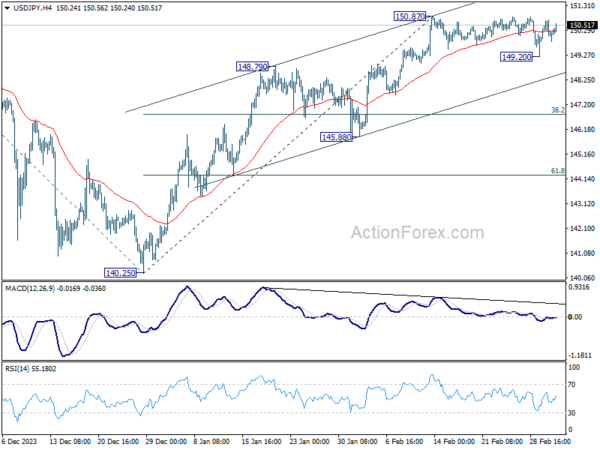

Daily Pivots: (S1) 149.79; (P) 150.26; (R1) 150.56; More…

USD/JPY is still extending the consolidation from 150.87 and intraday bias remains neutral. On the upside, break of 150.87 will resume the rise from 140.25 to 151.89/93 key resistance zone. On the other hand, considering bearish divergence condition in 4H MACD, firm break of 149.20 will confirm short term topping at 150.87. Deeper fall would be seen to channel support (now at 148.47), even as a corrective move.

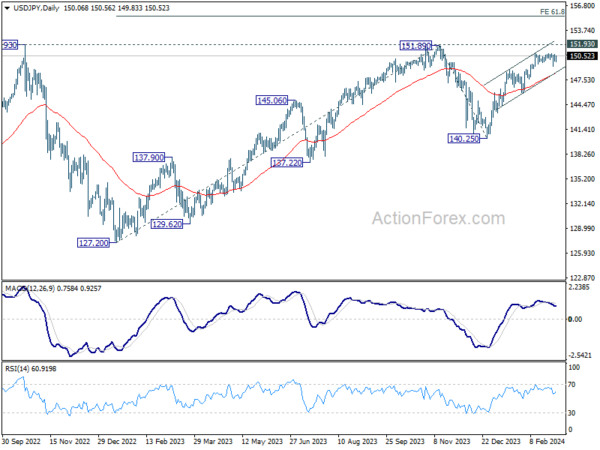

In the bigger picture, rise from 140.25 is seen as resuming the trend from 127.20 (2023 low). Decisive break of 151.89/.93 resistance zone will confirm this bullish case and target 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. However, break of 148.79 resistance turned support will delay this bullish case, and extend the corrective pattern from 151.89 with another falling leg.