Currency trading today remained lackluster, characterized by limited movements across major pairs and crosses. Key economic data releases, ranging from Japan’s Tokyo CPI, and retail sales figures from Australia and the Eurozone, to trade balance data from Canada and US, failed to significantly influence the markets.

Japanese Yen is currently a marginally stronger currency, continuing its near-term recovery. Dollar follows closely, ranking as the second strongest . Conversely, Australian Dollar remains at the lower end of the performance chart, facing additional downward pressure due to selling against Canadian Dollar and New Zealand Dollar. Meanwhile, Euro experienced a mild uplift, primarily driven by its recovery against British Pound and Swiss Franc.

Looking ahead, the overall risk sentiment in the markets could become a key driver in forex, especially today, if there are sustainable movements in the stock markets. US futures are indicating lower open, with NASDAQ leading the decline. This is partly fueled by warnings from South Korea’s tech giant Samsung, which projected a potential drop of up to 35% in its Q4 operating profit.

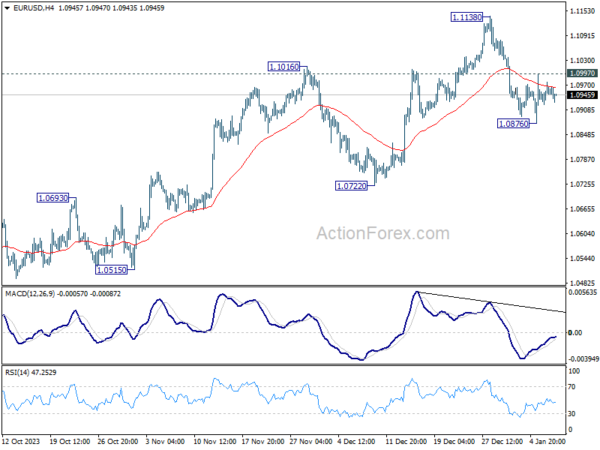

From a technical perspective, Dollar may have the potential to extend its near-term rebound against Euro and Australian Dollar, especially if the risk-off sentiment persists. For EUR/USD, a break below 1.0876 temporary low could resume the decline from 1.1138, targeting 1.0722 support level next.

In Europe, at the time of writing, FTSE is down -0.13%. DAX is down -0.60%. CAC is down -0.64%. Germany 10-year yield is up 0.053 at 2.188. UK 10-year yield is up 0.034 at 3.806. Earlier in Asia, Nikkei rose 1.16%. Hong Kong HSI fell -0.21%. China Shanghai SSE rose 0.20%. Singapore Strait Times rose 0.34%. Japan 10-year yield fell -0.0184 to 0.587.

US goods and services exports down -1.9% mom in Nov, imports down -1.9% mom

US goods and services exports fell -1.9% mom to USD 253.7B in November. Imports fell -1.9% mom to USD 316.9B. Trade deficit narrowed slightly from USD -64.5B to USD -63.2B, smaller than expectation of USD -64.8B.

Canada’s merchandise exports down -0.6% mom in Nov, imports up 1.9% mom

In November, Canada’s merchandise exports fell -0.6% mom to CAD 65.74B. This decrease occurred despite increases in 7 of the 11 product sections. Merchandise imports rose 1.9% mom to CAD 64.17B, with increases in 8 of the 11 product sections.

Merchandise trade surplus narrowed from CAD 3.2B to CAD 1.6B, smaller than expectation of CAD 2.5B.

Services exports rose 1.0% mom to CAD 16.6B. Services imports fell -0.1% mom to CAD 17.6B.

Combining goods and services, exports decreased -0.3% mom to CAD 82.4B. Imports rose 1.5% mom to CAD 81.8B. Trade surplus fell from CAD 2.0B to CAD 594m.

Eurozone unemployment rate falls to 6.4% in Nov, EU down to 5.9%

Eurozone unemployment rate fell from 6.5% to 6.4% in November, below expectation of 6.5%. EU unemployment rate fell from 6.0% to 5.9%.

According to Eurostat, total number of unemployed individuals in EU stood at approximately 12.954m, with around 10.970m of in Eurozone. This figure represents a decrease of -144k unemployed persons in EU and -99k in Eurozone compared to October.

Japan’s Tokyo CPI core down for the second month to 2.1%

Japan’s Tokyo CPI core, which excludes fresh food, slowed from 2.3% yoy to 2.1% yoy in December, aligning with market expectations. This figure represents the lowest reading since June 2022 and marks the second consecutive month of decline.

Additionally, CPI core-core, which excludes both food and energy, also slipped from 3.6% yoy to 3.5% yoy. This marks the fourth consecutive month of cooling in this measure. Headline CPI, similarly fell from 2.6% yoy to 2.4% yoy. T

Tokyo’s CPI figures are often regarded as precursors to the national data, suggesting that a similar trend might be observed in the broader Japanese economy.

In separate report, households reduced their spending in November -by 2.9% yoy, worst than expectation of -2.3% yoy. This decrease in consumer spending is attributed to the rising costs of living, which have led to more selective purchasing behaviors among shoppers.

Australia’s retails sales rises 2.0% mom in Nov on Black Friday boost

Australia retail sales rose 2.0% mom to AUD 36.5B in November, above expectation of 1.2% mom. That followed a fell of -0.4% mom in October.

Robert Ewing, ABS head of business statistics, attributed this surge to the impact of Black Friday sales. He noted, “Black Friday sales were again a big hit this year, with retailers starting promotional periods earlier and running them for longer, compared to previous years.”

Ewing further explained: “The strong rise suggests that consumers held back on discretionary spending in October to take advantage of discounts in November.” Additionally, he observed that shoppers might have advanced some of their Christmas shopping to November, which typically occurs in December.

Looking ahead

Swiss unemployment rate and foreign currency reserves, Germany industrial production, France trade balance, and Eurozone unemployment rate will be released in European session. Later in the day, US will release trade balance. Canada will release trade balance and building permits.

GBP/USD Mid-Day Outlook

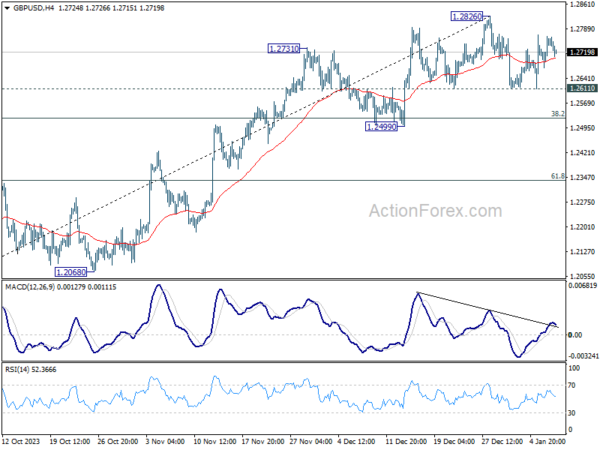

Daily Pivots: (S1) 1.2692; (P) 1.2729; (R1) 1.2786; More…

GBP/USD is extending sideway trading below 1.2826 and intraday bias remains neutral. On the upside, decisive break of 1.2826 high will resume whole rally from 1.2036. Nevertheless, another fall and break of 1.2611 will bring deeper correction to 1.2499 support instead.

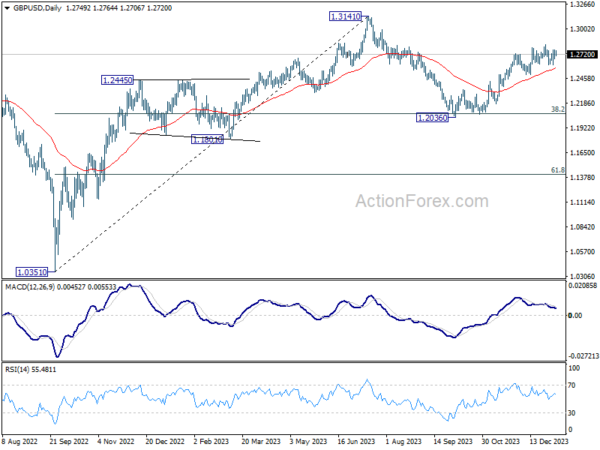

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Dec | 2.40% | 2.60% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Dec | 2.10% | 2.10% | 2.30% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Dec | 3.50% | 3.60% | ||

| 00:30 | AUD | Retail Sales M/M Nov | 2.00% | 1.20% | -0.20% | -0.40% |

| 00:30 | AUD | Building Permits M/M Nov | 1.60% | -2.00% | 7.50% | 7.20% |

| 06:45 | CHF | Unemployment Rate M/M Dec | 2.20% | 2.20% | 2.10% | |

| 07:00 | EUR | Germany Industrial Production M/M Nov | -0.70% | 0.40% | -0.40% | -0.30% |

| 07:45 | EUR | France Trade Balance (EUR) Nov | -5.9B | -7.9B | -8.6B | |

| 10:00 | EUR | Eurozone Unemployment Rate Nov | 6.40% | 6.50% | 6.50% | |

| 11:00 | USD | NFIB Business Optimism Index Dec | 91.9 | 90.9 | 90.6 | |

| 13:30 | USD | Trade Balance (USD) Nov | -63.2B | -64.8B | -64.3B | -64.5B |

| 13:30 | CAD | Trade Balance (CAD) Nov | 1.6B | 2.5B | 3.0B | 3.2B |

| 13:30 | CAD | Building Permits M/M Nov | -3.90% | 2.00% | 2.30% |