Japanese Yen rebounded broadly in Asian session today, shot up by comments from BoJ Governor Kazuo Ueda regarding the conditions for future interest rate hikes. Ueda’s discussion, while not immediately setting the stage for rate increases, could be taken as a sign to prepare the markets for such a possibility. Importantly, he underscored that an excessively weak Yen could trigger a monetary policy response, a statement that has provided considerable support to the currency.

This rally in Yen was also supported in the background by risk aversion stemming from the sharp selloff in US stock markets overnight, which extended into the Asian markets. The risk-off mood has not only favored Yen but has also contributed to rebound in Dollar, which managed to regain some of the ground it lost over the past two days.

Besides while there were varying views on the path of monetary easing from the chorus of comments from Fed officials, they have collectively emphasized the need for more data before commencing a cycle of interest rate reductions. The financial markets will now look into today’s US non-farm payroll report for guidance for the next move.

Overall for the week so far, Aussie is staying as the strongest one with help from surges in precious and industrial metal prices. Kiwi is in the second place, followed by Euro. Canadian Dollar is the worst performer, followed by Swiss Franc and Dollar. Yen and Sterling are positioned in the middle.

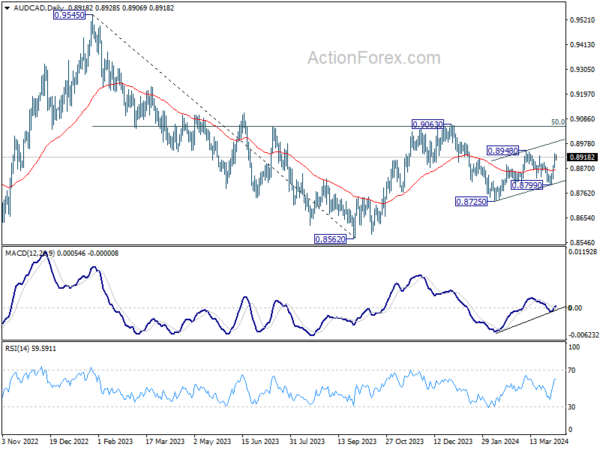

Technically, AUD/CAD is currently the top mover of the week with strong rebound from 0.8799. Further rise is mildly in favor for 0.8948 resistance and possibly above. Nevertheless, price actions from 0.8725 are currently seen as a corrective move only. Thus, AUD/CAD should start to lose momentum above 0.8948, and strong resistance should emerge below 0.9063 to limit upside. Break of 0.8799 support will argue that the fall from 0.9063 is ready to resume through 0.8725 to retest 0.8562 low.

In Asia, at the time of writing, Nikkei is down -2.03%. Hong Kong HSI is down -0.71%. China Shanghai SSE is on holiday. Singapore Strait Times is down -0.69%. Japan 10-year JGB yield is down -0.0006 at 0.777. Overnight, DOW fell -1.35%. S&P 500 fell -1.23%. NASDAQ fell -1.40%. 10-year yield fell -0.046 to 4.309.

Dow registers steepest decline in a year pre-NFP, a medium-term top established already?

DOW tumbled sharply overnight, shedding -530 points or -1.35%, marking its most pronounced session drop since March 2023 and its fourth consecutive day of losses. This sharp decline seems a natural reaction after the index’s robust bullish run since last November, which propelled it to new record highs, lost steam. It’s also a logical area for some profit-taking and consolidations, just ahead of 40k psychological level.

The strong rally was largely fueled by anticipations of forthcoming interest rate cuts, even with delays. Nevertheless, there is little, but growing skepticism among investors on whether the policy easing cycle would really start this year. The recent surge in commodity prices has also served as a stark reminder of the challenges in curbing inflation.

The selloff also come just ahead of the crucial non-farm payroll report from the US today. Markets are expecting 205k job growth in March. Unemployment rate is expected to be unchanged at 3.9% while average hourly earnings are expected to rise 0.3% mom. Any upside surprises in today’s report, in particular wages growth, could prompt further shift in Fed expectations, and hut overall risk sentiment in the stock markets.

Technically, considering bearish divergence condition in D MACD, 39899.05 could be a medium term top in DOW already, just ahead of 40k psychological level, and 61.8% projection of 18213.65 to 35962.65 from 28660.94 at 40241.64.

Decisive break of 38483.23 support should confirm this bearish case, and bring deeper correction back to 38.2% retracement of 32327.20 to 39889.05 at 37000.42.

Nevertheless, strong rebound from the current level would push DOW for another take on 40k before topping.

Fed officials want more evidence before considering rate cuts

A wave of comments from several Fed officials overnight highlighted a consensus on the need for patience before initiating interest rate reductions. While the higher than expected inflation readings in January and February were “concerning”, they’re not seen as derailing the broader disinflation process yet. Nevertheless, the sentiment is clear: more evidence is required to confirm inflation’s downward path towards 2% target before any policy easing is initiated.

Cleveland Fed President Loretta Mester emphasized the necessity of observing “a couple more months of data” to verify if the recent inflationary trends are indeed reversing. Mester pointed out the need for “more evidence” that supports the continuation of inflation’s decline. Meanwhile, Fed is in a “policy position” to adjust policy “more swiftly and sooner” if labor markets were to “deteriorate significantly”

Minneapolis Fed President Neel Kashkari on penciled in two “rate cuts” this year back in March, predicated on inflation’s decline towards target.” Yet, if inflation is “moving sideways”, he would question “whether we needed to do those rate cuts at all.”

Chicago Fed President Austan Goolsbee said the inflation in the first two months of the year “should not knock us off the path back to target”. He views housing inflation as the “most valuable indicator” now. “If it does not come down, we will have a very difficult time getting overall inflation back to the 2% target.”

Richmond Fed President Thomas Barkin emphasized the strategic patience afforded by a “strong labor market,” suggesting that Fed has the time needed for the economic “clouds to clear” before commencing with rate adjustments.

BoJ’s Ueda: Excessive Yen weakness could prompt monetary policy response

In an interview with The Asahi Shimbun newspaper, BoJ Governor Kazuo Ueda highlighted extended Yen weakness could prompt further rate hikes by the central bank.

“If exchange rate trends have an effect on the cycle between wages and prices that cannot be ignored, that would become a reason for responding to the situation through monetary policy,” he explained.

Ueda also outlined other conditions under which BoJ might consider additional rate hikes, after the landmark shift in March which exited negative interest rates.

The decision to end negative interest rates was made with a certain level of confidence, quantified by Ueda as “75 percent.” He indicated that an increase in this confidence level to “80 percent or 85 percent” could prompt further adjustments

Governor also touched on factors likely to boost personal consumption, including the government’s planned income tax cut in June, expected wage increases, and a slowdown in consumer price inflation. These developments, if they materialize as anticipated, could pave the way for a higher interest rate as early as between summer to autumn.

Moreover, Ueda acknowledged the impact of a “excessively weak yen” on Japan’s economy and consumer prices, suggesting that significant currency weakness could influence future decisions regarding interest rate hikes.

Looking ahead

Germany factory orders and import prices, France industrial production, Swiss foreign currency reserves and SECO consumer climate, UK PMI construction, Eurozone retail sales will be released in European session.

Later in the day, Canada will also release employment report, together with US non-farm payrolls.

USD/JPY Daily Outlook

Daily Pivots: (S1) 151.06; (P) 151.41; (R1) 151.71; More…

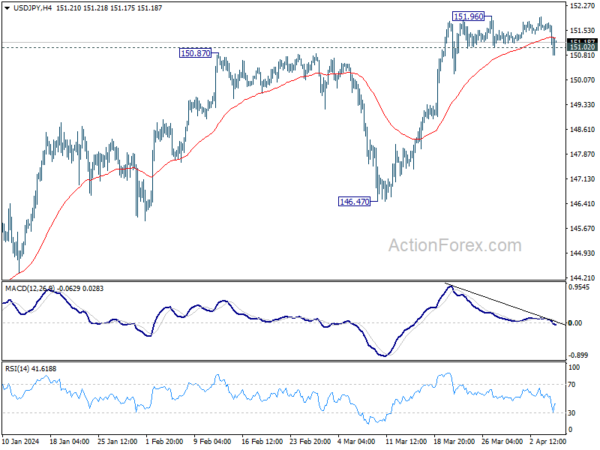

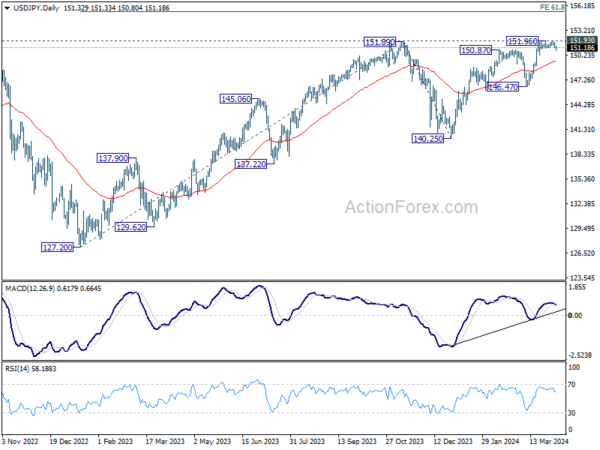

USD/JPY’s breach of 151.02 support suggests short term topping at 151.96. Intraday bias is now mildly on the downside for deeper pullback to 55 D EMA (now at 149.56). On the upside, however, sustained break of 151.93 key resistance will confirm long term up trend resumption.

In the bigger picture, correction from 151.87 (2023) high could have completed at 140.25 already. Rise from 127.20 (2023 low), as part of the long term up trend, is probably ready to resume. Decisive break of 151.93 resistance (2022 high) will confirm this bullish case. Next medium term target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. This will remain the favored case as long as 146.47 support holds, in case of another pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Household Spending Y/Y Feb | -0.50% | -2.80% | -6.30% | |

| 00:30 | AUD | Trade Balance (AUD) Mar | 7.28B | 10.50B | 11.03B | 10.06B |

| 05:00 | JPY | Leading Economic Index Feb P | 111.8 | 111.6 | 109.9 | 109.5 |

| 06:00 | EUR | Germany Factory Orders M/M Feb | 0.60% | -11.30% | ||

| 07:00 | EUR | Germany Import Price Index M/M Feb | -0.10% | 0.00% | ||

| 06:45 | EUR | France Industrial Output M/M Feb | 0.50% | -1.10% | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Mar | 678B | |||

| 08:30 | GBP | Construction PMI Mar | 49.8 | 49.7 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Feb | -0.30% | 0.10% | ||

| 12:30 | CAD | Net Change in Employment Mar | 34.5K | 40.7K | ||

| 12:30 | CAD | Unemployment Rate Mar | 5.90% | 5.80% | ||

| 12:30 | USD | Nonfarm Payrolls Mar | 205K | 275K | ||

| 12:30 | USD | Unemployment Rate Mar | 3.90% | 3.90% | ||

| 12:30 | USD | Average Hourly Earnings M/M Mar | 0.30% | 0.10% | ||

| 14:00 | CAD | Ivey PMI Mar | 54.2 | 53.9 |