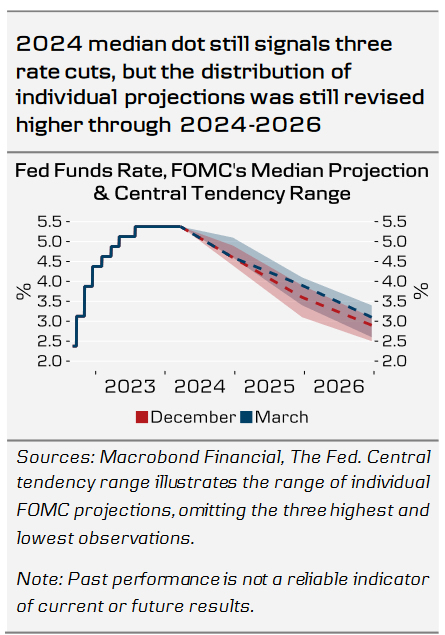

- The Fed made no changes to its monetary policy in the March meeting, as widely expected. Updated rate projections still signal three rate cuts this year, but 2025, 2026 and longer-term ‘dots’ we revised slightly higher.

- While Powell did not specify the timing, he suggested that the Fed is soon looking to slow down the pace of QT. That said, we do not believe that completely ending the balance sheet run-off will be on the cards in the near-term.

- Markets reacted dovishly, with end-2024 Fed Funds Rate pricing declining by around 7-8bp and EUR/USD rising above 1.09. 2s10s UST yield curve steepened in line with the signals from the dot plot.

The Fed remains on track towards price stability (and consequently, rate cuts), despite ‘bumps’ seen in the inflation data in early 2024. Powell chose his wording carefully to avoid sounding too optimistic on inflation, but also made it clear, that as monetary policy remains restrictive and labour supply recovers, further disinflation is still on the radar.

The updated 2024 dots continue to signal three rate cuts, in line with our forecast. There was a slight hawkish adjustment, however, as now only one participant saw the Fed cutting rates more than three times in 2024 (down from 4 in December). In addition, 2025 & 2026 dots were adjusted higher by 25bp, reflecting a more positive outlook for growth. GDP is now seen growing by 2.1% in 2024 (from 1.4%) and 2.0% in 2025-2026 (from 1.8% & 1.9%). Relative to the December projections, participants judged that growth risks had become more balanced (previously tilted to the downside) while risk of higher-than-expected unemployment rate was seen declining. Slightly higher share of participants reported core inflation risks as tilted to the upside.

Interestingly, the longer-term rate projection was revised up to 2.6% (from 2.5%). In the past, we have discussed quick recovery in foreign labour force, faster productivity growth and persistently expansionary fiscal policy as possible drivers of faster potential growth, which could imply that the neutral rate of interest is also higher. We discussed the recent data on labour force in this week’s edition of Reading the Markets USD, 19 March.

Powell provided only few details on the near-term plans for QT. He aimed to prepare the market for a slowdown in the pace of run-off in Treasury bond holdings ‘fairly soon’, but also suggested that completely ending QT will not be in the cards in the near-term. We believe the Fed will continue shrinking its balance sheet at least until the end of this year.

Powell’s wording on the near-term rate outlook was mostly unchanged from before. Sudden weakening in labour market conditions could be a potential trigger for an early cut even if for now, Powell saw ‘no cracks’ in the current conditions. Market pricing for year-end 2024 Fed Funds Rate declined by around 7-8bp and broad USD weakened. We still believe that if incoming hard data begins to show similar signs of weakness as already seen in some of the leading indicators (hiring, ISM), then the Fed could potentially move as early as in the next May meeting. For now, though, we note that it is not a high conviction call, as markets price in only 3-4bp of cuts by May.