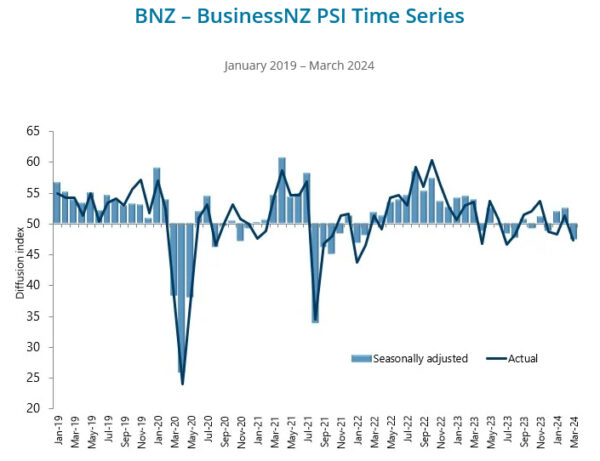

New Zealand’s service sector saw a significant downturn in March, as evidenced by BusinessNZ Performance of Services Index, which fell sharply from 52.6 to 47.5. This decline places the index back in contraction territory, and well below its long-term average of 53.4.

The components of the PSI painted a concerning picture: activity and sales saw a steep decline from 52.4 to 44.8. While employment showed a slight improvement, rising marginally from 49.4 to 50.1, new orders and business fell significantly from 55.5 to 48.3. Stocks and inventories also dropped from 52.2 to 46.9, and supplier deliveries was stagnant at 48.7.

Business sentiment mirrored these negative trends, with proportion of negative comments rising sharply to 63.0% in March, up from 57.3% in February and 53.0% in January. Respondents frequently cited ongoing recession and persistent inflationary pressures, including rising costs of living, as key factors impacting their operations.

BNZ Senior Economist Doug Steel stated, “Combining today’s weak PSI activity with last week’s similarly weak PMI activity, yields a composite reading that would be consistent with GDP falling by more than 2% compared to year-earlier levels. That is much weaker than what folk are forecasting.”