Financial markets are keenly focused on US GDP data today. Analysts expect GDP to grow at an annualized rate of 2.0% in Q4, marking a slowdown from the previous quarter’s 4.9%, and reaching the lowest rate since Q2 of 2022. This anticipated reading would align with the notion that the US economy, while experiencing a rapid cooling, remains resilient. A key component under scrutiny is the performance of consumption growth, which has been a significant support for the economy.

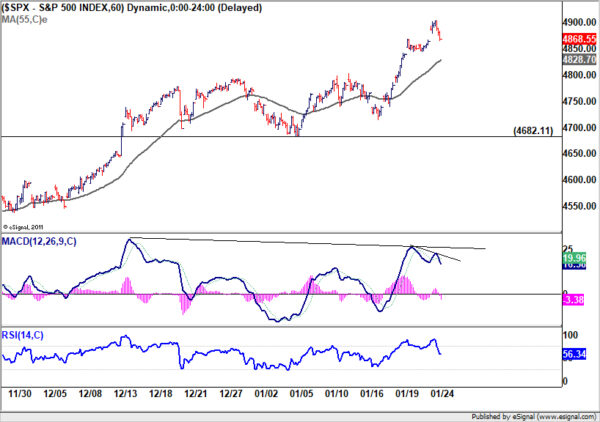

Notable profit taking was seen in the US stock markets after initial rally overnight. S&P 500 closed up just 0.08% at 4868.55, after climbing to 4903.68. Technically, there is prospect of a prolonged near-term consolidation given that SPX has just met 100% projection of 3808.86 to 4607.07 from 4103.78 at 4901.99.

Break of 55 H EMA (now at 4828.70) could trigger deeper correction towards 4682.11 support, which is slightly above 55 D EMA (now at 4658.15), and set the range for sideway consolidations.

Nevertheless, another rally, as supported by strong GDP data today, and sustained trading above 4901.99 would set the stage for a take on 5000 psychological level quickly.