Sterling would likely be on the move this week as key UK economic indicators, including GDP, employment, and wages data, are set to be released. These figures are eagerly watched, as any deviation from expectations could influence the market’s anticipations for the upcoming inflation report and BoE’s subsequent meeting next week.

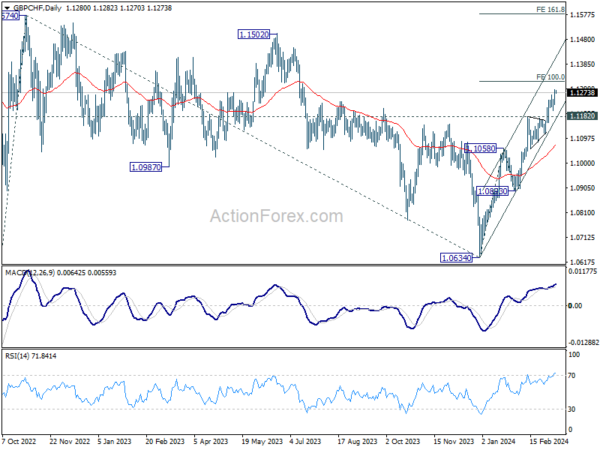

GBP/CHF’s rally from 1.0634 continued last week and hit as high as 1.1287. Immediate focus is now on 100% projection of 100% projection of 1.0634 to 1.1058 from 1.0893 at 1.1317. Decisive break there would prompt upside acceleration towards 161.8% projection at 1.1579. While overbought condition, as seen in D RSI, might limit upside at 1.1317 on initial attempt, near term outlook will stay bullish as long as 1.1182 resistance turned support holds.

In the larger picture, the break of 55 E EMA is a medium term bullish sign. This also strengthen the case that correction from 1.1574 has completed at 1.0634 already. Rise from 1.0183 (2022 low) could be ready to resume. Retest of 1.1574 should be seen next, and firm break there will pave the way to 100% projection of 1.0183 to 1.1574 from 1.0634 at 1.2025 in the medium term.

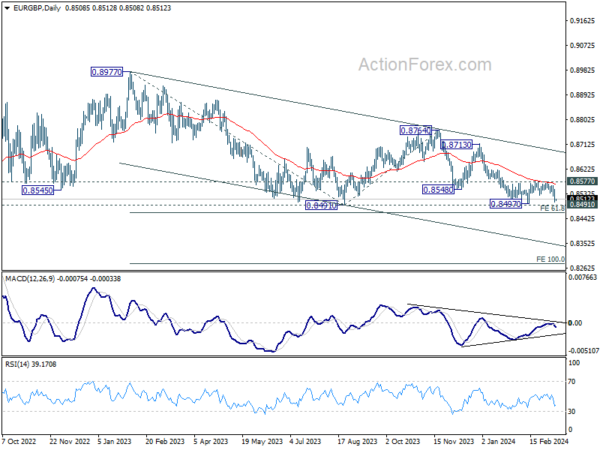

EUR/GBP’s rejection by 55 D EMA is a near term bearish sign, which suggests that fall from 0.8764 is still in progress. Break of 0.8497 support will resume this decline to 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464. Firm break there could trigger downside acceleration to 100% projection at 0.8278.

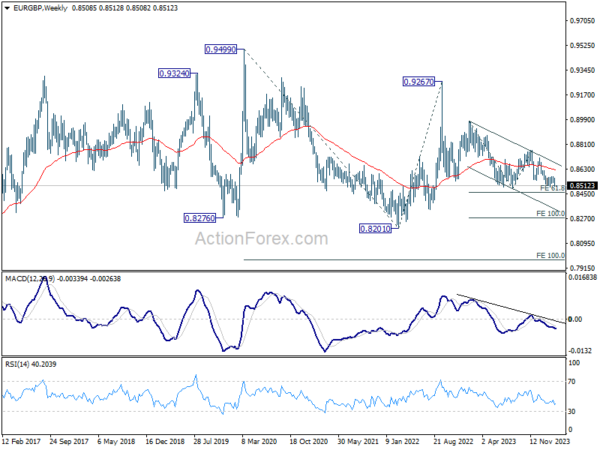

Any downside acceleration ahead would also strengthen the case that fall from 0.9267 is going to extend through 0.8201 (2022 low) in the medium term, as the third leg of the pattern from 0.9499 (2020 high).