurred more aggressive hiring policies. Service providers have shown confidence in their pricing power. The recovery in Germany and France, Eurozone’s largest economies, have particularly underscored the broader regional trend.

However, the latest figures pose a critical test for ECB on its readiness to cut interest rates in June. The “accelerated increases in input costs”, driven by higher oil prices and wages, necessitates close scrutiny. Moreover, the quicker pace at which service sector companies are raising prices suggests that “services inflation will persist”.

Despite these inflationary pressures, HCOB still expects an ECB rate cut in June, although de la Rubia expects ECB to proceed with more caution rather than adopting the “pragmatic speed” earlier suggested by Governing Council member François Villeroy de Galhau.

Germany’s PMI Manufacturing ticked up from 41.9 to 42.2 in April, below expectation of 42.9. PMI Services jumped from 50.1 to 53.3, well above expectation of 50.5, a 10-month high. PMI Composite rose from 47.7 to 50.5, also a 10-month high.

France’s PMI Manufacturing fell from 46.2 to 44.9 in April, below expectation of 46.9. But PMI Services rose from 48.3 to 50.5, above expectation of 49.0, an 11-month high. PMI Composite rose from 48.3 to 49.9, also an 11-month high.

BoJ’s Ueda: No preset idea on rate hikes

Addressing the parliament today, BoJ Governor Kazuo Ueda said while changes in inflation projections could necessitate a shift in monetary policy, the BoJ currently has no “preset idea on the specific timing and pace” of rate hikes.

Governor Ueda also reiterated the necessity of maintaining ultra-loose monetary policy for now. He pointed out that trend inflation — price rises driven by domestic demand and assessed through various indicators — is still “somewhat below 2%.”

Japan’s Suzuki points to US-South Korea trilateral meeting as groundwork for Yen intervention

Japan’s Finance Minister Shunichi Suzuki signaled the readiness to address the weakening yen, a pressing issue that has raised substantial concern due to its impact on import costs.

Speaking to the parliament, Suzuki conveyed the unease discussed during last week’s trilateral meeting with the US and South Korea. He emphasized the economic strain caused by the depreciating currency, stating there was “strong concern” about how a weak yen inflates the cost of imports, stressing the economy and affecting price levels domestically.

Suzuki’s remarks indicated that preparations are underway to counteract Yen’s decline. “I won’t deny that these developments have laid the groundwork for Japan to take appropriate action,” he noted, “though I won’t say what that action could be”.

Japan’s PMI Composite climbs to 52.6, weak Yen contributes to intensifying price pressures

Japan’s PMI Manufacturing rises from 48.2 to 49.9 in April, above expectation of 48.0, signalling a near-stabilization of manufacturing business conditions. PMI Services rises from 54.1 to 54.6, highest since May 2023. PMI Composite also rose from 51.7 to 52.6, matching the joint-fastest pace set in nearly a year.

Jingyi Pan, Economist Associate Director at S&P Global Market Intelligence, noted that while the service sector continues to be the main driver of growth, there are positive developments in manufacturing as well, where the decline in output has lessened.

April’s data, however, also unveiled “additional signs of intensifying price pressures” which were largely attributed to higher input costs inflation affecting both the goods and services sectors.

Notable factors contributing to these rising costs include increased expenses for materials, energy, and wages, with the “weaker Yen having played a significant part as well”. Consequently, businesses have been compelled to pass these increased costs onto their clients, resulting in the “fastest increase in average charges in a year.”

Australia’s PMI Composite rises to 53.6, RBA might hike again in H2

Australia’s PMI Manufacturing has nearly reached the neutral mark in April, jumping from 47.3 to 49.9. PMI Services edged higher from 54.2 to 54.4, contributing to PMI’s Composite rise from 53.3 to 53.6, marking a 24-month high and indicating the third consecutive month of expansion.

Warren Hogan, Chief Economic Advisor at Judo Bank, said that Composite PMI has averaged 51.5 over Q1, a substantial improvement from 46.9 average in Q4 2023 and correlates with GDP growth of around 0.6% for the March quarter. Hogan suggested that if this trend persists, GDP growth could accelerate to approximately 0.8% in the following quarter.

The results also suggest a cyclical recovery, rebounding from the consumer-led slowdown experienced in 2023. This recovery appears to be more robust than anticipated by RBA, suggesting that the economy is beginning to “wander off their ‘narrow path'”. This “narrow path” scenario envisages economic activity remaining subdued to ensure inflation eases back to target by late 2025

“The RBA will likely be concerned that a pick-up in activity, before inflation returns to target, could threaten medium to long-term price stability,” Hogan added. “These results are inconsistent with interest rate reductions at any stage in the foreseeable future and raise the risk that the RBA may have to start hiking again at some stage over the back half of 2024.”

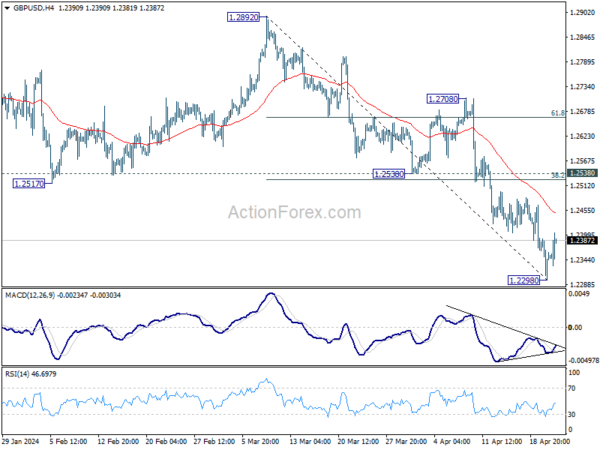

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2303; (P) 1.2347; (R1) 1.2395; More…

Intraday bias in GBP/USD is turned neutral first with current recovery, and some consolidations would be seen first. Upside of recovery should be limited by 1.2538 support turned resistance. On the downside, below 1.2298 will resume the fall from 1.2892 to 1.2036 support next.

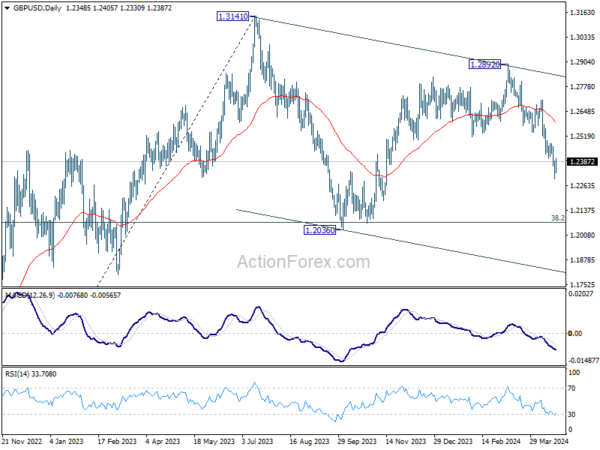

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Apr P | 49.9 | 47.3 | ||

| 23:00 | AUD | Services PMI Apr P | 54.2 | 54.4 | ||

| 00:30 | JPY | Manufacturing PMI Apr P | 49.9 | 48 | 48.2 | |

| 00:30 | JPY | Services PMI Apr P | 54.6 | 54.1 | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Mar | 11.0B | 8.9B | 7.5B | 8.6B |

| 07:15 | EUR | France Manufacturing PMI Apr P | 44.9 | 46.9 | 46.2 | |

| 07:15 | EUR | France Services PMI Apr P | 50.5 | 49 | 48.3 | |

| 07:30 | EUR | Germany Manufacturing PMI Apr P | 42.2 | 42.9 | 41.9 | |

| 07:30 | EUR | Germany Services PMI Apr P | 53.3 | 50.5 | 50.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Apr P | 45.6 | 46.5 | 46.1 | |

| 08:00 | EUR | Eurozone Services PMI Apr P | 52.9 | 51.8 | 51.5 | |

| 08:30 | GBP | Manufacturing PMI Apr P | 48.7 | 50.2 | 50.3 | |

| 08:30 | GBP | Services PMI Apr P | 54.9 | 53 | 53.1 | |

| 13:45 | USD | Manufacturing PMI Apr P | 52 | 51.9 | ||

| 13:45 | USD | Services PMI Apr P | 52 | 51.7 | ||

| 14:00 | USD | New Home Sales Mar | 668K | 662K |