Today’s Asian trading session has been relatively subdued. Japan reported deeper-than-expected contraction in household spending, while Tokyo CPI core showed slowdown in line with market expectations. However, Yen’s near-term rebound seems to be losing steam as these data releases have not provided significant market impetus. Meanwhile, Nikkei index returned from holiday with a bounce, though other Asian stock markets exhibited mixed performance.

In contrast, Australian Dollar appeared unaffected by the much stronger-than-expected retail sales data. Commodity currencies are generally weak, but the extent of the selloff has been limited. In other currency markets, Euro and Swiss Franc are showing mild strength after Yen, while Dollar and the British Pound are mixed.

Several secondary tier economic data are slated for release today, including Germany’s industrial production, Eurozone unemployment rate, and trade balance figures from Canada and US. However, market volatility might remain low until the next Asian session, which will feature Japan’s labor cash earnings and Australia’s monthly CPI data.

Technically, Bitcoin’s rally resumed after brief setback and hits as high as 47294 so far. Further rise is expected as long as 40701 support holds. Next target is 161.8% projection of 15452 to 31815 from 24896 at 51371, which is above 50k level.

In Asia, Nikkei closed up 1.16%. Hong Kong HSI is up 0.17%. China Shanghai SSE is up 0.17%. Singapore Strait Times is up 0.45%. Japan 10-year JGB yield is down -0.0144 at 0.591. Overnight, DOW rose 0.58%. S&P 500 rose 1.41%. NASDAQ rose 2.20%. 10-year yield fell -0.040 to 4.002.

Fed’s Bostic reiterates importance to staying on path to 2% inflation

Atlanta Fed President Raphael Bostic, in a moderated discussion yesterday, reiterated his expectation of two rate cuts by the Fed this year. He anticipates the first rate cut to occur in the third quarter.

For now, he’s “comfortable” with Fed’s “restrictive stance”. “I just want to see the economy continue to evolve with us in that stance and hopefully see inflation continue to get to our 2% level,” he added.

The US is “on a path to 2%” inflation and “the goal is to make sure we stay on the path,” he said.

Fed’s Bowman: Current monetary policy deemed sufficiently restrictive

Fed Governor Michelle Bowman indicated yesterday her willingness to consider the possibility that the current policy rate might be adequately restrictive to further reduce inflation.

“My view has evolved to consider the possibility that the rate of inflation could decline further with the policy rate held at the current level for some time,” she said in a speech yesterday.

She added that if inflation continues to decrease towards the 2% target, “it will eventually become appropriate to begin the process of lowering our policy rate.”

However, she also emphasized “While the current stance of monetary policy appears to be sufficiently restrictive to bring inflation down to 2 percent over time, I remain willing to raise the federal funds rate further at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed.”

Japan’s Tokyo CPI core down for the second month to 2.1%

Japan’s Tokyo CPI core, which excludes fresh food, slowed from 2.3% yoy to 2.1% yoy in December, aligning with market expectations. This figure represents the lowest reading since June 2022 and marks the second consecutive month of decline.

Additionally, CPI core-core, which excludes both food and energy, also slipped from 3.6% yoy to 3.5% yoy. This marks the fourth consecutive month of cooling in this measure. Headline CPI, similarly fell from 2.6% yoy to 2.4% yoy. T

Tokyo’s CPI figures are often regarded as precursors to the national data, suggesting that a similar trend might be observed in the broader Japanese economy.

In separate report, households reduced their spending in November -by 2.9% yoy, worst than expectation of -2.3% yoy. This decrease in consumer spending is attributed to the rising costs of living, which have led to more selective purchasing behaviors among shoppers.

Australia’s retails sales rises 2.0% mom in Nov on Black Friday boost

Australia retail sales rose 2.0% mom to AUD 36.5B in November, above expectation of 1.2% mom. That followed a fell of -0.4% mom in October.

Robert Ewing, ABS head of business statistics, attributed this surge to the impact of Black Friday sales. He noted, “Black Friday sales were again a big hit this year, with retailers starting promotional periods earlier and running them for longer, compared to previous years.”

Ewing further explained: “The strong rise suggests that consumers held back on discretionary spending in October to take advantage of discounts in November.” Additionally, he observed that shoppers might have advanced some of their Christmas shopping to November, which typically occurs in December.

Looking ahead

Swiss unemployment rate and foreign currency reserves, Germany industrial production, France trade balance, and Eurozone unemployment rate will be released in European session. Later in the day, US will release trade balance. Canada will release trade balance and building permits.

AUD/USD Daily Report

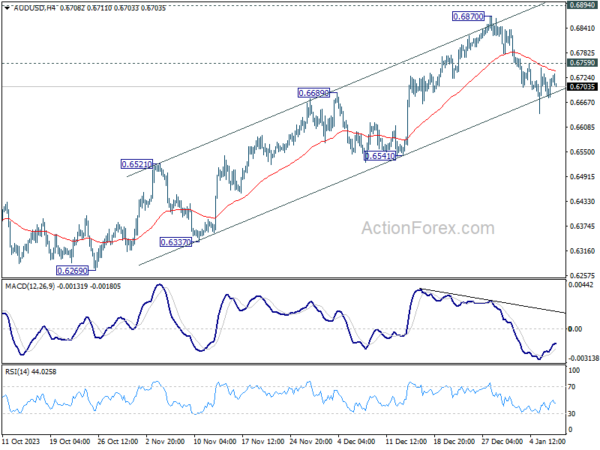

Daily Pivots: (S1) 0.6687; (P) 0.6711; (R1) 0.6744; More…

No change in AUD/USD’s outlook as further decline is in favor with 0.6759 minor resistance intact. Fall from 0.6870 short term top would target 55 D EMA (now at 0.6619). Some support could be seen there to bring rebound on first attempt. On the upside, however, break of 0.6759 minor resistance will suggest that the pull back is over, and bring retest of 0.6870 instead.

In the bigger picture, price actions from 0.6169 (2022 low) could be just a medium term corrective pattern to the down trend from 0.8006 (2021 high). Rise from 0.6269 is seen as the third leg of the pattern that could target 0.7156 on break of 0.6894 resistance. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Dec | 2.40% | 2.60% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Dec | 2.10% | 2.10% | 2.30% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Dec | 3.50% | 3.60% | ||

| 00:30 | AUD | Retail Sales M/M Nov | 2.00% | 1.20% | -0.20% | -0.40% |

| 00:30 | AUD | Building Permits M/M Nov | 1.60% | -2.00% | 7.50% | 7.20% |

| 06:45 | CHF | Unemployment Rate M/M Dec | 2.20% | 2.10% | ||

| 07:00 | EUR | Germany Industrial Production M/M Nov | 0.40% | -0.40% | ||

| 07:45 | EUR | France Trade Balance (EUR) Nov | -7.9B | -8.6B | ||

| 10:00 | EUR | Eurozone Unemployment Rate Nov | 6.50% | 6.50% | ||

| 11:00 | USD | NFIB Business Optimism Index Dec | 90.9 | 90.6 | ||

| 13:30 | USD | Trade Balance (USD) Nov | -64.8B | -64.3B | ||

| 13:30 | CAD | Trade Balance (CAD) Nov | 2.5B | 3.0B | ||

| 13:30 | CAD | Building Permits M/M Nov | 2.00% | 2.30% |