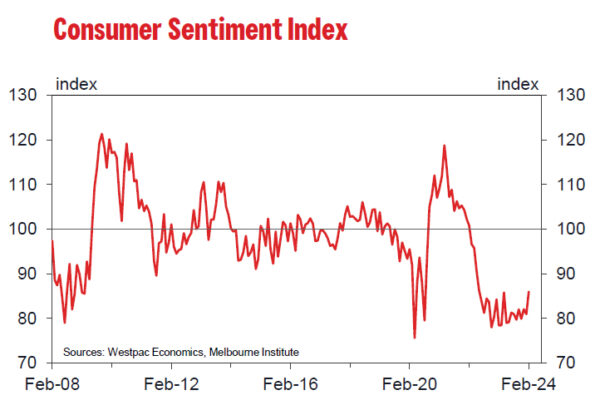

Australia Westpac Consumer Sentiment Index surged by 6.2% mom to 86 in February, marking the highest level since June 2022. This increase also represents the largest monthly gain since April of the previous year, which conincided with a period when RBA temporarily halted its tightening cycle.

According to Westpac, the surge in consumer sentiment was notably propelled by improved sentiment towards major purchases, which climbed 11.3% to 86.8, and more optimistic outlook for the economy over the next year, rising 8.8% to 88.9—the highest since May 2022. Additionally, five-year economic outlook rose 4.4% to 93.

The cooling inflation and more favorable perspective on interest rates are believed to be the primary factors behind this uplift. However, despite the recent gains, consumer mood remains in the pessimistic territory.

A notable “sharp turnaround” in sentiment was observed following RBA’s decision in February to maintain the cash rate steady, with sentiment dropping from 94.1 to just 80 post-meeting. While the decision to keep rates unchanged aligned with general expectations, the decline in sentiment suggests consumers were anticipating a “clearer indication” that interest rates might begin to decrease.

Looking forward, Westpac anticipates the RBA will maintain the current interest rate in March, contingent on inflation continuing to align with expectations.