Euro trades mildly higher today after two known ECB hawks raised skepticism about a near term rate cut. Yet, upside momentum is somewhat tempered by weak trade and production data. Also, Euro is outshone slightly by Dollar, but the latter is also struggling to break out from familiar range other major currencies. Subdued trading could continue for the rest of the day with US on holiday.

Meanwhile, Sterling, Australian Dollar, and New Zealand Dollar are trading on the softer side. Overall markets in Europe are mildly on the risk-off side. Yen is also among the worst performers, apparent on speculations that BoJ isn’t ready to hike yet, which also boosts Nikkei. Swiss Franc and Canadian Dollar are mixed like pedestrians.

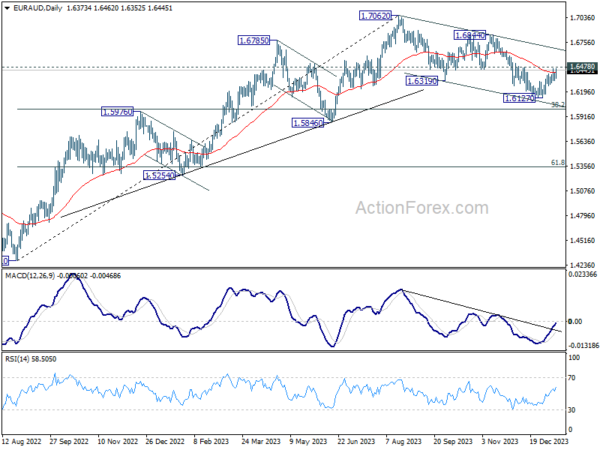

Technically, EUR/AUD is trying to resume the rebound from 1.6127 today, with sight set on 1.6478 resistance. Decisive break there will strength the case that whole correction from 1.7062 has completed with three waves down. Further rise should then be seen to 1.6844 resistance for confirmation. However, any significant movesmight only materialize following the release of China’s economic data on Wednesday or Australia’s employment data on Thursday.

In Europe, at the time of writing, FTSE is down -0.34%. DAX is down -0.43%. CAC is down -0.67%. Germany 10-year yield is up 0.032 at 2.238. UK 10-year yield is up 0.009 at 3.809. Earlier in Asia, Nikkei rose 0.91%. Hong Kong HSI fell -0.17%. China Shanghai SSE rose 0.15%. Singapore Strait Times rose 0.24%. Japan 10-year yield fell -0.0331 to 0.558.

ECB’s Nagel signals caution, rate cuts possible after summer break

In an interview with Bloomberg TV, ECB Governing Council member and Bundesbank President Joachim Nagel hinted at the possibility of delaying interest rate cuts until after the summer, stating, “Maybe we can wait for the summer break.” However, he was cautious not to delve into speculation, emphasizing, “I don’t want to speculate.” He also empahsized, “it’s too early to talk about cuts.”

Further elaborating on the current market expectations, Nagel addressed the speculations of six 25 basis points rate cuts by ECB this year. He noted, “The markets from time to time are optimistic. Sometimes they are overly optimistic.” This acknowledgment highlights a divergence between market expectations and the ECB’s internal assessments. Nagel’s observation, “I have a different view,” underscores a more cautious and less aggressive approach towards monetary easing.

ECB’s Holzmann cautions against premature rate cuts amid uncertainty

During the World Economic Forum in Davos, ECB Governing Council member Robert Holzmann expressed skepticism about the possibility of rate cuts in the near term. He told CNBC, “I cannot imagine that we’ll talk about cuts yet, because we should not talk about it.”

His asserted, “Everything we have seen in recent weeks points in the opposite direction, so I may even foresee no cut at all this year.”

“Unless we see a clear decline towards 2%, we won’t be able to make any announcement at all when we’re going to cut,” he explained.

Holzmann also highlighted the potential for structural changes in the economy, which could have longer-term implications for pricing. He mentioned, “Prices on a day-to-day basis may increase, but it may also risk to change the way we do business.” This comment points to the possibility of enduring economic shifts that could affect pricing dynamics and, consequently, ECB’s monetary policy decisions.

Eurozone goods exports fell -4.7% yoy in Nov, imports down -16.7% yoy

Eurozone goods exports to the rest of the world fell -4.7% yoy to EUR 252.5B in November. Goods imports fell -16.7% yoy. A EUR 20.3B goods trade surplus was recorded. Intra-Eurozone trade fell -9.4% yoy to EUR 227.2B.

In seasonally adjusted term, goods exports rose 1.0% mom to EUR 236.8B. Imports fell -0.6% mom to EUR 222.1B. Trade surplus widened from prior month’s EUR 11.1B to EUR 14.8B, above expectation of EUR 11.2B.

Eurozone industrial production down -0.3% mom in Nov, EU down -0.2% mom

Eurozone industrial production fell -0.3% mom in November, match expectations. Industrial production fell by -2.0% mom for durable consumer goods, by -0.8% mom for capital goods and by -0.6% mom for intermediate goods, while production grew by 0.9% mom for energy and by 1.2% mom for non-durable consumer goods.

EU industrial production fell -0.2% mom. Among Member States for which data are available, the largest monthly decreases were registered in Greece (-4.1%), Slovakia (-4.0%) and Belgium (-3.8%). The highest increases were observed in Denmark (+9.1%), Slovenia (+3.7%) and Portugal (+3.4%).

Contrary to market expectations, PBoC maintains MLF rate but increases liquidity

Despite the anticipation of a rate cut to bolster the weakening economy, currently grappling with deflation for the past three months, PBoC held firm, keeping the rate on CNY 995B worth of one-year medium-term lending facility loans steady at 2.50%. This decision defied the general expectation of a 0.1% cut to 2.40%.

Opting not to alter the policy rate, the central bank instead chose to enhance liquidity in the banking system. This is seen from the net injection of CNY 216B of fresh funds, following the expiration of CNY 779B worth of MLF loans this month. Moreover, PBoC also infused CNY 89B yuan through seven-day reverse repos, maintaining a stable borrowing cost at 1.80%.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0929; (P) 1.0958; (R1) 1.0980; More…

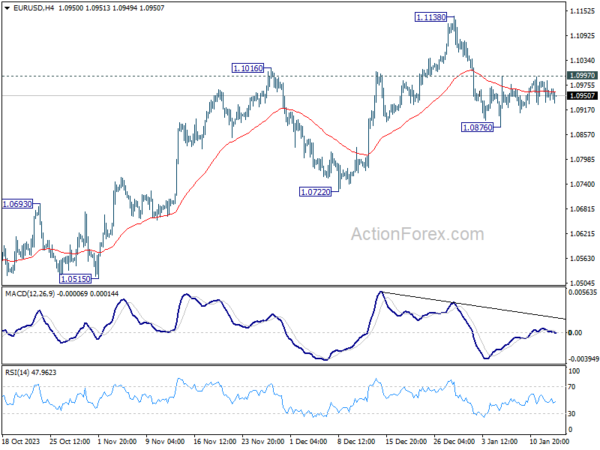

No change in EUR/USD’s outlook as it’s staying in very tight range. Intraday bias stays neutral at this point. Further fall is in favor as long as 1.0997 minor resistance intact. Break of 1.0876 will resume the fall from 1.1138 to 1.0722 support next. Nevertheless, firm break of 1.0997 will turn bias back to the upside for retesting 1.1138 high instead.

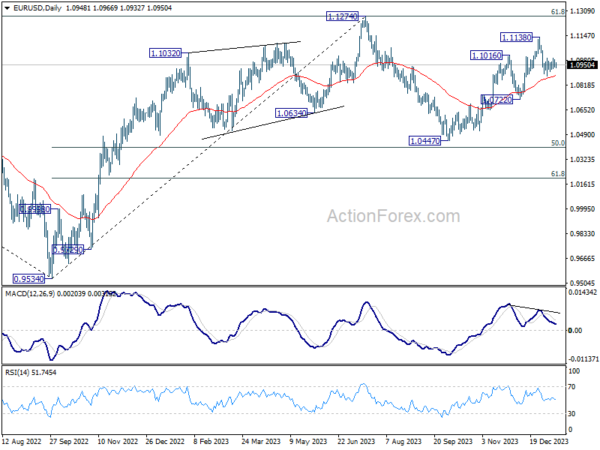

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Dec | 2.30% | 2.20% | 2.30% | |

| 00:00 | AUD | TD Securities Inflation M/M Dec | 1.00% | 0.30% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Dec | -15.50% | -13.60% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Nov | -0.30% | -0.30% | -0.70% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | 14.8B | 11.2B | 10.9B | 11.1B |

| 13:30 | CAD | Manufacturing Sales M/M Nov | 1.20% | 0.90% | -2.80% | |

| 13:30 | CAD | Wholesale Sales M/M Nov | 0.90% | 0.80% | -0.50% | |

| 15:30 | CAD | BoC Business Outlook Survey |