- At today’s monetary policy meeting the BoE left the Bank Rate unchanged at 5.25% as widely expected.

- The BoE explicitly removed its tightening bias and signalled a shift to a more neutral stance on monetary policy.

- The reaction in EUR/GBP was muted with EUR/GBP set to end the day higher.

As expected, the Bank of England (BoE) decided to keep the Bank Rate unchanged at 5.25%. The vote split indicated a continued split committee, as 6 members voted for an unchanged decision, 2 for a 25bp hike and 1 for a 25bp cut.

The BoE shifted towards a more neutral approach to monetary policy by removing its tightening bias, a less hawkish vote split than previously and overall being more confident in developments in the persistence of inflation, as expected. More explicitly, the BoE removed the phrase “further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures” and added that “the MPC will keep under review for how long the Bank Rate should be maintained at its current level“.

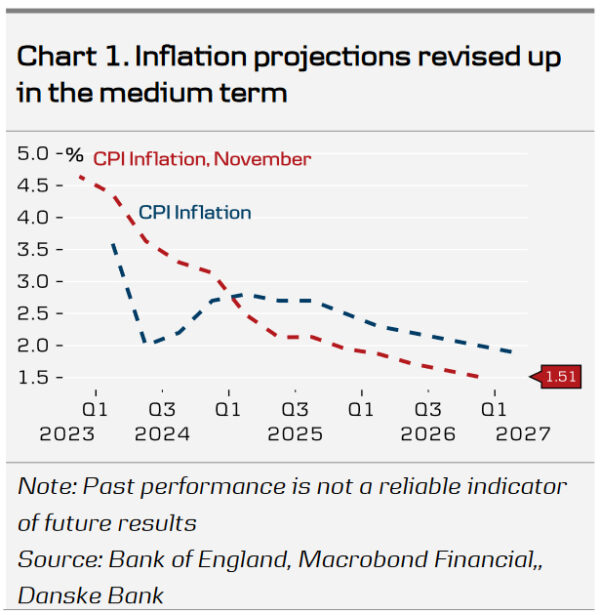

The inflation forecast was revised down in the near-term but revised higher in the medium-term with headline inflation set to reach target in Q4 2026, using a significantly lower trajectory for the Bank Rate (chart 1). This is a year later than expected in the November monetary policy report (MPR)). While the MPC still judges the risks as skewed to the upside for the inflation outlook due to geopolitical factors, it sees the risks from domestic price and wage pressures “more evenly balanced“. Additionally, GDP growth forecast was revised higher across the forecast period.

While the dovish tilt fell slightly short of market expectations, today’s meeting marks an important shift in communication from the MPC, opening the door for impending rate cuts. Before the next meeting on 21 March, we will get a lot of data, namely two job reports (including a continuation of LFS-based data) and inflation data for January and February. Overall, we expect the UK economy to show further signs of weakness, inflation to level off and wage growth to have peaked as shown by recent data releases.

Rates. The reaction in rates markets was very muted. 2Y Gilt yields moved 5bp higher on the statement but fully retraced the move during the press conference. Markets have shifted the probability of the first rate cut further out, now expecting the first 25bp cut by June 2024.

FX. Following the release of the statement, EUR/GBP dipped slightly lower but is set to end the day higher. On balance we still see relative rates as a slight negative for GBP but note that risks are more balanced. We see the recent rebound as attractive levels to sell GBP and continue to forecast EUR/GBP to move higher the coming year to 0.89.

Our call. We continue to expect the first rate cut of 25bp in June 2024, which we think today’s meeting supports. We subsequently expect 25bp cuts in the following quarters, totalling of 75bp of cuts for 2024. This is less than current market pricing (110bp). We do not see the BoE deviating from the Fed and ECB by the extent currently priced by markets and expect markets to scale back on expectations from the latter.