Dollar is trading mixed in early US session despite positive economic data. Personal income rose 0.4% in September, up from 0.2% and met consensus. Spending jumped solidly by 1.0%, above expectation of 0.9%. Headline PCE accelerated to 1.6% yoy while core PCE was unchanged at 1.3% yoy. However, the greenback is weighed down, especially against Yen, by news that Special Prosecutor Robert Mueller launched the first charge on Russian probe. Paul Manafort, a former campaign manager for President Donald Trump, was indicted on 12 counts including "conspiracy against the United States."

German CPI missed, but Eurozone confidence solid

Euro trades lower after disappointing German inflation data. Healing CPI rose 0.0% mom in October. Annually, CPI slowed to 1.6% yoy, down from 1.8% yoy and missed expectation of 1.7% yoy. Also from Germany, retail sales rose 0.5% mom in September. Eurozone business climate rose to 1.44 in October up from 1.34, above expectation of 1.40. That’s the highest reading since March 2011. Economic confidence rose to 114.0, up from 113.1, above expectation of 113.3. The 114.0 economic confidence was the highest level since January 2001. Industrial confidence improved to 7.9, up from 6.7, above expectation of 7.1. Services confidence rose to 16.2, up from 15.4, above expectation of 15.0. Consumer confidence was finalized at -1.

In Spain, the Madrid government is set to take control of Catalan institutions today. If Catalonia regional President Carles Puigdemont refuses to step down, he could face possible arrest and prosecution on charges of rebellion. And the maximum sentence for the charge is 30 years. Spanish Foreign Minister Alfonso Dastis said he hoped that the upcoming elections would help to "restore legal governance and rule of law in Catalonia". And after that, "Catalonia will again be the same society it was before: open and integrated."

Euro has been under much selling pressure after ECB announced to half monthly asset purchase to EUR 30b and extend the program for another nine months. The common currency will need to look into GDP and CPI data to be released tomorrow for some support.

Sterling firm ahead of BoE hike

Sterling is trading generally firm today. Mortgage approvals dropped to 66.2k in September. M4 money supply dropped -0.2% mom in September. The main focus is BoE Super Thursday. BoE is widely expected to raise the Bank Rate by 25bps to 0.50%, first hike in a decade. In our view, this will be a one-off as the Bank Rate will be brought back to pre-Brexit referendum level. The impact of the voting decision is largely absorbed by the monetary stimulus as well as depreciation in Sterling. BoE policy makers would be hesitate to make any more move before getting a clearer picture on Brexit. With that in mind, the vote split of the decision is the first key point to watch. The tighter the decision, the more unlikely for another hike in near term. In addition, BoE will release the quarterly inflation report. Revision in inflation projection there will tell us how policymakers general feel about the recent surge in inflation.

Swiss KOF points to bright outlook

Swiss KOF leading indicator rose to 109.1 in October, up from 105.8 and beat expectation of 106.5. That’s also the highest level since September 2010. KOF noted in the release that "Autumn is welcoming the Swiss economy with a tailwind." Economic outlook is bright "mainly driven by the banking and manufacturing indicators." "The prospects for exports and the accommodation and food service activities are also somewhat better than before. " But "indicators for domestic consumption are stagnating:" and "indicators for the further development of the construction sector have declined somewhat."

BoJ may downgrade inflation forecast tomorrow

BoJ rate decision will be a focus in the upcoming Asian session. It’s widely expected to keep monetary policies unchanged. That is, the short-term rate will be held at -0.1%. And the central bank will continue target to keep 10 year JGB yield at 0% under the Yield Curve Control framework. The main question is whether BoJ would revise down inflation projections again. Release from Japan today, retail sales rose 2.2% yoy in September, below expectation of 2.3% yoy.

EUR/USD Mid-Day Outlook

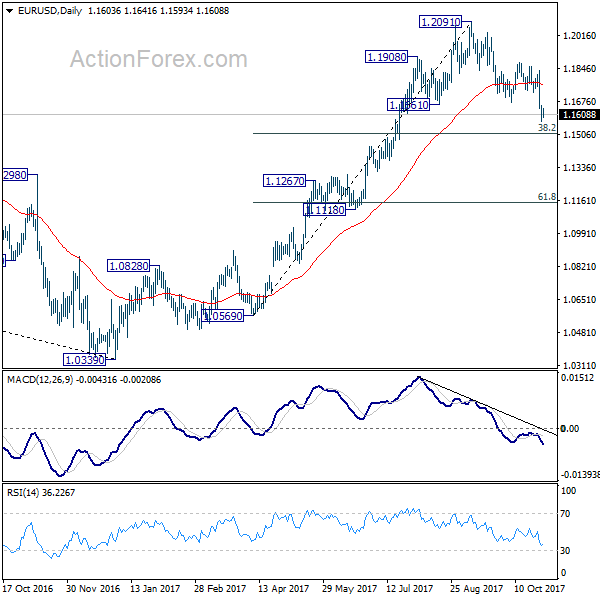

Daily Pivots: (S1) 1.1568; (P) 1.1612 (R1) 1.1651; More…

With 1.1643 minor resistance intact, intraday bias in EUR/USD remains on the downside for 38.2% retracement of 1.0569 to 1.2091 at 1.1510. We’d expect strong support from there, at least on first attempt, to bring rebound. Above 1.1643 minor resistance will turn bias neutral first. But break of 1.1879 is needed to confirm completion of the decline. Otherwise, near term outlook remains bearish. Meanwhile, sustained break will of 1.1510 will carry larger bearish implication and target 55 week EMA (now at 1.1346).

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Sep | 2.20% | 2.30% | 1.70% | 1.80% |

| 07:00 | EUR | German Retail Sales M/M Sep | 0.50% | 0.50% | -0.40% | -0.20% |

| 08:00 | CHF | KOF Leading Indicator Oct | 109.1 | 106.5 | 105.8 | |

| 09:30 | GBP | Mortgage Approvals Sep | 66.2K | 66.0K | 66.6K | 67.2K |

| 09:30 | GBP | M4 Money Supply M/M Sep | -0.20% | 0.70% | 0.90% | 1.10% |

| 10:00 | EUR | Eurozone Economic Confidence Oct | 114 | 113.3 | 113 | 113.1 |

| 10:00 | EUR | Eurozone Business Climate Indicator Oct | 1.44 | 1.4 | 1.34 | |

| 10:00 | EUR | Eurozone Industrial Confidence Oct | 7.9 | 7.1 | 6.6 | 6.7 |

| 10:00 | EUR | Eurozone Services Confidence Oct | 16.2 | 15 | 15.3 | 15.4 |

| 10:00 | EUR | Eurozone Consumer Confidence Oct F | -1 | -1 | -1 | |

| 12:30 | USD | Personal Income Sep | 0.40% | 0.40% | 0.20% | |

| 12:30 | USD | Personal Spending Sep | 1.00% | 0.90% | 0.10% | |

| 12:30 | USD | PCE Deflator M/M Sep | 0.40% | 0.40% | 0.20% | |

| 12:30 | USD | PCE Deflator Y/Y Sep | 1.60% | 1.60% | 1.40% | |

| 12:30 | USD | PCE Core M/M Sep | 0.10% | 0.10% | 0.10% | |

| 12:30 | USD | PCE Core Y/Y Sep | 1.30% | 1.30% | 1.30% | |

| 13:00 | EUR | German CPI M/M Oct P | 0.00% | 0.10% | 0.10% | |

| 13:00 | EUR | German CPI Y/Y Oct P | 1.60% | 1.70% | 1.80% |