- We expect the Fed to maintain its monetary policy unchanged in the January meeting. We expect the first rate cut in March and a total of four cuts in 2024.

- The Fed is in a comfortable position with regards to both sides of its dual mandate. Cooling inflation warrants cutting rates towards neutral, but solid growth and labour markets allow the Fed to move gradually.

- The Fed is also starting to look towards fine-tuning the endgame for QT, which we expect to last at least until the end of the year. Overall, we see risks tilted towards slightly higher yields and lower EUR/USD around the meeting.

The title of this preview quotes SF Fed’s Mary Daly, a new FOMC voter for 2024, who was the last participant to comment on monetary policy outlook ahead of the January blackout. Next Wednesday, with no new economic forecasts, all eyes will be on Powell, who we expect to echo Daly and several of their colleagues’ recent remarks, emphasizing cautious yet optimistic outlook.

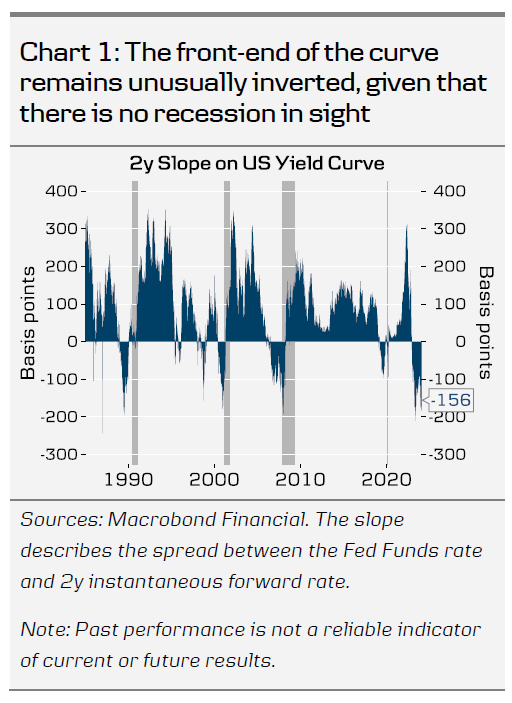

Market prices in around 140bp of cuts for this year. Over the past 40 years, the front-end of the curve has only been as inverted just ahead of recessions, which does not seem like the case today. Recovering real wages, easier financial conditions, rising consumer optimism and supportive fiscal policy all suggest that an imminent slowdown is unlikely.

The December projections showed that real policy rate would remain somewhat above 2% this year, around 1.5% in 2025 and then settle close to neutral in 2026. While the Fed is happy to discuss rate cuts for 2024, monetary policy will not be expansionary anytime soon.

The December minutes suggested that upside risks to inflation have ‘diminished’, but some risk of persistent inflation still remains, especially in housing and non-housing services. With the recent strong data signals from labour markets, consumer demand and housing market, we think that the near-term inflation outlook supports the gradual approach.

In addition to Daly, also Mester, Barkin and Bostic are rotating in as the new FOMC voters for 2024, while Goolsbee, Harker, Kashkari and Logan are moving out. We do not expect the rotation to have a significant impact on the Fed’s decision making, but if anything, the new voters’ recent comments have been on the hawkish side of the spectrum. Mester explicitly noted that March is too early for a rate cut in her view, while Bostic outlined Q3 as his base case for the first cut. Barkin has not specified a timeline for cuts but noted that progress on inflation has remained narrow and focused on goods.

The outlook for tapering QT has also been increasingly brought up in the latest Fed speak. Waller noted that the endpoint level of reserves could as low as 10-11% of GDP, and that the ON RRP could well be drained to zero. We looked at the arithmetics of QT in our recent edition of Reading-the-Markets USD (16 January), but the key takeaway is that liquidity conditions will likely allow the Fed to continue QT at least until the end of 2024. Overall, we think Powell could guide modestly against the notion of rapid rate cuts and/or end of QT, which leaves risks tilted towards a hawkish market reaction. That said, the upside potential to yields is likely limited, as we still expect a total of four cuts in 2024.

Markets: Stronger USD & stable UST yields in 2024

UST yields looks somewhat vulnerable to a pushback from Powell, especially if it coincides with the Quarterly Refunding statement (also out Wednesday evening) signalling further increases in long-end issuance. Our base case is for the 10Y UST yield to remain close the current level (4.15%-4.20%) by the end of the year, though risks are tilted to the upside in the short run.

If Powell pushes back on the market notion of rapid rate cuts, as we anticipate, we could see a lower EUR/USD upon announcement. Our forecast for the cross is lower at 1.07/1.05 on a 6/12M horizon.