- EURUSD remains above downtrend line

- RSI and MACD look weak

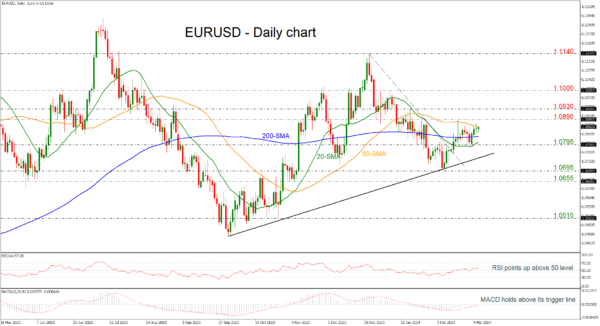

EURUSD has been developing within a narrow range of the 20- and the 50-day simple moving averages (SMAs) of 1.0805 to 1.0860 respectively. The pair is still standing above the short-term downtrend line and the 200-day SMA, confirming the broader bullish outlook.

Technically, the RSI indicator is pointing slightly up above the neutral threshold of 50; however, the MACD oscillator is weakening its momentum above its trigger and zero lines.

If prices overcome the 50-day SMA and the immediate resistance of 1.0890 then it may open the way towards the 1.0930 resistance ahead of the 1.1000 round number, taken from the high on January 24.

On the flip side, it there is a potential decline below the 200-day SMA and the critical level of 1.0795 then the market may dive towards the medium-term supportive trend line at 1.0750. A successful break lower could retest the 1.0695 barricade ahead of 1.0655, switching the outlook to negative.

All in all, EURUSD is looking neutral to bullish in the short-term and bullish in the medium-term timeframes, but a climb above 1.0890 is expected to endorse the positive outlook.