Key Highlights

- Bitcoin price started a fresh decline below $68,000 and $65,000.

- BTC is facing hurdles near $68,000 and a bearish trend line on the 4-hour chart.

- Crude oil price corrected gains below $86.20.

- Gold price also dipped below the $2,380 and $2,365 support levels.

Bitcoin Price Technical Analysis

Bitcoin price failed to stay above $68,000 and started a fresh decline amid a rise in Israel-Iran tensions. BTC traded below the $66,000 and $65,000 support levels to move into a short-term bearish zone.

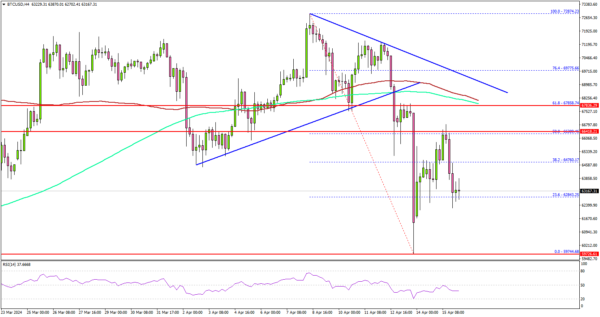

Looking at the 4-hour chart, the price traded below a key bullish trend line with support at $68,550. It even settled below the $67,000 level, the 100 simple moving average (red, 4 hours), and the 200 simple moving average (green, 4 hours).

Finally, it tested the $60,000 zone and recently started a decent recovery wave. There was a move above the $64,000 and $65,000 levels.

However, it struggled near the 50% Fib retracement level of the downward move from the $72,874 swing high to the $59,744 low. Immediate resistance is near the $67,000 level. The first key resistance is near the 100 simple moving average (red, 4 hours), $68,000, and a connecting bearish trend line.

The next resistance is near $68,500. A successful close above $68,500 might start another steady increase. In the stated case, the price may perhaps rise toward the $72,500 level.

Immediate support is near the $64,750 level. The next major support sits at $62,850. Any more losses might send the price toward the $60,000 support zone.

Economic Releases

- US Industrial Production for March 2024 (MoM) – Forecast +0.4%, versus +0.1% previous.

- Fed’s Williams speech.