GBP/USD – 1.3210

Original strategy :

Sold at 1.3195, Target: 1.3030, Stop: 1.3255

Position: – Short at 1.3195

Target: – 1.3030

Stop: – 1.3255

New strategy :

Hold short entered at 1.3195, Target: 1.3030, Stop: 1.3255

Position: – Short at 1.3195

Target: – 1.3030

Stop:- 1.3255

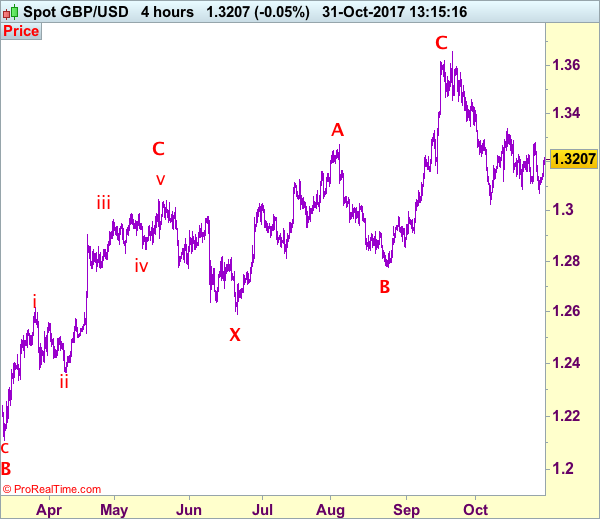

As sterling has maintained a firm undertone after staging a strong rebound from 1.3070, suggesting near term upside risk remains and marginal gain from here cannot be ruled out, however, as broad outlook remains consolidative, reckon upside would be limited to 1.3240-50 and bring retreat later, below 1.3115-20 would suggest the rebound from 1.3070 has ended, bring test of this level, below there would extend weakness towards 1.3027 support. Looking ahead, a break below there is needed to confirm early decline from 1.3658 top has resumed for further fall to psychological support at 1.3000 first.

In view of this, we are holding on to our short position entered at 1.3195. Above 1.3240-50 would defer and prolong choppy consolidation, risk rebound to indicated resistance area at 1.3279-87 which is likely to hold from here. Our preferred count is that (pls see the attached chart) the wave IV is unfolding as a complex double three (ABC-X-ABC) correction with 2nd wave B ended at 1.2774, hence 2nd wave C could have ended at 1.3658.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.