Dollar gains modest ground in Asian session today, driven by mild risk-off sentiment. Mixed data emerging from China’s PMI manufacturing sector has cast a shadow over market sentiment, contributing to a tepid start in Hong Kong’s stock market. The HSI index is grappling with the aftermath of its fourth consecutive year of losses, as a prolonged period of underperformance continues.

Contrasting this, Japanese Yen is showing a broad softening while Japan is on holiday. A powerful earthquake in Japan’s central region on New Year’s Day adds a layer of uncertainty to the economic outlook. Investors are closely monitoring the situation, assessing the potential repercussions of this natural disaster.

In Europe, both the Swiss Franc and the Euro are seeing The British Pound, meanwhile, is showing a mixed performance. Meanwhile, Aussie and Loonie are on the firmer side.

Looking ahead, trading activity is poised to intensify with focus on crucial economic data releases. Markets are particularly attuned to ISMs and NFP from US, as well as inflation data from Eurozone. FOMC minutes is also a major highlight.

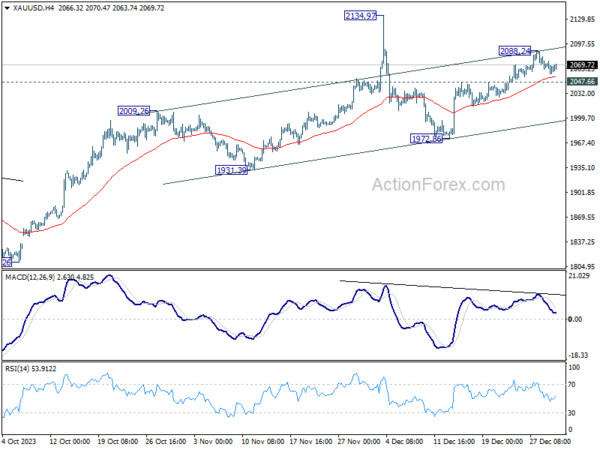

Technically, Gold lost much upside momentum after hitting channel resistance (disregarding the exaggerated spike to 2134.97 on thin liquidity). For now, further rise is still in favor as long as 2047.66 resistance turned support holds. Sustained break of the channel resistance could prompt upside acceleration. However, break of 2047.66 will bring deeper pull back to channel support (now at around 2000 psychological level.

In Asia, at the time of writing, Hong Kong HSI is down -1.45%. China Shanghai SSE is down -0.21%. Singapore Strait Times is down -0.27%. Japan is on holiday.

China’s Caixin PMI manufacturing rises, as NBS PMI shows contraction

December brought mixed signals from China’s manufacturing sector, as indicated by two key indices: Caixin PMI and official NBS PMI. Caixin PMI Manufacturing slightly increased from 50.7 to 50.8, surpassing expectations of 50.4, suggesting a marginal yet steady expansion in the manufacturing sector. Notably, Caixin highlighted that both output and new orders are rising at faster rates, indicating increased production and demand within the industry.

However, the same period saw a dip in official PMI Manufacturing, which fell from 49.4 to 49.0. This decline suggests contraction in the sector, contrasting with optimism reflected in Caixin PMI data. The difference between these two indices can be attributed to their varied focus groups; Caixin PMI typically surveys small and medium-sized enterprises, while NBS PMI is more reflective of larger, state-owned companies.

Wang Zhe, Senior Economist at Caixin Insight Group, emphasized the improved economic outlook for the manufacturing sector, with expanding supply and demand, and stable price levels. Yet, he also pointed out significant challenge in employment, highlighting businesses’ cautious approach in areas like hiring, raw material purchasing, and inventory management.

On the other hand, NBS PMI Non-Manufacturing showed a slight improvement, rising from 50.2 to 50.4. This marginal increase suggests a modest expansion in China’s services sector.

Bitcoin Price Rallies On Rumors of Spot ETF Approval

Bitcoin is trying to resume its medium term up trend, breaking 45k handle for the first time in nearly two years. Bitcoin could be gathering momentum at the start of the year in anticipation of two important events. One is SEC approval of one or several of the 14 outstanding applications for a spot Bitcoin ETF product, currently pending a decision with the regulator. Another is The halving, which happens every four years, is an event written in bitcoin’s code.

Technically, break of 44727 short term top indicates resumption of whole up trend from 15452 (2022 low). Near term outlook will stay bullish as long as 41511 support holds. Next target is 161.8% projection of 15452 to 31815 from 24896 at 51371.

In the bigger picture, upside acceleration as seen in W MACD suggests that rise from 15452 is an impulsive move. Hence, sustained break of 51371 would solidify the case that Bitcoin is ready to resume the long term up trend through 68986 historical high at a later stage.

Fed Minutes, NFP, and Eurozone inflation in focus as year of rate cuts starts

The upcoming release of FOMC’s minutes from its December 12-13 meeting is anticipated to shed light on Fed’s pivotal policy shift. This meeting is particularly notable for its projection of downward adjustment in interest rates from the current 5.25-5.50% to 4.625% by the end of 2024, followed a further reduction to 3.625% by the end of 2025. The financial community is bracing for insights into FOMC’s deliberations on key issues: the planned trajectory of interest rate reductions, with a keen focus on the timing of the initial cut. Current market sentiment, as indicated by Fed funds futures, strongly anticipates a reduction as soon as March, with a probability exceeding 80%.

Furthermore, the upcoming release of US ISM manufacturing and services data, along with non-farm payroll statistics, holds considerable weight. These datasets serve as critical barometers for assessing the strength and resilience of the economy, labor market health, and inflationary undercurrents. Their outcomes will not only provide valuable insights into the current state of the economy but will also play a decisive role in steering Fed’s forthcoming policy decisions.

In Europe, Eurozone’s CPI flash report is drawing considerable attention. Forecast suggests rebound in headline inflation to 3.0%, while core inflation is expected to continue its slowdown to 3.4%. ECB, yet to signal a shift in policy direction, is closely monitored amidst market speculations about a possible easing of policy in the second quarter. The rate at which inflationary pressures ease will be a critical factor for ECB as it contemplates the appropriate timing for reducing borrowing costs.

Canadian economic scenario is also under scrutiny, with the focus on employment data. Unemployment rate, which has been on a gradual uptick since last May, is projected to increase further to 5.9%. A crucial factor in this context is the rate at which job market is loosening and the economy is slowing down. These dynamics will be pivotal in influencing BoC decision on whether to initiate interest rate cuts this year.

Here are some highlights for the week:

- Tuesday: China Caixin PMI manufacturing; Eurozone PMI manufacturing final, M3 money supply; UK PMI manufacturing final; Canada PMI manufacturing; US PMI manufacturing final, construction spending.

- Wednesday: Swiss PMI manufacturing; Germany unemployment; US ISM manufacturing, FOMC minutes.

- Thursday: Japan PMI manufacturing final; China Caixin PMI services; Germany CPI flash; Eurozone PMI services final; UK PMI services final, M4 money supply, mortgage approvals; US Challenger job cuts, ADP private employment, jobless claims, PMI services final.

- Friday: Japan monetary base, consumer confidence; Germany retail sales; UK PMI construction; Eurozone CPI flash, PPI; Canada employment, Ivey PMI; US non-farm payrolls, ISM services, factory orders.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1020; (P) 1.1052; (R1) 1.1070; More…

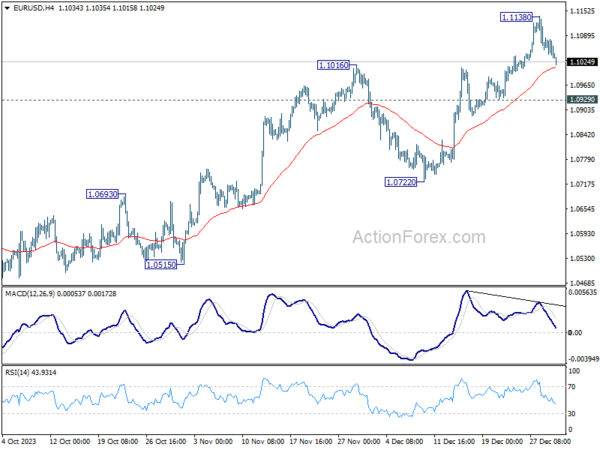

EUR/USD’s retreat from 1.1138 extends lower today but stays well above 1.0929 support. Intraday bias remains neutral for the moment. Further rally is expected as long as 1.0929 support holds. Break of 1.1138 will resume the rise from 1.0447 to retest 1.1274 high. Strong resistance should be seen from there to limit upside, at least on first attempt. Meanwhile, break of 1.0929 will indicate short term topping and turn bias back to the downside for 1.0772 support.

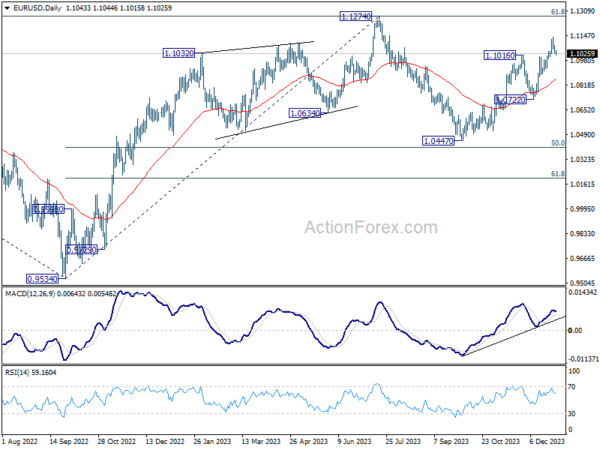

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | 4.30% | 4.30% | ||

| 01:45 | CNY | Caixin Manufacturing PMI Dec | 50.8 | 50.4 | 50.7 | |

| 08:45 | EUR | Italy Manufacturing PMI Dec | 44.4 | 44.4 | ||

| 08:50 | EUR | France Manufacturing PMI Dec F | 42 | 42 | ||

| 08:55 | EUR | Germany Manufacturing PMI Dec F | 43.1 | 43.1 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Dec F | 44.2 | 44.2 | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Nov | -1% | -1% | ||

| 09:30 | GBP | Manufacturing PMI Dec F | 46.4 | 46.4 | ||

| 14:30 | CAD | Manufacturing PMI Dec | 47.7 | |||

| 14:45 | USD | Manufacturing PMI Dec F | 48.2 | 48.2 | ||

| 15:00 | USD | Construction Spending M/M Nov | 0.60% | 0.60% |