Commodity currencies bounce in early US session, spurred by unexpectedly robust US GDP data that has invigorated stock futures. This surge in risk appetite is exerting some pressure on Dollar, although the impact remains relatively contained for the moment. The sustainability of this risk-on sentiment is still in question, which will be critical for the next move in currencies too. Yen, meanwhile, is also rebounding, benefiting from retreat in benchmark US and European treasury yields. Despite these movements, major currency pairs involving the Yen remain within familiar ranges, indicating ongoing market caution.

Euro is maintaining its ground against Dollar but is showing signs of weakness against other major currencies, which is mirrored by Sterling and Swiss Franc too. ECB President Christine Lagarde noted, at the post-meeting press conference, there was consensus in the Governing Council that it’s “premature” to start discussing interest rate cuts. Furthermore, when probed about potential rate cuts in the summer, Lagarde emphasized that ECB is “data-dependent” rather than “time-dependent”.

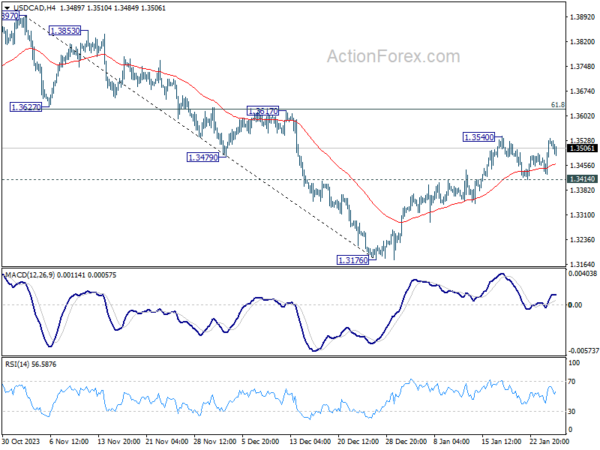

Technically, USD/CAD dips mildly after failing to break through 1.3540 resistance, but stays well above 1.3414 support. Further rally is in favor for now, and break of 1.3540 will resume the rebound from 1.3176 to 1.3617 cluster resistance next. However, break of 1.3414 will risk deeper pull back towards 1.3176 low instead.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 0.04%. CAC is down -0.02%. UK 10-year yield is down -0.035 at 3.977. Germany 10-year yield is down -0.052 at 2.288. Earlier in Asia, Nikkei rose 0.03%. Hong Kong HSI rose 1.96%. China Shanghai SSE rose 3.03%. Singapore Strait Times fell -0.18%. Japan 10-year JGB yield rose 0.0269 to 0.749.

ECB stands pat, declining trend in underlying inflation continues

ECB left monetary policy unchanged as widely expected. Main refinancing, marginal lending and deposit rates are held at 4.50%, 4.75%, and 4.00% respectively.

In the accompanying statement, ECB noted that incoming information has “broadly confirmed its previous assessment of the medium-term inflation outlook. “Aside from an energy-related upward base effect”, the declining trend in underlying inflation “has continued.

The central bank also maintained that current interest rates, “maintained for a sufficiently long duration”, will make substantial contribution to bringing down inflation to target. Future policy decisions will follow a “data-dependent approach” to determine both the level of duration of monetary restriction.

US GDP grows 3.3% annualized in Q4, core PCE prices unchanged at 2%

US GDP grew 3.3% annualized in Q4, well above expectation of 2.0%. Looking at some details, consumer spending slowed from 3.1% to 2.8%. Goods spending slowed from 4.9% to 3.8%, but services spending growth rose from 2.2% to 2.4%. Gross private domestic investment growth slowed notably from 10.0% to 2.1%. Headline PCE prices slowed notably from 2.6% to 1.7%. Meanwhile, PCE core prices was unchanged at 2.0%.

Also released, initial jobless claims rose from 189k to 214k in the week ending January 19, above expectation of 199k. Goods trade deficit narrowed from USD -90.3B to USD -88.5B, versus expectation of USD -88.7B. Durable goods orders rose 0.0% mom in December, below expectation of 1.0% mom. But ex-transport orders rose 0.6% mom, above expectation of 0.2% mom.

Germany Ifo business climate falls to 85.2, stuck in recession

German Ifo Business Climate fell from 86.3 to 85.2 in January, below expectation of 86.7. Current Assessment Index fell from 88.5 to 87.0, below expectation of 88.6. Expectations Index fell from 84.2 to 83.5, below expectation of 84.9.

But sector, manufacturing rose from -17.4 to -16.0. Services fell from -1.7 to -4.9. Trade fell from -26.7 to -29.7. Construction fell from -33.5 to -35.9.

Ifo said, sentiment among German companies has deteriorated further at the beginning of the year. The German economy is “stuck in recession”.

Japan downgrades export outlook, raises concerns over earthquake impacts

In the new Monthly Economic Report, the Japanese Government continues to observe that the economy is “recovering at a moderate pace”, even though it’s “pausing in part”. A significant shift in this report is the revised perspective on exports, now viewed as “appearing to be pausing for picking recently”. The report also calls for heightened vigilance regarding the economic repercussions of the 2024 Noto Peninsula Earthquake.

Apart from the change in export assessment and the earthquake’s impact, the report’s overall tone remained consistent with previous evaluations. Key economic indicators such as private consumption is characterized as “picking up”, although business investment appears to be “pausing”. Industrial production is also showing signs of recovery.

The report paints a positive picture of corporate health, noting improvements as a whole. The employment scenario reflects positive trends, with signs of ongoing improvement. Lastly, consumer prices have been identified as “rising moderately”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0843; (P) 1.0888; (R1) 1.0929; More…

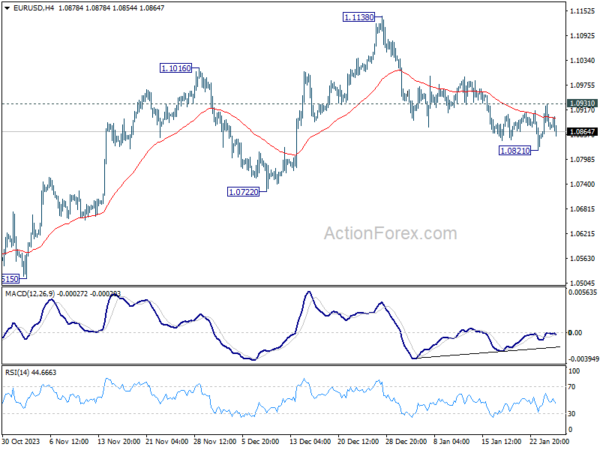

EUR/USD is staying in range above 1.0821 and intraday bias remains neutral. On the downside, break of 1.0821 will resume the fall from 1.1138 to 1.0722 support. On the upside, above 1.0931 will resume the rebound from 1.0821 towards 1.1138 resistance.

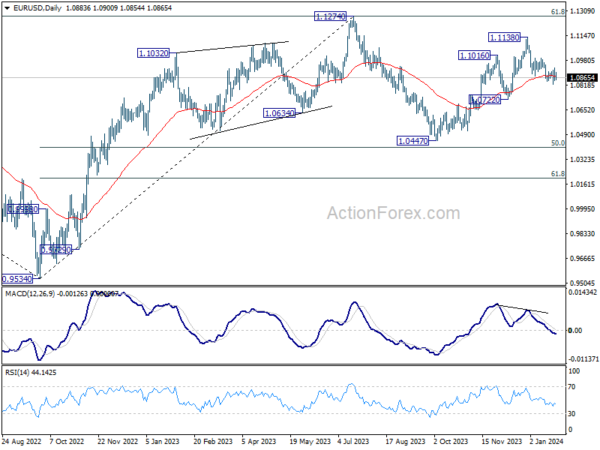

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Bulletin Q4 | ||||

| 09:00 | EUR | Germany IFO Business Climate Jan | 85.2 | 86.7 | 86.4 | 86.3 |

| 09:00 | EUR | Germany IFO Current Assessment Jan | 87 | 88.6 | 88.5 | |

| 09:00 | EUR | Germany IFO Expectations Jan | 83.5 | 84.9 | 84.3 | 84.2 |

| 13:15 | EUR | ECB Main Refinancing Rate | 4.50% | 4.50% | 4.50% | |

| 13:30 | USD | Initial Jobless Claims (Jan 19) | 214K | 199K | 187K | 189K |

| 13:30 | USD | GDP Annualized Q4 P | 3.30% | 2.00% | 4.90% | |

| 13:30 | USD | GDP Price Index Q4 P | 1.50% | 2.20% | 3.30% | |

| 13:30 | USD | Goods Trade Balance (USD) Dec P | -88.5B | -88.7B | -90.3B | |

| 13:30 | USD | Wholesale Inventories Dec P | 0.40% | -0.20% | -0.20% | |

| 13:30 | USD | Durable Goods Orders Dec | 0.00% | 1.00% | 5.40% | |

| 13:30 | USD | Durable Goods Orders ex Transport Dec | 0.60% | 0.20% | 0.40% | |

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | New Home Sales Dec | 646K | 590K | ||

| 15:30 | USD | Natural Gas Storage | -322B | -154B |