- The 10-year US yield is a key determinant of FX moves

- It tends to drop when the Fed prepares to cut its interest rates

- Despite market expectations about the Fed, the 10-year US yield remains high

- A stock market correction could be a catalyst for a sizeable drop in US yields

The 10-year US yield is the barometer of the US economy. It is the basis for pricing both sovereign and corporate debt and it also determines US mortgage rates and savings rates. Along with the market risk appetite and underlying inflation, these are the chief determinants of FX rates.

In a recent special report, the market performance in the period between the last rate hike and the first rate cut was analysed. One of the key findings was than the 10-year US treasury yield recorded sizeable decreases in anticipation of the Fed’s rate cutting cycle.

The 10-year US yield reached 5% in mid-October but quickly dropped lower on the back of weaker economic data. This allowed the market to freely speculate about around six possible rate cuts announced by the Fed in 2024.

However, following the recent mixed data releases, the market looks convinced that the Fed will be announcing its first rate cut at the July 31 meeting, assigning a 60% chance of a surprise of a June move, exactly one year after the last rate hike. And only three rate cuts could take place in 2024.

As a result, the 10-year US yield remains north of 4.3%, around 45bps above the July 26, 2023 level when the Fed announced its last rate hike, which defied the aforementioned historical analysis. What is then keeping the 10-year US yield elevated? Is the market defying its own expectations?

Stickier inflation than anticipated

The US inflation continues to hover in the 3%+ region since November 2023 with most survey-based inflation indicators also pointing to decent inflation pressures, surprising the market. All in all, stronger wage increases, the recent pick up in energy prices and geopolitical uncertainty appear to have contributed to this continued inflation stickiness.

Decent growth in place

Similarly, growth remains decent and consistently above 2% per annum despite the obvious dampening effect of 525bps of rates hikes announced over the past two years. Financial conditions are mostly restrictive, strongly impacting the housing sector, but they do not appear to have choked growth yet.

Uncertainty matters for yields

The 10-year US yield also reflects risk sentiment. In periods of severe market angst, funds flow in the bond market for protection, pushing bond prices higher and yields lower. Considering that stock markets are close to their recent all-time highs and the VIX index remains relatively muted, the market appears to be enjoying a rather calm period, thus limiting demand for the lower-yielding US bonds.

In addition, the countdown to the November US election has already started. The market is preparing for a barrage of commentary especially about fiscal policy, which could open the door to an even larger budget deficit and an accompanying increase in US Treasury issuance, especially in a period that the Fed is reducing its bond holdings.

In the meantime, the continued gold rally is confirming that certain large US bond holders are trying to diversify their portfolio holding away from US assets.

Putting everything together, higher uncertainty means higher volatility and therefore bond holders demand higher compensation. This is one of the key reasons keeping yield elevated and could act as a barrier when the Fed finally decides to commence its rate cutting cycle.

A strong equities correction could lead to lower yields

The S&P500 index stands around 50% and 28% higher from the October 2022 and October 2023 troughs respectively. This pace of these moves is not unheard off, but it has obviously been very aggressive, raising questions about the viability of this rally.

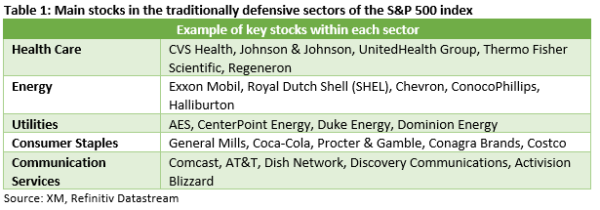

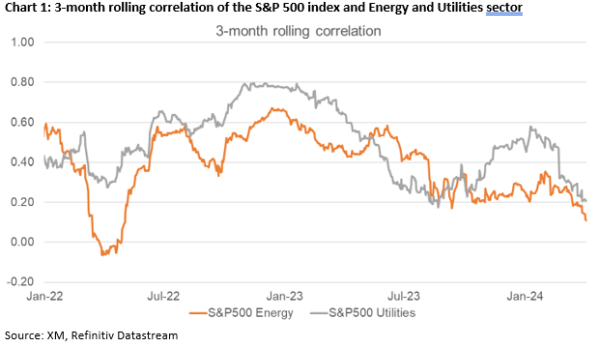

Should a correction in US equities take place, we could see safe haven flows materialize and pushing the 10-year US yield lower. In this case, defensive stocks could feature again in the headlines due to their historical performance in risk averse periods. As shown in Chart 1, the Energy and Utility sectors appear to enjoy the smallest correlation with the S&P 500 index.