The forex markets opened the week rather steadily. Euro recovers mildly as there was no escalation in Catalonia tension. sacked regional president Carles Puigdemont remained calm and called for peaceful "democratic opposition" the Madrid’s takeover. Dollar pares back some more of recent gains as markets await an eventful week. It’s repeatedly reported that US President Donald Trump favors Fed Governor Jerome Powell for the job of Fed Chair after Janet Yellen’s term expires early next year. And Powell is seen as sone one who will speed up the pace of tightening. But it’s far from being certain as some unnamed persons close to Trump were quote saying he changes his minds everyday.

Meanwhile, it’s reported in Japan over the weekend that BoJ Governor Haruhiko Kuroda remains the leading candidate to renew his term next year. Prime Minister Shinzo Abe’s has already took renewed mandate on his Abenomics after recent landslide victory in the snap election. And no matter who will take the job of BoJ Governor, the ultra loose monetary policies will continue. Elsewhere, commodity currencies remain the weakest ones and will release need some strong economic data to give them support for rebound.

A busy week ahead with BoJ, Fed, BoE and NFP featured

It’s a very busy week ahead. Three central banks will meet including BoJ, Fed and BoE.

BoE rate decision will catch most attention as it’s widely expected to hike interest rate for the first time in a decade. The Bank Rate would be raised by 25bps to 0.50%. The core question is whether this is a one-off hike. In our view, it will be a one-off as the Bank Rate will be brought back to pre-Brexit referendum level. The impact of the voting decision is largely absorbed by the monetary stimulus as well as depreciation in Sterling. BoE policy makers would be hesitate to make any more move before getting a clearer picture on Brexit. With that in mind, the vote split of the decision is the first key point to watch. The tighter the decision, the more unlikely for another hike in near term. In addition, BoE will release the quarterly inflation report. Revision in inflation projection there will tell us how policymakers general feel about the recent surge in inflation.

FOMC meeting is possibly a non-event this week. Fed is widely expected to hike interest rates again in December. Fed fund futures are pricing in 97.8% chance for a 25bps hike to 1.25-1.50% in December. There is practically no chance for a change this week. The accompanying statement will be watched but shouldn’t contain any surprise. Markets’ focus will likely be more on news regarding the next Fed chair, Jerome Powell or John Taylor? Tax cuts, and economic data like ISM indices and non-farm payroll are the more important ones to watch.

BoJ will also keep monetary policies unchanged this week. The focus is on whether the central bank will downgrade inflation projections again.

On the data front, US data like ISMs and NFP will be the key to watch. Dollar was the strongest one last week as tax cut hopes and strong data bolster the case for December hike. Fed policymakers are projecting three more hikes next year but will need favorable data and developments to solidify the case. Sterling was also strong despite slow progress in Brexit negotiation. The Pound will also look into PMIs to be released this week. Eurozone will release GDP and CPI but that’s unlikely to help the Euro after the dovish reactions to ECB last week. Meanwhile, commodity currencies will look into their own data for support after steep selloff. Canada GDP, Australia trade balance and retail sales, New Zealand employment, as well as China PMIs will be closely watched.

Here are some highlights for the week ahead:

- Monday: German retail sales, CPI; Swiss KOF leading indicator; UK mortgage approvals, M4; US personal income and spending

- Tuesday: Japan households spending, unemployment rate, industrial production, housing starts, BoJ rate decision; New Zealand building permits; China PMIs; French GDP; Eurozone GDP, unemployment rate, CPI; Canada CDP, IPPI and RMPI; US employment cost, S&P Case Shiller house price, Chicago PMI; consumer confidence

- Wednesday: New Zealand employment; China PMI manufacturing; Swiss PMI manufacturing; UK PMI manufacturing; US ADP employment, ISM manufacturing, construction spending, FOMC rate decision

- Thursday: Japan monetary base, consumer confidence; Australia trade balance, building approvals; Swiss SECO consumer confidence, retail sales; German unemployment; UK construction PMI; BoE rate decision; US jobless claims, non-farm productivity

- Friday: Australia retail sales; UK PMI services; Canada employment, trade balance; US trade balance, non-farm payroll; ISM services, factory orders

EUR/JPY Daily Outlook

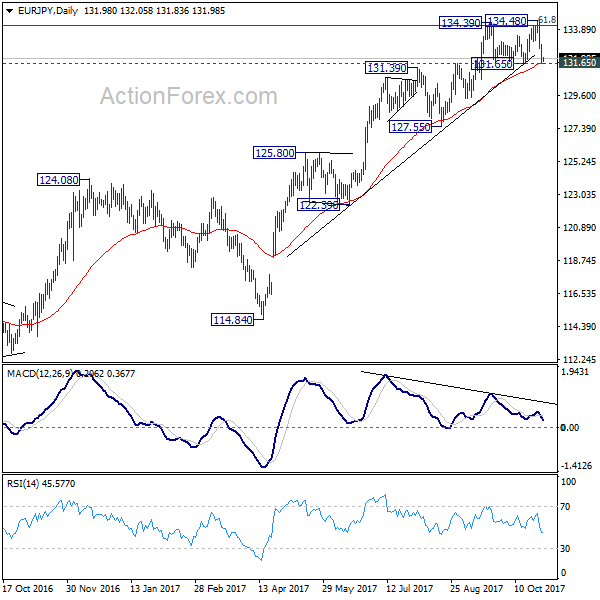

Daily Pivots: (S1) 131.49; (P) 132.22; (R1) 132.68; More…

Intraday bias in EUR/JPY remains neutral for the moment with focus on 131.65 key support. Decisive break there will confirm rejection from 134.20 fibonacci level. That will also complete and double top pattern (134.39, 134.48) and confirms near term reversal. 55 day EMA will also be firmly taken out. In that case, deeper decline should be seen back to 127.55 key support. On the upside, decisive break of 134.39/48 resistance zone is needed to confirm up trend resumption. Otherwise, even in case of rebound, near term outlook is neutral at best.

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). 61.8% retracement of 149.76 to 109.03 at 134.20 is already met. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. However, break of 127.55 support will argue that the medium term trend has reversed and will turn outlook bearish for deeper fall back to 114.84/124.08 support zone at least.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Sep | 2.20% | 2.30% | 1.70% | 1.80% |

| 07:00 | EUR | German Retail Sales M/M Sep | 0.50% | -0.40% | ||

| 08:00 | CHF | KOF Leading Indicator Oct | 106.5 | 105.8 | ||

| 09:30 | GBP | Mortgage Approvals Sep | 66.0K | 66.6K | ||

| 09:30 | GBP | M4 Money Supply M/M Sep | 0.70% | 0.90% | ||

| 10:00 | EUR | Eurozone Economic Confidence Oct | 113.3 | 113 | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Oct | 1.4 | 1.34 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Oct | 7.1 | 6.6 | ||

| 10:00 | EUR | Eurozone Services Confidence Oct | 15 | 15.3 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Oct F | -1 | -1 | ||

| 12:30 | USD | Personal Income Sep | 0.40% | 0.20% | ||

| 12:30 | USD | Personal Spending Sep | 0.90% | 0.10% | ||

| 12:30 | USD | PCE Deflator M/M Sep | 0.40% | 0.20% | ||

| 12:30 | USD | PCE Deflator Y/Y Sep | 1.60% | 1.40% | ||

| 12:30 | USD | PCE Core M/M Sep | 0.10% | 0.10% | ||

| 12:30 | USD | PCE Core Y/Y Sep | 1.30% | 1.30% | ||

| 13:00 | EUR | German CPI M/M Oct P | 0.10% | 0.10% | ||

| 13:00 | EUR | German CPI Y/Y Oct P | 1.70% | 1.80% |