- BoC monetary report due on Wednesday 13:45 GMT, press conference at 14:30 GMT

- Interest rates to remain steady this time, but policymakers might support a June rate cut

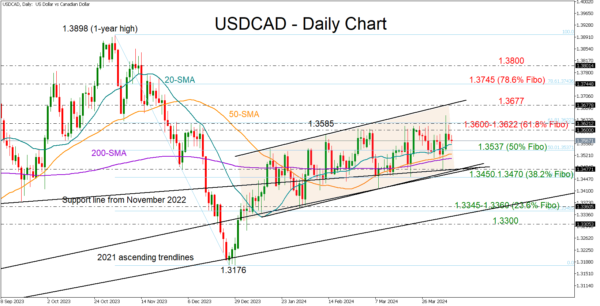

- USDCAD maintains soft uptrend, needs a clear close above 1.3600 to rally

BoC closer to its inflation goal than its major peers

The Bank of Canada (BoC) will probably stick to the sidelines during its coming policy meeting on April 10, leaving interest rates unchanged at 5.0%. Like its peers, the central bank believes that it will be able to slash borrowing costs later this year, but policymakers still have different opinions on the timing. Nevertheless, the base scenario is for major central banks to start the easing cycle in June and there is reason to believe that the BoC is less likely to diverge from that path compared to its US counterpart.

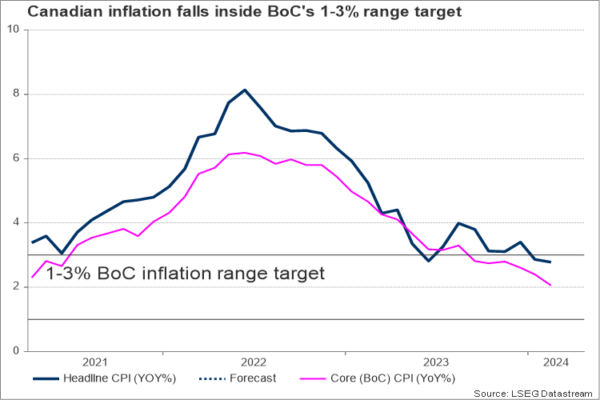

First of all, inflation data has been more favorable since the March meeting. Headline inflation slowed down to a 2.8% year-on-year; faster than analysts expected, further easing within the BoC target zone of 1-3%. Remarkably, the core measure, which excludes volatile items like energy and food, declined to 2.1%, almost reaching the central bank’s 2.0% target, while the eurozone and US equivalents remain consistently higher. The monthly CPI readings have been subdued so far in 2024, reflecting weak price dynamics in the first quarter of the year too. Due to this, the monetary policy report released with the rate decision might contain lower inflation projections.

Labor market shows cracks, but real wages still high

As regards the labor market, conditions have returned to pre-pandemic levels. The economy lost 2.2k jobs in March, while on average, jobs growth was below 40k over the past year. What is more striking is that the unemployment rate continued to ascend in March, hitting a 26-month high of 6.1% from 5.8%. There are arguments that if the US methodology was applied to the Canadian labor data, the unemployment rate could still be elevated at 5.2%, reflecting the increased slack in the Canadian employment conditions.

Growth in population backed by rising migration has been the tailwind behind the rising jobless rate and the resilient wage growth. Canadian average hourly earnings are running hot and faster than the US ones at 5.0% despite changing trajectory to the downside in 2024. Policymakers argue that this level does not align with the central bank’s price stability objective, particularly when combined with low labor productivity, as is currently the case. In other words, if companies cannot increase the value of produced goods per worker, they will increase consumer prices to compensate for higher wages.

BoC might cut rates in June but under certain conditions

Consequently, even though a rate reduction could have positive effects on business motivations and alleviate growth restrictions, the central bank may need to take some time to ensure a sustainable return to its inflation target, considering the recent increase in oil prices and elevated real wage growth. Besides, cutting rates to see inflation turning up again in the coming months could harm its credibility.

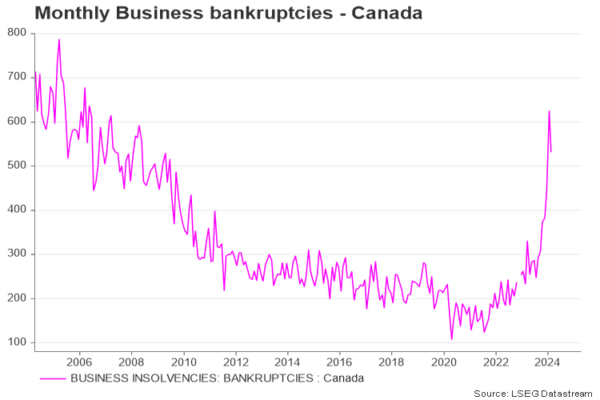

Moreover, while business bankruptcies have surged to the highest level since 2006, household debt relative to disposable income has gradually reverted to pre-pandemic levels, offering some relief for a potential delay. Hence, an immediate rate cut this week will be avoided, but clearer communication on the next policy steps is possible since there is no other meeting before June, although the BoC provides no guidance on its future policy decisions. Overall, policymakers could avoid any confusion by saying that a June rate cut could take place if the next inflation prints stay favorable.

How USDCAD might react?

According to futures markets, there is a 65% probability of a quarter percentage rate cut in June. If policymakers play down the odds, the loonie could gain fresh positive momentum, driving USDCAD down to the lower band of the two-month-old bullish channel at 1.3470-1.3450. A close lower would motivate a sharper decline to 1.3345-1.3360, unless the March low of 1.3418 adds a strong footing under the price.

Otherwise, if the central bank opens the door to a June rate cut, the pair could break the wall at 1.3600-1.3622 and climb to 1.3677. Above the latter, the recovery could continue towards the 1.3745-1.3800 region.