Dollar initially gained momentum in European session and breaks through near term resistance against Euro. However, the greenback then saw a swift reversal as the market transitioned into US session.

Despite a stronger final reading for US Q4 GDP, the impact on the greenback was muted, attributed largely to the data’s perceived obsolescence given the current date nearing the end of March. Furthermore, initial jobless claims aligning largely with market expectations did little to sway the currency’s trajectory.

The market’s hesitancy is apparent as traders seem reluctant to commit to their positions throughthe long weekend.

Amidst this backdrop, Sterling is staying as the strongest currency for the week. Canadian Dollar trails behind, receiving a lift from unexpectedly strong monthly GDP growth figures. Yen is trading the third strongest, benefitting from Japan’s verbal interventions.

Conversely, Swiss Franc remains at the bottom of the performance ladder, with Kiwi and Aussie also underperforming. Dollar and Euro find themselves in a middle ground.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is up 0.07%. CAC is up 0.24%. UK 10-year yield is up 0.010 at 3.944. Germany 10-year yield is up 0.013 at 2.308. Earlier in Asia, Nikkei fell -1.46%. Hong Kong HSI rose 0.91%. China Shanghai SSE rose 0.59%. Singapore Strait Times fell -0.85%. Japan 10-year JGB yield is down -0.0126 at 0.712.

US initial jobless claims falls to 210k, vs exp 211k

US initial jobless claims fell -2k to 210k in the week ending March 23, slightly below expectation of 211k. Four-week moving average of initial claims fell -750 to 211k.

Continuing claims rose 24k to 1819k in the week ending March 16. Four-week moving average of continuing claims rose 3.5k to 1803k.

Canada’s GDP expands 0.6% mom in Jan, above exp 0.4% mom

Canada’s GDP grew 0.6% mom in January, above expectation of 0.4% mom. Services-producing industries increased 0.7% mom. Goods-producing industries were up 0.2% mom. Overall, there was broad-based growth with 18 of 20 sectors increasing.

Advance information indicates that GDP rose 0.4% mom in February. Broad-based increases, with main contributions from mining, quarrying, and oil and gas extraction, manufacturing, and finance and insurance, were partially offset by decreases in utilities.

ECB’s Panetta: Conditions for monetary easing are materializing

In a speech delivered in Rome, ECB Governing Council member Fabio Panetta acknowledged the impact of restrictive policies on demand, attributing these measures, alongside the falling energy prices, as key factors in the “rapid fall in inflation”.

More importantly, Panetta highlighted “risks to price stability have diminished”. Hence, and the “conditions are materializing to launch monetary easing.”

Swiss KOF falls to 101.5, yet outlook remains positive

Swiss KOF Economic Barometer fell from 102.0 to 101.5 in March, below expectation of 102.3. Despite this minor setback, the barometer continues to hover above its long-term average, indicating a positive outlook for the Swiss economy in the coming months.

The decline can primarily be attributed to weaker performances in the construction sector and private consumption. However, finance and insurance sector emerged as a bright spot, with indicators pointing to slight improvements.

BoJ opinions: Board emphasizes caution in historic shift away from negative rate

At last week’s policy meeting, which marked the conclusion of Japan’s extensive easing program and its first interest rate hike since 2007, BoJ board members underscored the importance of a cautious approach. The Summary of Opinions from this pivotal gathering highlighted board members’ perspectives on the delicate balance required in this new phase of monetary policy.

One member stressed the necessity of maintaining a “cautious stance”, especially in light of ending the negative interest rate policy, pointing out that “Japan’s economy is not in a state where rapid policy interest rate hikes are necessary.”

Furthermore, clarity and communication were emphasized as crucial elements in this transitional period. “It is important to clearly communicate through the use of various methods that the changes in the monetary policy framework proposed at this monetary policy meeting will not be a regime shift toward monetary tightening,” another member articulated.

The summary also conveyed concerns about the potential impact of premature expectations on Japan’s economic stability. A member warned of the risks associated with policy changes sparking speculative expectations misaligned with economic fundamentals, which could inadvertently destabilize financial conditions. Such volatility could “dampen the momentum of the virtuous cycle operating in Japan’s economy and delay the achievement of the inflation target.”

NZ ANZ business confidence fall to 22.9, inflation expectations down to 3.8%

New Zealand ANZ Business Confidence fell from 34.7 to 22.9 in March. Own Activity Outlook fell from 29.5 to 22.5. Inflation expectations fell from 4.03% to 3.80%. Cost expectations rose from 73.5 to 74.6. Pricing intentions fell from 48.2 to 45.1. Profit expectations fell from 5.3 to -3.8. Wage expectations rose from 78.9 to 80.5. Employment intentions fell sharply from 6.2 to 3.5.

ANZ acknowledged the solid progress being made, such as narrowing current account deficit and downward trend in inflation. However, concerns are raised about “stickiness” of some inflation measures and persistent uncertainty around inflation outlook. The bank’s message emphasizes caution, stating, “It’s certainly too soon to declare victory. But eyes on the prize; we’re getting there.”

EUR/USD Mid-Day Outlook

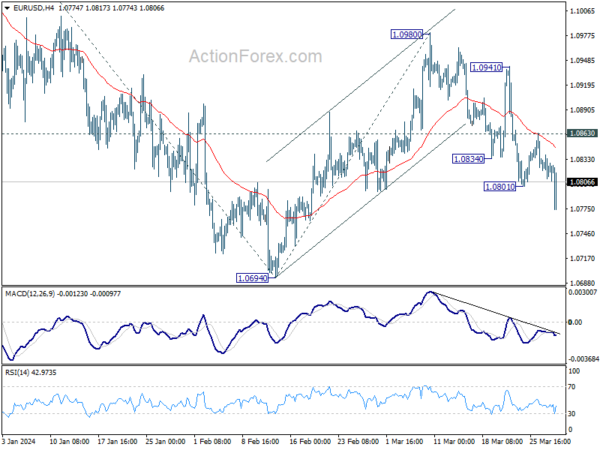

Daily Pivots: (S1) 1.0813; (P) 1.0826; (R1) 1.0841; More…

EUR/USD’s fall from 1.0980 resumed by breaking through temporary low. Intraday bias is back on the downside for 1.0694 support first. Break there will resume the whole decline from 1.1138 and target 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536. Nevertheless, break of 1.0863 minor resistance will turn intraday bias neutral again.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:00 | NZD | ANZ Business Confidence Mar | 22.9 | 34.7 | ||

| 00:00 | AUD | Consumer Inflation Expectations Mar | 4.30% | 4.50% | ||

| 00:30 | AUD | Retail Sales M/M Feb | 0.30% | 0.40% | 1.10% | |

| 00:30 | AUD | Private Sector Credit M/M Feb | 0.50% | 0.40% | 0.40% | |

| 07:00 | EUR | Germany Retail Sales M/M Feb | -1.90% | 0.30% | -0.40% | |

| 07:00 | GBP | GDP Q/Q Q4 F | -0.30% | -0.30% | -0.30% | |

| 07:00 | GBP | Current Account (GBP) Q4 | -21.2B | -21.5B | -17.2B | -18.5B |

| 08:00 | CHF | KOF Economic Barometer Mar | 101.5 | 102.3 | 101.6 | 102 |

| 08:55 | EUR | Germany Unemployment Rate Mar | 5.90% | 5.90% | 5.90% | |

| 08:55 | EUR | Germany Unemployment Change Mar | 4K | 10K | 11K | |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 0.40% | 0.30% | 0.10% | |

| 12:30 | CAD | GDP M/M Jan | 0.60% | 0.40% | 0.00% | |

| 12:30 | USD | Initial Jobless Claims (Mar 22) | 210K | 211K | 210K | 212K |

| 12:30 | USD | GDP Annualized Q4 F | 3.40% | 3.20% | 3.20% | |

| 12:30 | USD | GDP Price Index Q4 F | 1.60% | 1.70% | 1.70% | |

| 13:45 | USD | ChicagoPMI Mar | 46.4 | 44 | ||

| 14:00 | USD | Pending Home Sales M/M Feb | -2.00% | -4.90% | ||

| 14:00 | USD | Michigan Consumer Sentiment Mar F | 76.5 | 76.5 | ||

| 14:30 | USD | Natural Gas Storage | -26B | 7B |