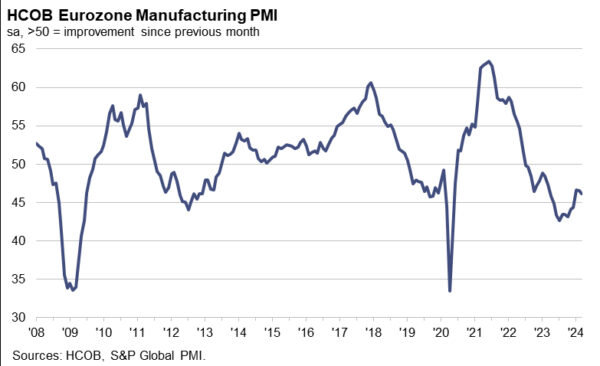

Eurozone PMI Manufacturing was finalized at 46.1 in March, down from February’s 46.5. Disparities across member countries continued, with Greece achieving a 25-month high at 56.9, Italy at 12-month high at 50.4, and Spain dipped slightly to 5.1.4. Meanwhile, Germany recorded a 5-month low at 41.9, and France fell to 46.2.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, provided a grim outlook based on the latest PMI figures, suggesting that the recession in Eurozone’s manufacturing sector is likely to persist.

De la Rubia noted that Eurozone’s manufacturing industry, heavily reliant on the collective output of Germany, France, Italy, and Spain—known as the Euro-4 countries—faces significant challenges as Germany and France experience notable downturns. While Italy and Spain showed signs of recovery in March and February, respectively, their improvements have yet to offset the overall sector’s decline.

While that the pace of decrease in incoming orders has slowed in the first quarter, yet the industry still records a net loss in orders compared to the previous months. This trend raises concerns that the sector may soon exceed the longest contraction spell for incoming new orders recorded during the euro crisis from 2011 to 2013. Such a scenario underscores the difficulties facing a swift reversal in manufacturing activity across Eurozone.